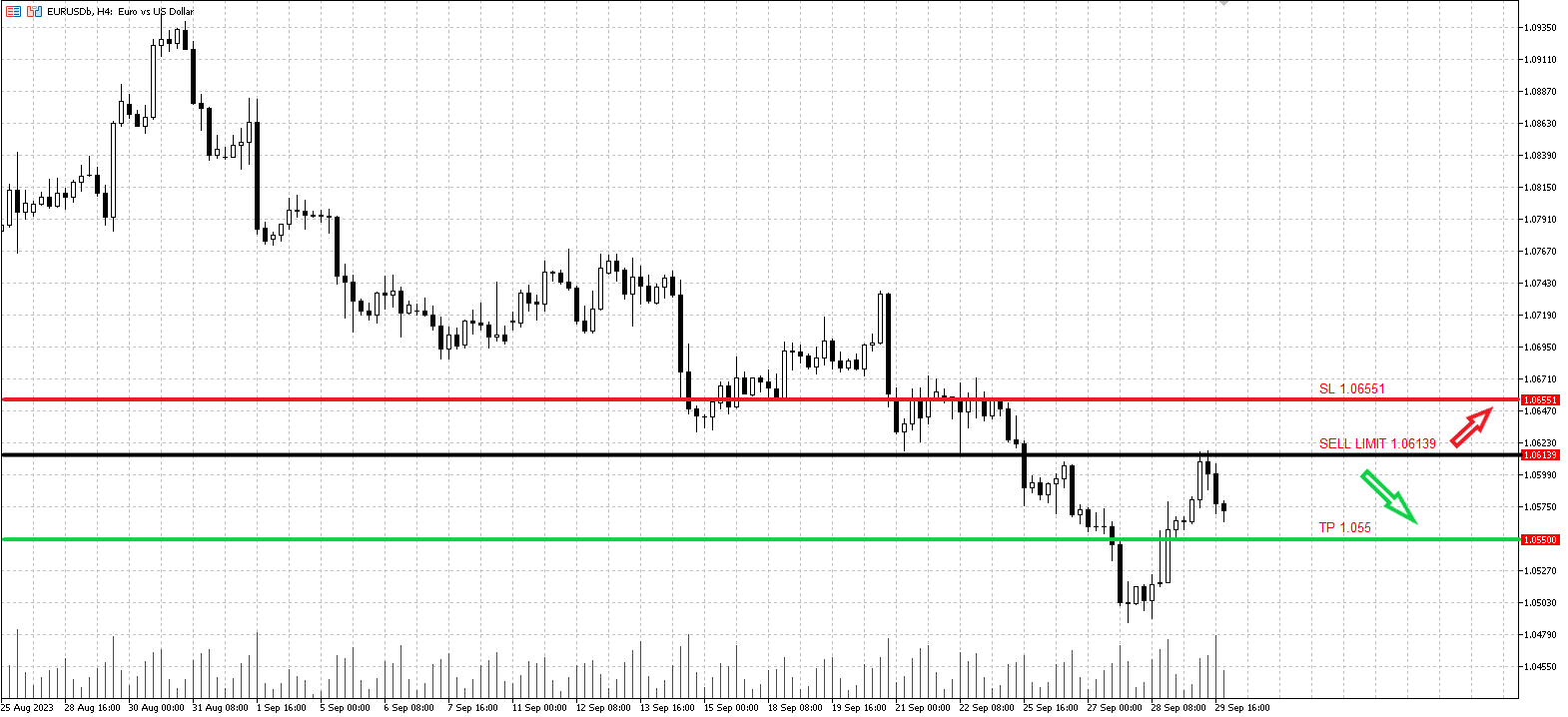

Friday's American trading session bore witness to the EUR/USD pair's mercurial nature. Despite early indications of a rebound, the currency pair slipped beneath the 1.0600 mark, wiping away a chunk of its intraday appreciation. However, one silver lining emerged from the day's cloud: the positive vibes echoing in the market, spurred by the release of PCE inflation figures, which appeared to cushion the Euro's descent. Even so, when analyzing the broader picture, it's crucial to pinpoint the enduring bearish disposition encircling the Euro. While there's chatter about a potential respite rally elevating the pair to levels approximating 1.0650, it's pivotal to recognize that such a move wouldn't necessarily spell the end of the prevalent bearish momentum.

Trade Insight: Establish a sell limit at 1.06139, targeting a price point of 1.055, with a stop loss set at 1.06551.

The GBP/USD Landscape

The American session on Friday brought with it a reversal of fortunes for the GBP/USD pair. After confidently surging past the 1.2270 mark earlier in the day, the currency pair faced a setback, dipping below the 1.2200 threshold. Such a retreat could be construed as traders deciding to lock in profits as the quarter drew to a close, resulting in amplified downward pressure on the British pound. As the market gazes forward, all eyes will be on the US Department of the Treasury's imminent 5-year US Treasury note auction. This event could swing the pendulum for the USD, either amplifying its prowess or slightly denting it. Concurrently, the political theater in the US promises to continue to influence investor sentiment.

Trade Insight: Consider setting a sell limit at 1.22400, with an aim to reach 1.21780, and placing a stop loss at 1.22770.

The XAU/USD Scenario

Gold, represented as XAU/USD, faced its set of tribulations as Q3 came to a close. Interestingly, even as the 10-year US T-bond yield took a tumble, gold couldn't capitalize on this opportunity. This inertia can be largely attributed to the looming shadow of the Federal Reserve's anticipated hawkish approach. With inflation continuing its march, speculations are rife about another potential interest rate adjustment before we bid adieu to this year. Subsequently, gold seems to be on track to register significant weekly downturns, potentially marking its weakest weekly conclusion since the past March. For traders, it's prudent to consider the current context; any resurgence in gold prices might be fleeting. If the US data appears softer than anticipated, the market's reaction could be swift yet temporary.

Trade Insight: Think about initiating a sell limit at 1852.00, targeting 1846.00, and designating a stop loss at 1856.55.

Concluding Thoughts

Currency markets, with their intricate weave of macroeconomic and geopolitical factors, often present a multifaceted narrative. While the immediate future for the Euro seems tinted with bearish hues, external data releases and events, like the PCE inflation figures or the US Treasury note auction, can offer short-term fluctuations that seasoned traders can potentially capitalize on. As always, it's imperative to navigate these waters with informed caution and a keen eye on global developments.