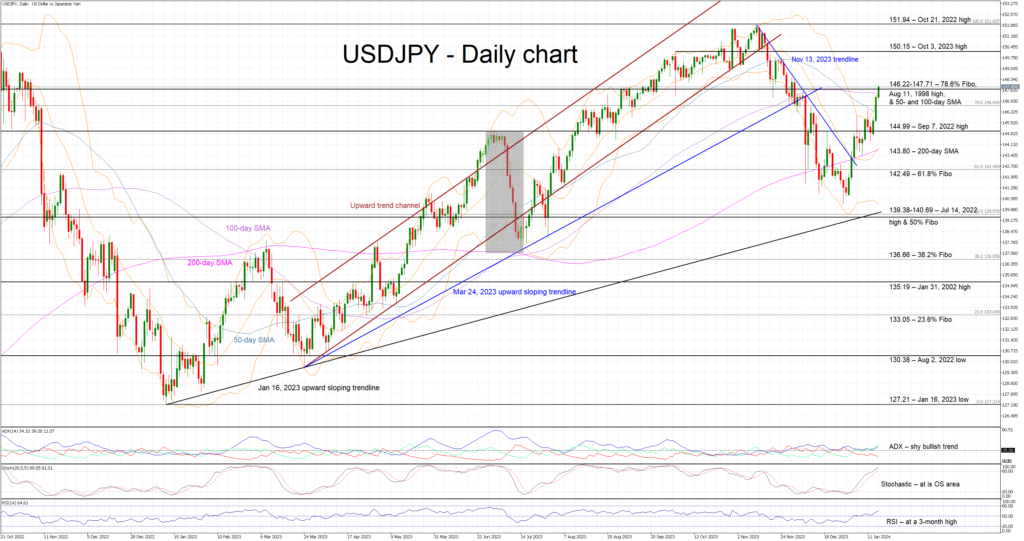

USDJPY, the currency pair pairing the US dollar with the Japanese yen, has been displaying a robust upward trend, marking its third consecutive day of gains. The pair is currently striving to surmount a challenging resistance area situated between 146.22 and 147.71. This recent surge in USDJPY comes after an aggressive rally from its December 28, 2023 low of 140.24, effectively nullifying a substantial portion of the downtrend experienced during November and December 2023. As the market braces for significant upcoming events, most momentum indicators appear to favor the ongoing upward movement.

One noteworthy indicator supporting the bullish trend is the Average Directional Movement Index (ADX), which is gradually climbing above its 25-threshold. This suggests the presence of a modest bullish trend within the market. Similarly, the Relative Strength Index (RSI) has surged above its 50-midpoint and is currently hovering around a new three-month high. Perhaps the most crucial development is the stochastic oscillator's entry into overbought territory, positioned slightly above its moving average. This overbought condition may persist for some time before indicating the potential conclusion of the present bullish phase.

If the bullish momentum persists, the next objective for the bulls is to decisively breach the 146.22-147.71 range. Within this range lies the 78.6% Fibonacci retracement level, calculated from the downtrend observed between October 21, 2022, and January 16, 2023, in addition to the August 11, 1998 high. Furthermore, the range is intersected by the 50- and 100-day simple moving averages (SMAs). Beyond this range, the bulls could set their sights on the October 3, 2023 high at 150.15, with an ultimate target potentially being the 151.94 level.

On the other hand, should the bears seek to assert themselves, their initial line of defense will likely be the 146.22-147.71 area. If successfully defended, they may attempt to gradually push USDJPY lower towards the September 7, 2022 high of 144.99. In the event of further downside momentum, the support offered by the 200-day SMA at 143.80 may prove to be more formidable than anticipated. However, a successful breach of this support level could open the door for the bears to target the 61.8% Fibonacci retracement level at 142.49.

To summarize, USDJPY's upward trajectory remains intact, buoyed by the support of multiple momentum indicators. Nevertheless, bears are eyeing the challenging 146.22-147.71 range as a potential barrier to the ongoing rally. The currency pair's future movements will likely be influenced by the outcome of these competing forces.