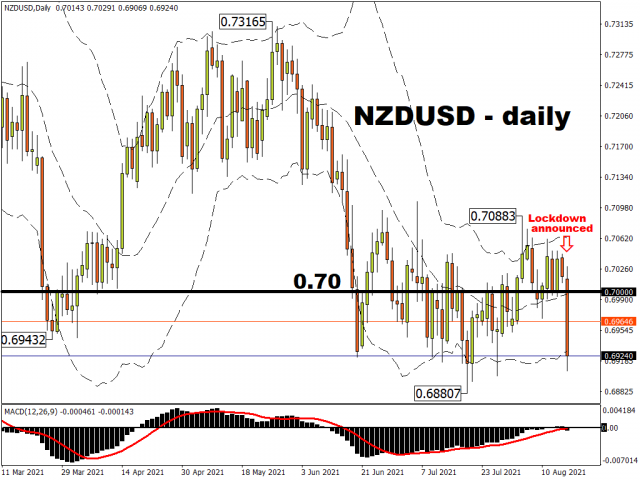

Entering this trading week, the New Zealand dollar had a roaring start to August, being the best-performing G10 currency against the US Dollar so far this month. As of Monday, the NZD had also strengthened against all of its G10 peers on a month-to-date basis. Then, one Covid case was detected in New Zealand.

Such is the impact from the island nation’s first community case since February that it forced a three-day lockdown across New Zealand. Today’s shock announcement was all it took to undo a lot of the month-to-date gains that the kiwi had against several of its G10 peers, especially currencies deemed as safe havens such as the Japanese Yen, US dollar, and the Swiss Franc.

The New Zealand dollar is the worst-performing G10 currency against the US dollar today, and has also weakened against all major Asian and EM currencies. The NZD index also tanked below its 50-day simple moving average, giving the decline on 23 March a run for its money as the largest single-day drop so far this year.

Note that this index measures the NZD’s performance across six currency pairs, all in equal weights: NZDUSD, EURNZD, GBPNZD, NZDCHF, NZDCAD, AUDNZD

That solitary infection now undermines the optimism that had lifted the New Zealand dollar. For context, the country’s economic reopening had been chugging along, so much so that the Reserve Bank of New Zealand appears ready to hike its benchmark cash rate this week (policy decision due Wednesday, 18 August). After all, there were enough signs pointing to an imminent rate hike:

- New Zealand’s unemployment rate fell to 4% in 2Q 2021, matching the same pre-pandemic figure in 4Q 2019.

- Private sector wages (excluding overtime pay) rose by 0.9% last quarter, which was its biggest spike in 13 years.

- The consumer price index has broken above the central bank’s 1-3% target range (3.3% in 2Q).

In short, the economic conditions had ripened enough for a rate hike. In fact, markets had been forecasting two rate hikes by the end of the year.

(Note: central banks tend to raise benchmark rates to prevent the economy from overheating and rein in prices paid by consumers from rising too fast).

Downside risks from delta (if confirmed)

But that single case now presents some serious downside risks for the economy, the RBNZ’s policy outlook, and for the New Zealand dollar. This would be especially the case if it’s confirmed to be the Delta variant and the lockdowns are extended beyond this week, while taking into account the nation’s slow vaccine rollout. The country has only administered enough vaccines for less than 30% of its population, which is lower than the vaccination rates in the UK (66%), US (56%) and even neighboring Australia (30%). One just has to look up north past the Tasman Sea to assess how the Delta variant is wreaking havoc on Australia’s attempts to reopen its economy.

If the NZ lockdowns are extended and negatively impacts the economic recovery, that might end up also delaying the RBNZ’s plans to hike rates. Such a scenario should translate into more downward pressure for the New Zealand dollar, perhaps enough to embolden kiwi bears into setting their sights on the current year-to-date low for NZDUSD around the 0.688 mark.

Can the NZD recover?

Tuesday’s tumble could yet prove to be a knee-jerk reaction and the kiwi could unwind today’s declines. Here’s what it would take. The RBNZ has to sound very hawkish (suggesting more rate hikes are coming) and downplay the downside risks from this latest lockdown. An OCR hike on Wednesday may not be enough to cause the NZD to unwind most of Tuesday’s drop.

Alternatively, government officials have to dispel the uncertainties surrounding the duration of this lockdown, assuring that it would indeed be just “short and hard”.

Such an all-clear, either by the central bank or from the Ardern administration over the immediate term, could then help the NZD pare recent losses.