The EUR/USD currency pair is witnessing a renewed vigor as the Euro capitalizes on its upward trajectory against the US Dollar, with the pair marching towards its weekly peaks. The US Dollar, after initially faltering to around the 106.5 mark, as demonstrated by the USD Index, has made a comeback. The momentum driving this turnaround can be attributed to a combination of renewed risk appetite among traders and the evolving dynamics of US bond yields.

Market participants are gearing up for a possible interest rate increment of 25 basis points by the Federal Reserve before the curtains fall on this year. On the European front, speculation continues to brew regarding the European Central Bank (ECB) and its possible inaction on policy amendments. This is despite the Eurozone's inflation overshooting its targets and the looming specter of either a regional recession or stagflation.

Drilling down into the Eurozone's economic data, Germany's Construction PMI reported a slump to 39.3 in September. However, the broader Eurozone observed a marginal recovery to 43.6. Furthermore, Germany’s trade balance for August showcased a surplus of €16.6 billion. In contrast, French Industrial Production dipped by 0.3% on a month-to-month basis. Forecasters are tipping the Euro to sustain its upward climb.

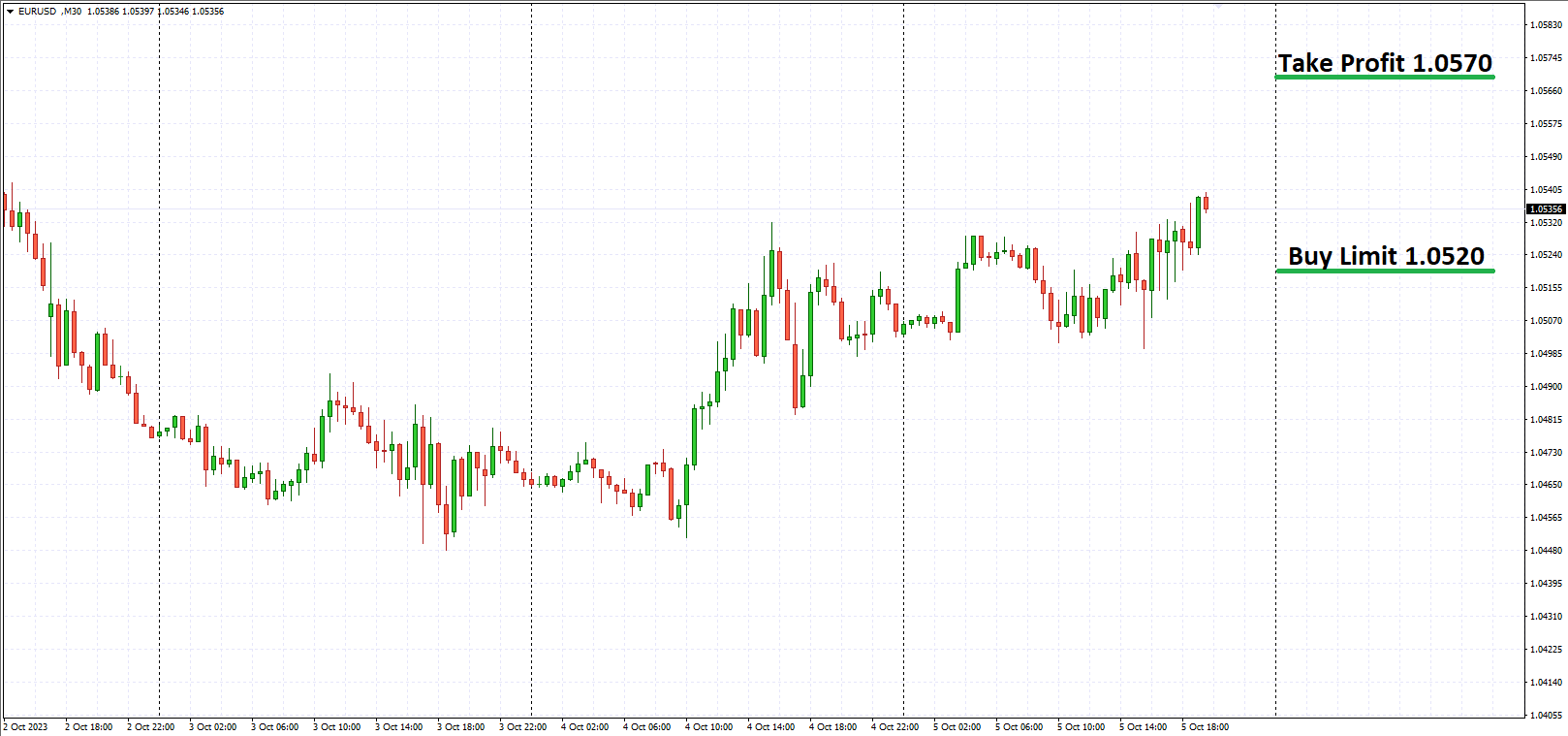

Trading Strategy: BUY LIMIT 1.0520/TP 1.0570/SL 1.0500

USD/CAD: Oil Prices Put the Canadian Dollar on the Defensive

The Canadian Dollar (CAD) faced turbulence, descending to a six-month nadir against the US Dollar, largely due to a precipitous fall in oil prices. Such a scenario put significant pressure on currencies tethered to commodities. The CAD's performance was 0.3% vis-a-vis the greenback, touching its most fragile point since March 24th. There was a semblance of relief for the CAD as global bond yields displayed stabilization, especially after the recent jolt that left investors rattled. US crude oil futures took a 5.6% hit, settling approximately at $84.2 per barrel. This plunge was a reaction to anticipated actions from Russia on its diesel ban and US data pointing to subdued gasoline demand.

A critical indicator to monitor would be the upcoming Canadian employment data for September, which is poised to provide insights into the domestic economic climate. Predictions are pointing towards a job surge of 20,000. In the immediate term, the trajectories of the US and Canadian Dollar will hinge on the imminent release of labor market statistics.

Trading Strategy: BUY STOP 1.3750/TP 1.3810/SL 1.3620

XAU/USD: Gold's Equilibrium Ahead of Key Data

Gold has been trading in a rather compact range since the beginning of the week. Market observers are in anticipation of the forthcoming Nonfarm Payrolls report, which will cast light on the existing conditions of the US labor landscape. Despite the softer-than-expected ADP Employment Change and the new Services PMI data, gold struggled to breach the $1,830 ceiling. The overarching sentiment is that the Federal Reserve will hold on to its 'sustained-elevated' outlook concerning interest rates. The recent uptick in the US Dollar is a consequence of climbing real rates set against a backdrop of receding inflation. However, a slackening labor market could dent the greenback's appeal.

Additionally, recent reports from the US Department of Labor signal a steady state of weekly jobless claims. Any indications of faltering labor demand might serve as a deterrent, potentially causing the Federal Reserve to maintain the status quo on interest rates.

Trading Strategy: SELL STOP 1826.00/TP 1808.00/SL 1835.00