Scalp trading in crypto is a strategy that short-term traders employ to take advantage of trading opportunities. It is not a novice, but it can be profitable. The professional scalper has significant discipline, so it may or not be for certain people. Scalp trading in crypto brings challenges but can be beneficial. So-called “scalp trading” is a style that specializes in profiting off small market movements and making a fast profit from reselling those positions. Quite often, the trader will use prominent positions to try to make a profit from small moves. This means that the trader is in and out of the market several times a day on average, and therefore traders take on less risk as far as time is concerned. This is a short-term crypto strategy in its purest form.

Scalp trading is complex and takes a certain amount of experience and agile behavior to get good at this. The most important thing you can do as a scalp trader is to have a rock-solid exit strategy because the significant danger is that you hang onto the losses for far too long. If that’s the case, overcoming failures would take an extraordinarily high success rate. Crypto scalpers understand that it is a high-risk/high-reward situation they find themselves in and take steps to mitigate disaster.

How does scalp trading work?

Scalp trading is very straightforward. It works the same way as any other trading because you are trying to find something at a lower price and sell it at a higher one. Alternatively, if you are trying to short the market, you are selling the market at a higher price and then rebuying the asset at a lower price.

Either way, the idea is that you are trying to do so in short time frames, mitigating the time spent in the market, so, therefore, more significant swings do not work against you. However, the position sizing in a scalp trait is quite often a lot larger because the idea is that you have a minimal amount of leeway, meaning that if the trade starts to go against you, the trader will exit before the losses get out of hand. It is common for scalpers to be in and out of trades in just a few moments, sometimes even less.

Crypto Scalping vs. Forex Scalping

Both crypto and Forex traders employ scalping strategies, which have many similarities and differences. You can trade both in this style by understanding where these markets overlap and where they do not. Scalping strategies can vary drastically, mainly because the spread can be radically different in markets.

- Similarities. To begin with, they are both very similar in the sense that it is a short-term trade. You are trying to pick up a few ticks or pips to profit very quickly. You do not hang onto the trade for very long, and in that sense, both of these markets, which are open 24 hours a day for most of the week at least, are going to behave very similarly.

- Differences. One of the most significant differences you will encounter is that the Forex market is much more liquid. This means that the spreads are much tighter and that it’s easier to come out ahead trading Forex than crypto. However, that does not mean that it is impossible. With crypto, you probably have to give it more room than with Forex, so you may not want to use as much leverage.

Another thing worth pointing out is that if you are going to scalp the crypto market, you need to trade the CFD or contract for difference market, which is offered at PrimeXBT. This is because all you have to do is press the “buy” or “sell” button. You do not have to transfer over the blockchain into a wallet and vice versa. With this, the speed is much more viable for scalping than typical exchanges.

Advantages and disadvantages of crypto scalp trading

Before you begin to do any crypto scalp trading, you need to understand that there are both advantages and disadvantages to this type of trading style. The following points are some of the most obvious ones, but there will be specific nuances depending on the market you are trading.

Advantages of scalp trading

There are some advantages to scalp trading, the first one, of course, being that you are not in the market for very long, so the idea is that the risks of some type of “black swan event” happening are much less likely. This is when some kind of random news rocks the market back and forth. By being in and out of the market relatively quickly, the idea is that you take your profits and leave immediately.

Another advantage, of course, is the fact that it takes much less in the way of movement to make a profit. By using short time frames and being in and out of the market quickly, traders typically will use a more significant position to take advantage of these moves. You can quickly make a lot of money if you are good at it.

