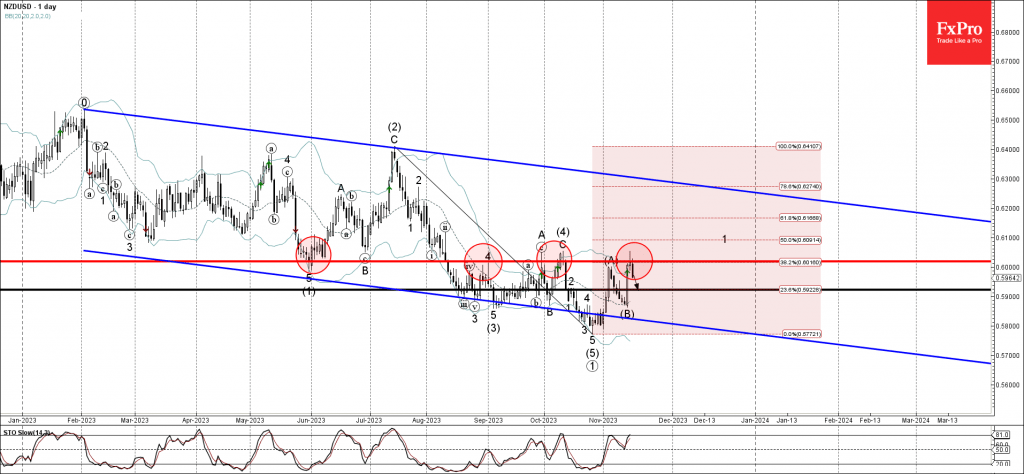

The NZDUSD currency pair has been exhibiting some notable technical movements recently, particularly with its reversal from a significant resistance level. The pair turned downward upon reaching the 0.6020 mark, a level that has consistently acted as a barrier to its price since August. This resistance level gains additional significance as it aligns with the upper boundary of the daily Bollinger Bands, indicating a potential overextension in the price movement.

Further reinforcing the strength of the 0.6020 resistance is its convergence with the 38.2% Fibonacci retracement level. This retracement is calculated from the downward impulse that began in July, suggesting that the recent upward move in NZDUSD could be a corrective phase in a broader downtrend. The confluence of these technical indicators – the upper Bollinger Band and the Fibonacci level – at 0.6020 adds weight to the argument that this level is a substantial hurdle for the pair.

Looking ahead, the current market dynamics and technical setup suggest that the NZDUSD pair may continue its downward trajectory. The next key level to watch is the support level at 0.5925. This level could act as a target for the ongoing decline, and its breach or defense will be crucial in determining the pair's short-term direction.

It's also important to consider the broader market context in which this movement is occurring. While the pair is currently in a clear daily uptrend, the recent reversal at a key Fibonacci level and the upper Bollinger Band might signal a potential shift in momentum. Traders and analysts will likely be monitoring whether this reversal is a temporary pullback within the uptrend or the start of a more significant bearish reversal.

In summary, the NZDUSD pair is at a critical juncture, having reversed from the formidable resistance at 0.6020. The confluence of technical indicators at this level adds credibility to its significance. Moving forward, the support level at 0.5925 will be a key area to watch, as a break below this could confirm a deeper bearish sentiment in the pair, while holding above could suggest a continuation of the current uptrend.