Selecting a reliable trading platform is one of the most important decisions a new trader can make. For beginners, clarity, education, and regulatory protection matter just as much as trading conditions.

Riverquode is a newer CFD broker that has started gaining attention due to its simplified platform, strong educational focus, and supervision under the Financial Sector Conduct Authority of South Africa.

This review provides a structured and transparent evaluation of Riverquode, specifically tailored for individuals entering the markets for the first time.

Is Riverquode a Legit Broker?

Yes, Riverquode is a legitimate and properly regulated CFD broker.

The firm operates under AzurevistaFX (Pty) Ltd, which is licensed and supervised by the Financial Sector Conduct Authority (FSCA) of South Africa. This oversight requires Riverquode to adhere to strict financial standards, maintain transparent operational procedures, and protect client funds through segregated accounts.

Traders also benefit from negative balance protection, which stops accounts from going below zero during volatile market conditions. These safeguards work together to strengthen Riverquode’s reputation as a safe and reliable broker.

Market Instruments Available

Riverquode gives traders access to more than 160 CFD instruments across global financial markets. This includes major and minor forex pairs, commodities, metals, global stock indices, equity CFDs, and cryptocurrency CFDs.

This broad product range allows traders to diversify their strategies and adapt to changing market conditions without needing multiple brokerage accounts.

In addition to its wide selection of instruments, Riverquode offers traders access to both highly liquid markets and more niche opportunities, allowing users to tailor their approach based on risk appetite and preferred trading style. The variety of asset classes makes it possible to switch between trending markets, hedge positions, or explore new sectors as conditions shift globally.

Trading Platform: WebTrader

Riverquode uses a modern WebTrader interface that operates directly from a browser. The platform delivers a clean, intuitive layout designed to help users focus on analysis and execution without dealing with unnecessary complexity.

Traders have access to real-time price feeds, advanced charting tools, economic updates, and built-in risk management features. WebTrader is also fully optimized for smartphones and tablets, allowing mobile trading without requiring app installations.

MT4 and MT5 are not currently supported but the streamlined nature of WebTrader is well suited to beginners and intermediate users who prefer simplicity over platform depth.

Riverquode Account Types

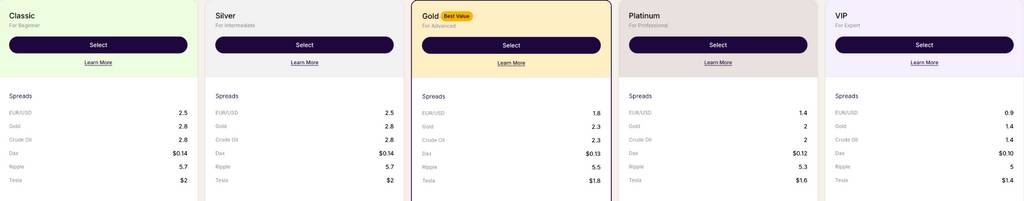

Riverquode offers a tiered account system that grows with the trader, providing a clear path from entry-level to professional-grade conditions. Each tier builds on the one before it, allowing users to progress naturally as their experience, confidence, and trading volume increase.

As traders advance, they gain access to tighter spreads, improved swap terms, and greater overall value, making it easy to start with a simple setup and transition into more competitive trading conditions over time. The breakdown below outlines what each account type includes and who it is best suited for.

Account Tier Breakdown

- Classic

Standard spreads and no swap benefits. Suitable for beginners seeking a simple start. - Silver

Slightly improved spreads and reduced swaps. Designed for traders progressing into more consistent strategies. - Gold

Competitive spreads and discounted swaps. A strong choice for active users looking to lower trading costs. - Platinum

Tight spreads and notable swap advantages. Ideal for experienced traders who operate at higher frequency. - VIP

The lowest spreads and the most favorable swap conditions. Tailored for high-volume and professional clients.

Across all five tiers, traders benefit from leverage up to 1:400 (forex), a 20% stop-out level, and a minimum trade size of 0.01 lots. This consistency across the structure ensures smooth progression without platform disruptions.

Education and Research

Education is one of Riverquode’s most prominent strengths. The broker places considerable focus on developing traders through a structured educational ecosystem that spans beginner to advanced material.

Users can access video lessons, market theory sessions, strategy workshops, and dedicated modules on trading psychology and risk management. More advanced content includes courses on CFD trading, trading tools, and strategic planning, helping traders move beyond basic concepts and into more refined techniques.

Riverquode also provides a comprehensive library of e-books covering global market structure, terminology, capital management, technical and fundamental analysis, chart patterns, advanced strategies, and more. This is supported by Trading Central integration, offering professional-grade insights, indicators, and signal-based analysis.

Combined, these resources create a supportive learning environment that benefits both new traders and those looking to sharpen their market knowledge.

Customer Support

Riverquode’s customer support is multilingual and accessible, serving users in languages that include Portuguese, Spanish, German, French, Hindi, Malay, Thai, and Italian. Assistance is provided via email and phone, with response times often praised for their promptness.

The support team is known for professionalism and clarity, offering solutions tailored to each client’s situation rather than generic replies. This personalized approach is especially appreciated by beginners who may need more guidance when learning the platform.

Deposits and Withdrawals

Riverquode offers a simple and secure funding system that supports credit cards, debit cards, and bank wire transfers. The process is designed to be clear and user-friendly, with deposits typically processed quickly.

The broker adheres to recognised financial protection standards to ensure safe transaction handling. Withdrawals are processed transparently, though processing times may vary depending on the payment method used. The main limitation is that the number of supported payment methods is currently small, but the existing options are familiar and secure.

Conclusion

Riverquode emerges as a legitimate, regulated, and beginner-friendly CFD broker with a clear focus on safety, simplicity, and trader development. The FSCA license, education-first approach, intuitive WebTrader platform, and responsive support structure make it a strong option for new and intermediate traders seeking a reliable trading environment.

While the lack of MT4 and MT5 may be a drawback for advanced or automated traders, the overall offering remains well-balanced, secure, and accessible, particularly for those who value straightforward navigation and guided learning.

For traders exploring new platforms, trying Riverquode via its demo account is an excellent way to experience its interface and features before committing to live trading.