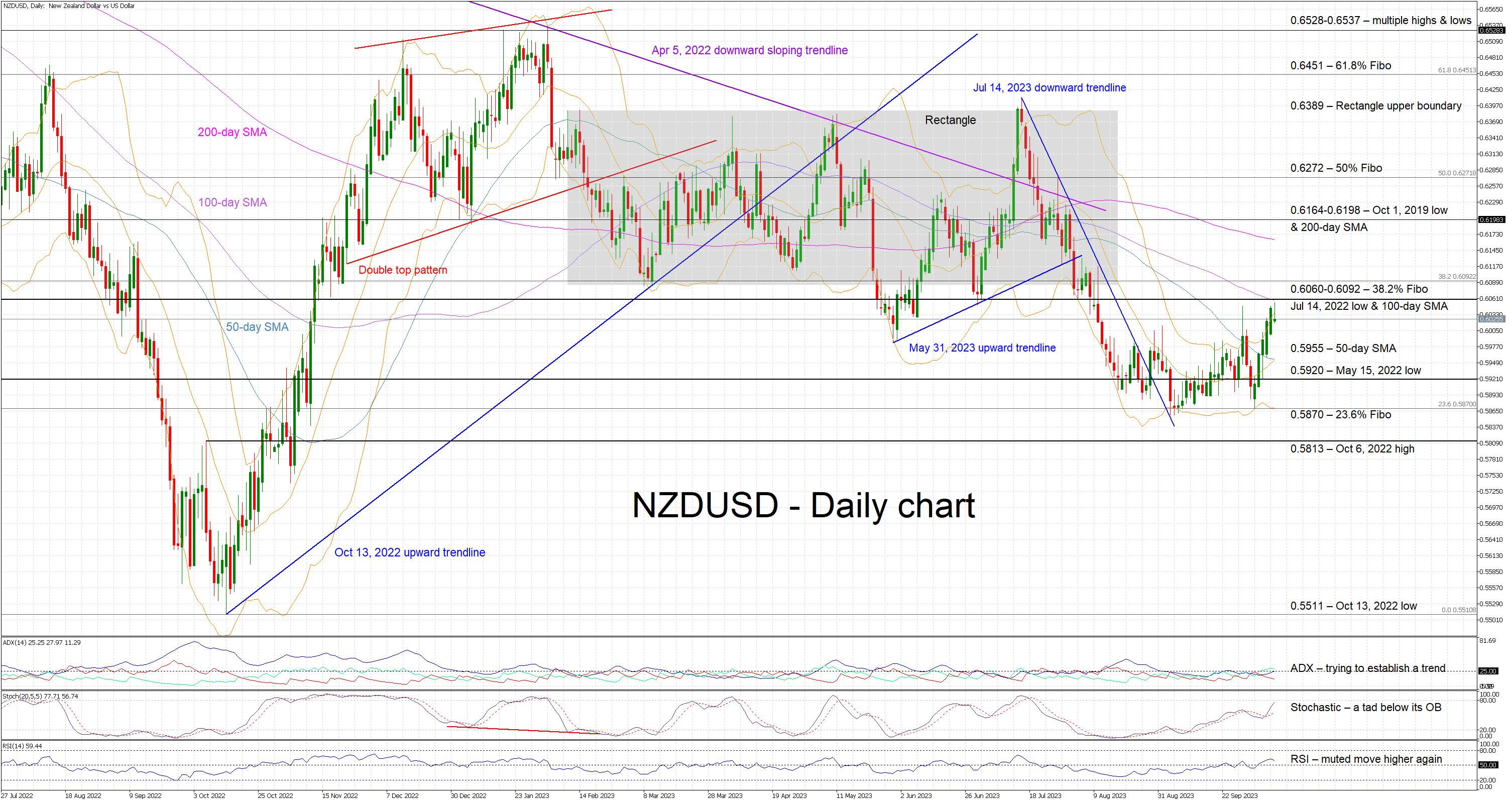

In the midst of tumultuous geopolitical events, the NZDUSD currency pair has seen some pivotal trading movements recently. This was especially noticeable when the pair embarked on a short-term upward trajectory after repeatedly facing resistance at the 0.5870 level throughout September. Upon a closer look at the pair's behavior over the past few months, the sustained inability to breach the 0.5870 threshold culminated in a significant upswing, propelling the NZDUSD towards crucial resistance levels, just shy of the floor of the February-August trading range.

When analyzing this rally, market analysts are keenly observing momentum indicators to discern potential trends and shifts. The Average Directional Movement Index (ADX) currently suggests a mild bullish sentiment. Simultaneously, the Relative Strength Index (RSI) is hovering slightly above its midpoint of 50, indicating a moderate upward momentum. The stochastic oscillator, an important momentum indicator, is showing aggressive moves towards its overbought region, hinting at the possibility of an extended rally.

For traders bullish on the NZDUSD, the significant hurdle lies in the 0.6060-0.6092 bracket. This range is particularly noteworthy, marked by the 38.2% Fibonacci retracement of the slide from April 5, 2022, to October 13, 2022, paired with the low of July 14, 2022, and the 100-day Simple Moving Average (SMA). Surpassing this barrier could potentially set the stage for the NZDUSD to re-enter the trading rectangle established in February 2023, effectively nullifying the August sell-off.

Conversely, for those bearish on the pair, staunch defense of the aforementioned 0.6060-0.6092 zone is imperative. A successful defense could pave the way for bears to target the 0.5955 and 0.5920 benchmarks, marked by the 50-day SMA and the May 15, 2022, low. An even more aggressive move might see the bears eyeing the 23.6% Fibonacci retracement level at 0.5870, which has historically been a formidable resistance level.

In wrapping up, while the NZDUSD has showcased a commendable rally recently, a decisive move beyond the 0.6060-0.6092 region will be critical for bulls to firmly assert their dominance in the market. As always, traders are advised to stay informed and tread with caution, taking into account the broader geopolitical landscape that can influence currency movements.