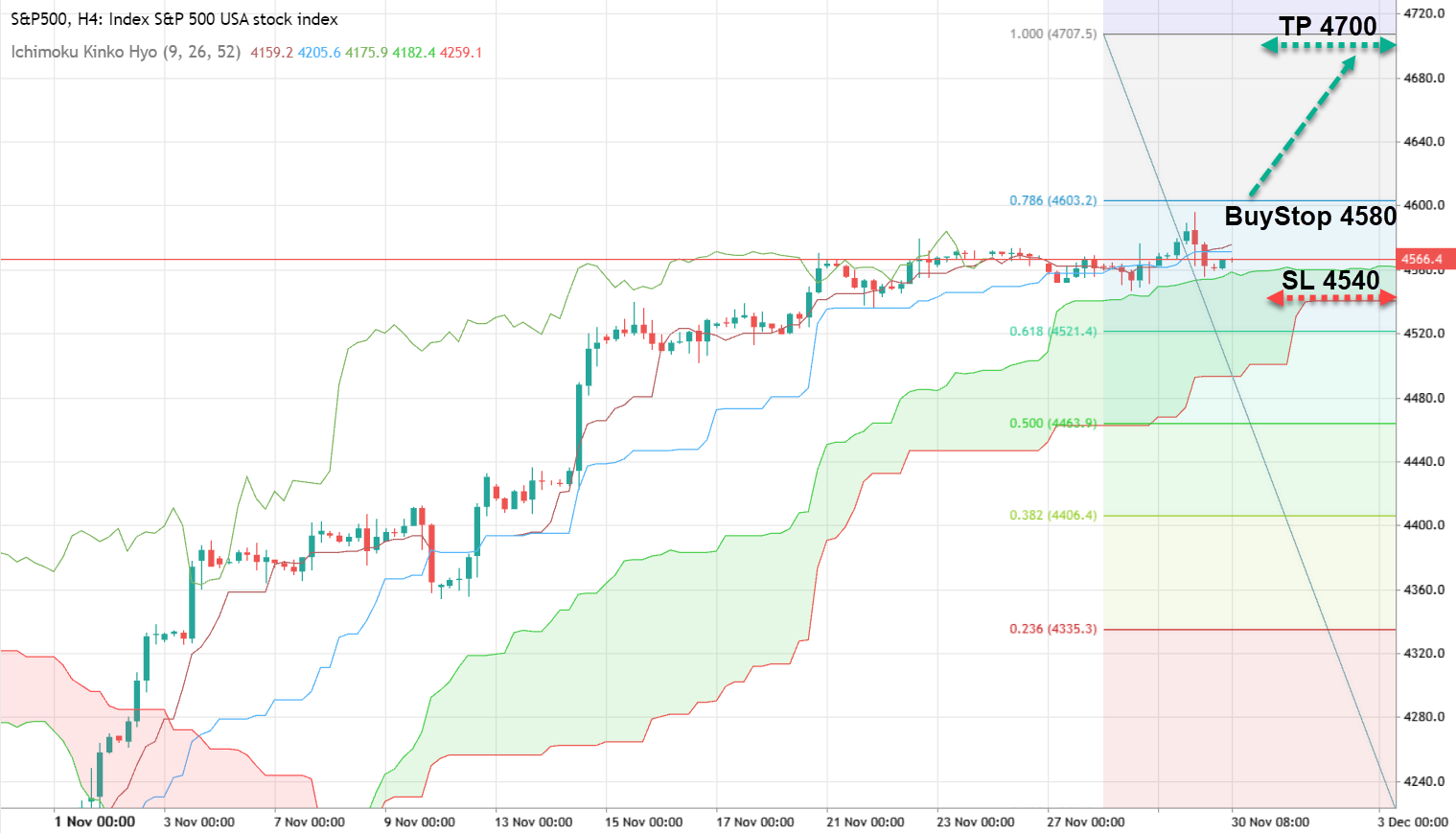

The S&P 500 Index, a bellwether of U.S. stock market health, is exhibiting robust performance, trading near 4570 and hitting multi-month highs. This surge is underpinned by a confluence of favorable economic data and market sentiments. The S&P 500 Index is showing signs of strong performance, buoyed by positive economic data and a conducive monetary policy environment.

The Brent crude oil market and the AUD/USD currency pair also present interesting opportunities for investors, each influenced by a unique set of economic and geopolitical factors. As always, careful consideration of market conditions and risk management is essential for successful trading in these dynamic markets.

Key Drivers of the S&P 500's Upward Trajectory

- Strong GDP Growth: The U.S. GDP growth for the third quarter outpaced expectations, registering a 5.2% increase compared to the initial estimate of 4.9%. This upward revision plays a crucial role in mitigating recession fears and fuels investor optimism.

- Federal Reserve's Stance: The market has also reacted positively to comments from Federal Reserve spokesperson Christopher Waller. His indication that declining inflation rates could lead the Fed to relax its tight monetary policy adds to the bullish sentiment. A softer monetary stance is typically favorable for stock markets as it often leads to lower borrowing costs and increased economic activity.

- Decline in Treasury Yields: A notable decrease in Treasury yields further enhances the appeal of riskier assets like stocks. Lower yields on government bonds often redirect investments towards equities, seeking higher returns.

Given these dynamics, a strategic entry point for investors could be a BUY STOP at 4580, with a target price (TP) of 4700 and a stop loss (SL) at 4540, capitalizing on the index's upward momentum.

Commodities Outlook: Brent Crude in Focus

The Brent crude oil market is currently at a critical juncture, with investors keenly awaiting the outcome of the upcoming OPEC+ meeting. Key decisions expected include:

- Potential Production Cuts: Major oil producers, including Saudi Arabia and Russia, may consider extending export restrictions or even additional output cuts to stabilize oil prices, despite opposition from some member countries.

- External Factors: External events such as the recent storm in the Black Sea, which has cut exports by 3 million barrels per day, are also playing into the oil price dynamics.

- Impact of the Weakening Dollar: The declining dollar, pressured by expectations of the Federal Reserve easing its monetary policy, also contributes to the rising commodity prices. A weaker dollar typically makes dollar-denominated commodities like oil more attractive to international buyers.

For investors considering entry into the Brent market, a BUY STOP at 83.50, targeting a price of 86.00 and a stop loss at 82.00, could be a viable strategy.

Currency Markets: The Case of AUD/USD

The AUD/USD pair is another interesting market segment, currently trading near 0.6650. Several factors are influencing its movements:

- Inflation Data Impact: Recent inflation data showed a decrease in the consumer price index from 5.6% to 4.9%, the first drop below 5% in twenty months, primarily driven by falling energy costs. This decline has put some pressure on the Australian dollar.

- Monetary Policy Anticipation: Traders continue to buy the Australian dollar, encouraged by expectations of further interest rate hikes by the Reserve Bank of Australia, as suggested by the central bank's head, Michele Bullock.

In this context, a strategic trading move could be a BUY STOP at 0.6650, with a target price of 0.6750 and a stop loss at 0.6620.