Beginner traders hold a position to the last minute, trying to break even, close it prematurely and have a missed profit, skipping a good exit point. Do you want to minimize such situations? Follow the exit strategy for beginners. We will analyze the basic signals for exiting a position and teach you how to work with the terminal's auxiliary tools.

Stop Loss and Take Profit: How to Work with Limit Orders?

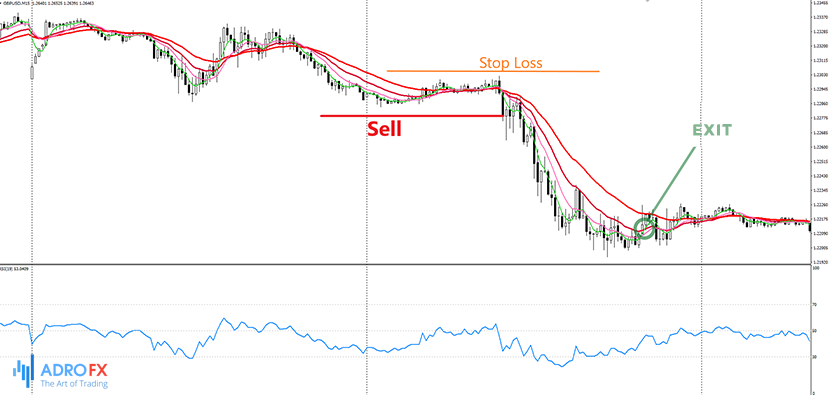

Stop Loss is a type of pending market order, with which you give a command to sell or buy an asset automatically when the price reaches a set point. Simply put, when a trader sets a Stop Loss, they say: "I expect the trade to make a profit, but if something goes wrong, I want to limit the loss. I'm willing to lose N points on the trade. Exchange, sell N assets on my behalf if the price hits the N mark."

Take Profit works in exactly the opposite way. The trader gives a command to close the position if a certain profit is achieved. Ideally, the Take Profit should occur at the moment of the beginning of a corrective movement. In fact, the exit strategy using orders can be called a strategy of a given mathematical expectation.

Please note: Stop Loss should be 2-3 times lower than Take Profit. Thus, one profitable trade will outweigh several losing trades. The trader will remain in the black. If you want to win not by quantity but by the quality of trades, you can set Stop Loss and Take Profit to approximately the same values. Using Stop Loss and Take Profit is very convenient, but it is wrong to just set them and wait until the trade will close with a profit or loss. Think of these tools as a safety net. Only give them up completely when you can't track a position in real-time.

Trailing Stop Loss Exit Strategy

A Trailing Stop is a Stop Loss that moves behind the price at a predetermined distance. For example, at a distance of 100 or 200 pips. It is not fixed as in the previous example. Let's consider its use on simple figures.

Efficient Output

The trader has opened a Buy position when the price of one unit of the asset was 1000 dollars, and has set a 100 pips Trailing Stop Loss from the price (for the sake of convenience, let's assume that 1 point equals 1 dollar). Soon the price of the asset increased to 2000 dollars, and the Stop Loss increased together with it. Now it is not 900 dollars, as at the previous price, but 1900.

Reaching the level of 2000 dollars, the price of the asset began to decrease actively and stopped at the level of 900. The trader's position turned out to be profitable. At 1900 dollars, the Trailing Stop Loss was triggered. If the trader had set a regular Stop Loss, the trade would have been unprofitable.

Exiting a trade with a Trailing Stop is more suitable for automation. Just remember that if you set it separately, the Stop Loss will pull up only after the specified distance has passed in the direction of profit. You can not leave your trade unattended until that moment. You risk losing your entire deposit if the price moves in the wrong direction.

Exiting a Position Gradually: Taking Profits in Small Portions

The method of market exit can be combined with the strategy we discussed above. Use it when you are not sure that the price will keep moving in the right direction.

The strategy is as follows:

- Open a position;

- Wait for the anticipated price peak;

- Set a Trailing Stop;

- Take some profits off to make sure the trade is breakeven.

Then all that remains is to relax and wait. In terms of game theory, the stepwise exit approach is completely disadvantageous compared to the other strategies described. It reduces the mathematical expectation of profit by half. Why use it then? The key advantage of the strategy is that it relieves the trader of psychological stress. You should not underestimate the pressure factor at the initial stage.

Simple Market Exit Signals: How Do You Know When It's Time to Exit?

We learned how to set the Stop Loss and Take Profit, we have disassembled the concept of Trailing Stop, and we mentioned the stepwise method of closing a position. Now we know how to exit correctly, but the question "When?" remains open.

Here are the key signals indicating the need to close a position:

- Support and resistance levels. You already know that every trend is accompanied by a correction movement. So, it is necessary to set a Stop Loss and Take Profit exactly when the chart approaches these boundaries. At this point, you can stop trading or switch to a short/long position different from the one you had before;

- The beginning of a sideways movement. You never reliably know where the price chart will go during a flat - it is safer to just apply the strategy of closing a position. An exception to this is when your strategy involves trading in a flat market. For example, the Rubber Band;

- Entering an overbought or oversold area. Pay attention to the Stochastic indicator, which allows you to determine whether the market is oversold or overbought. This is when the value goes outside of the trend channel. Unlike a trendline breakout, an oversold or overbought condition occurs only when the breakout takes place in the direction of the trend movement.