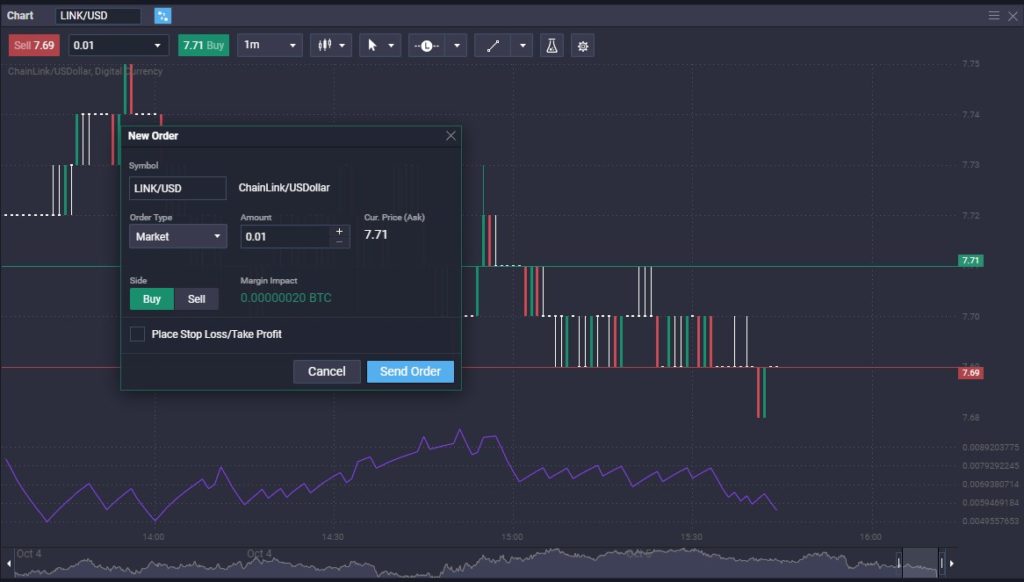

Scalping LINK/USD 1 minute chart

Disadvantages of scalp trading

One of the most significant disadvantages to scalp trading is that it takes a lot of nerve to hang onto trades, as markets will most certainly bang around erratically on short time frames. After all, it takes very little to move the market a few ticks on the one-minute chart compared to moving a few hundred ticks on a weekly chart.

Another major disadvantage of scalp trading is that most of the time, traders will use prominent positions, and therefore they need to have a high hit rate because losses tend to be more often.

These losses need to be much smaller than gains, but trying to get in and out of the market quickly is not as likely to have a substantial risk-to-reward ratio. For example, if you are a “swing trader,” you might have a system that risks $1 for every $3 profit. In other words, if you are correct, 1 in 4 attempts, you will be breakeven. You would gain $3 while losing $3. In a scalp situation, having that type of risk-to-reward ratio is tough, so you need to be correct much more often.

Types of Crypto Scalping Strategies

There are several ways to employ a crypto scalping strategy, which are virtually limitless. There are a couple of major ones that a lot of traders will use, including:

- Margin Trading. Traders will often use leverage to maximize the potential gains when scalping the crypto markets. They will mainly do so with extreme leverage. This is when you borrow money from the broker to control more prominent positions than you usually would. There are a couple of things to think about, though. The first one is, of course, the idea that leverage can increase your potential gains and exacerbate losses if you are not correct in your trade. Therefore, any leveraged transactions are ones that you must adhere to an exit plan. Unfortunately, many traders out there cannot do so, and they do irreparable damage to their accounts.

- Big figure/level trading. Many traders will do something straightforward: Only take trades at significant support/resistance levels, or for that matter, large round numbers. For example, you may wish to trade Bitcoin at the psychologically important $25,000 level. You could also look for other “big figure” areas, such as buying a cryptocurrency at $5. The idea is that many more significant inflows of money tend to happen at these big levels, and a bit of a bounce or pullback, if it is resistance, should be expected – even if it is very short-lived.

MANA/USD trading near the “big figure” of 0.70

How do you start crypto scalping?

Because you are trying to profit on very short-term moves in the crypto markets, you will find the CFD markets the best alternative to taking custody of crypto and then going through the entire process of moving it around. With the PrimeXBT platform, you must press a button to get in or out of the market, regardless of direction.

- Step 1. The first step is opening your account and supplying an email address. (You will use it to log into the platform each time to open it.

- Step 2. Next, you will need to get started to obtain some crypto. You can either transfer it to your account from a wallet or you can buy it directly on the platform. This allows the trader to use PrimeXBT as a “one-stop shop” for your needs in this field.

- Step 3. Learn to use the platform. You can use a free demo account to understand how to place trades, set stop-loss orders, and navigate. The platform is available through most modern web browsers. The broker does all the back-end work, and updates are automatically done.

Conclusion

Scalp trading is a tough and challenging endeavor. However, those who are good at scalping can earn a significant number of daily profits, as there will be so many opportunities. However, it’s not as if it’s as easy as pressing the button and cashing out. However, it’s not impossible; therefore, if you have the right qualities, you can do quite well scalping.

The most important thing you need to do is pay close attention to the movement in the marketplace and recognize when an opportunity presents itself. The second most important thing is understanding that the trade not working out needs to be exited immediately. You do not have the luxury of letting the trade “breathe” in this environment. This comes down to psychology. Therefore psychology is crucial when it comes to the idea of doing this.

Scalping will also be very sensitive to the spread, so some cryptocurrency markets will not be as likely to be scalped. The tighter the spread, the better off you will be, so make sure you understand how much “distance” you need to cover to get profitable.

FAQ: Frequently Asked Questions

- Is crypto scalp trading worth it? Scalp trading is a difficult way to make money, and that’s especially true with some cryptocurrencies. This will come from your pay spread or the difference between the bid and ask prices. If it is too broad, it’s challenging to make money.

- Is scalping profitable in crypto? It can be. However, you must be very good and take losses quickly so the gains can perform much better than the losses taken away from profits.

- Which indicator is best for crypto scalping? Whether or not there is a particular indicator that’s best for crypto will come down to the individual strategy that you build, but the reality is that simply trading with the longer-term trend is the smartest thing you can do. In other words, if the weekly chart is in an uptrend, the daily chart is in an uptrend, and the hourly chart is in an uptrend, you need to be a buyer.