The business of storage operators with a high level of security, in which physical, not virtual, metal is stored, is in a boom of demand from wealthy investors as the Covid-19 pandemic worsens, Bloomberg writes.

Typically, such companies help investors buy gold, but now that governments have closed many enterprises in times of crisis, obtaining physical gold has become impossible.

Gold is in short supply

“If today someone wants to buy gold, I wish them all the best in the search. Most bullion traders have closed,” Ludwig Karl, board member of Swiss Gold Safe Ltd, says. The Switzerland’s refining industry, the largest international hub for processing gold into bullion and coins, has basically stopped. Canceled flights disrupt bullion transportation plans around the world, and gold miners cut back on operations by slowing precious metal production.

“The supply chain is shrinking,” Debra Thomson, Global Gold Sales Director at IBV International Vaults, a company that offers safes and precious metals purchases around the world, says. “The last time I saw so much chaos in the market was the events of September 11th.”

At the same time, demand for gold is growing. Private investors usually buy gold bars weighing up to 1 kg, and this is much less than what banks require. Those who want to buy and store smaller gold bars will have to wait for the factories to open. The three largest factories in the world - Valcambi SA, Argor-Heraeus SA and the refinery MKS PAMP Group - are based in Ticino, the Swiss canton bordering northern Italy, the country most affected by the COVID-19 coronavirus pandemic. That is, supply shortages affect the lower range of the market most.

Gold prices fell sharply in March, as some investors were forced to sell precious metals amid a liquidity crisis comparable to 2008. Others sold gold to buy cheaper assets.

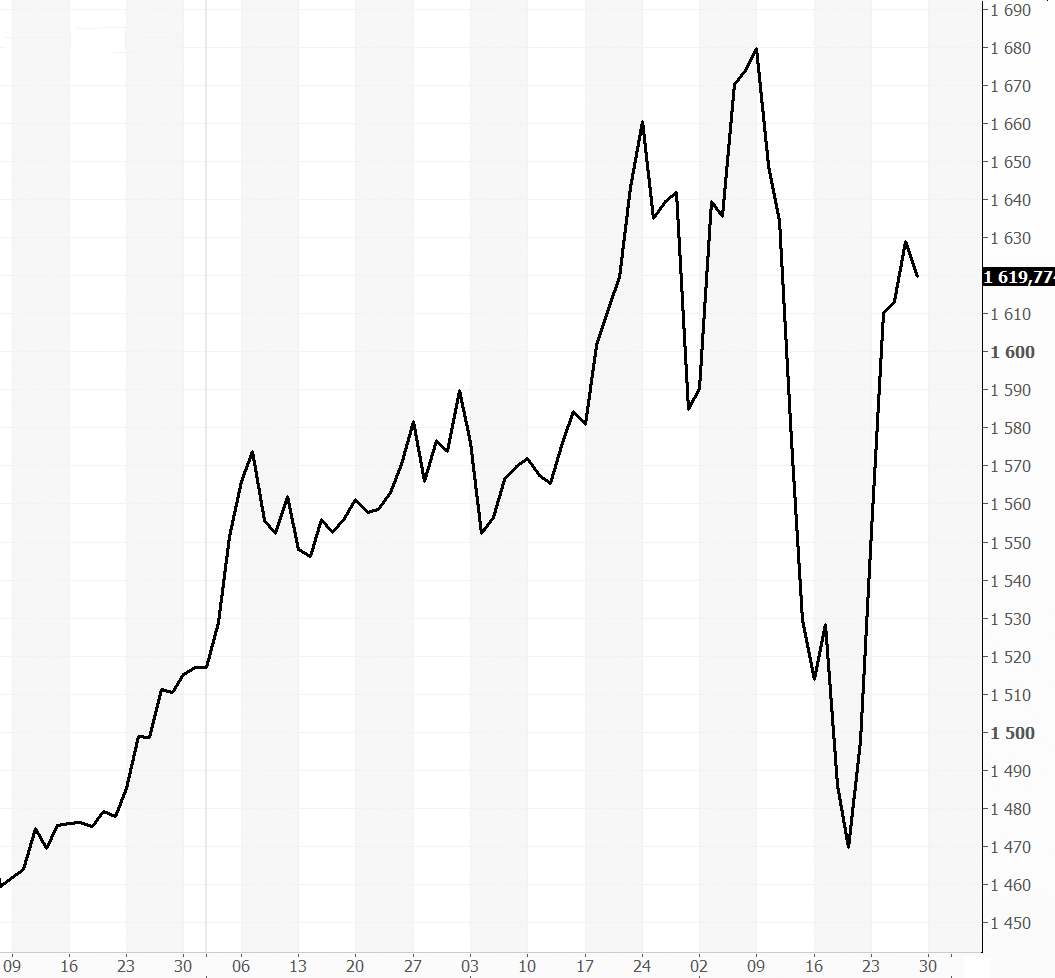

But later buyers returned to the market amid aggressive stimulus measures, which somewhat reduced pressure on liquidity. Spot gold has grown by almost 10% over the last week of the March, trading in the region of $1620 per ounce.

Goldman Sachs believes gold bullion is probably at the point when it is time to buy.

Bloomberg reports that Egyptian billionaire Naguib Saviris is increasing its stake in upstream shares, and professional investor Mark Mobius said in an interview with Bloomberg TV: “People must have gold, and now is the time to increase its reserves.”

However, for those who want to get physical metal, this is difficult to do, because supply chains are torn all over the world. The pandemic also created a shortage of some of the most popular investment coins, such as Krugerrand from South Africa and Maple Leaf from Canada.

This means that when it comes to buying, it no longer matters what form to buy physical gold in. Seamus Fahy, co-founder of Merrion Vaults, a company that holds gold in security institutions in the UK and Ireland, states: “Now investors will buy everything they can. They are desperate to get physical gold.”

Gold is at highs for 8 years. Why is it so and who will benefit from it?

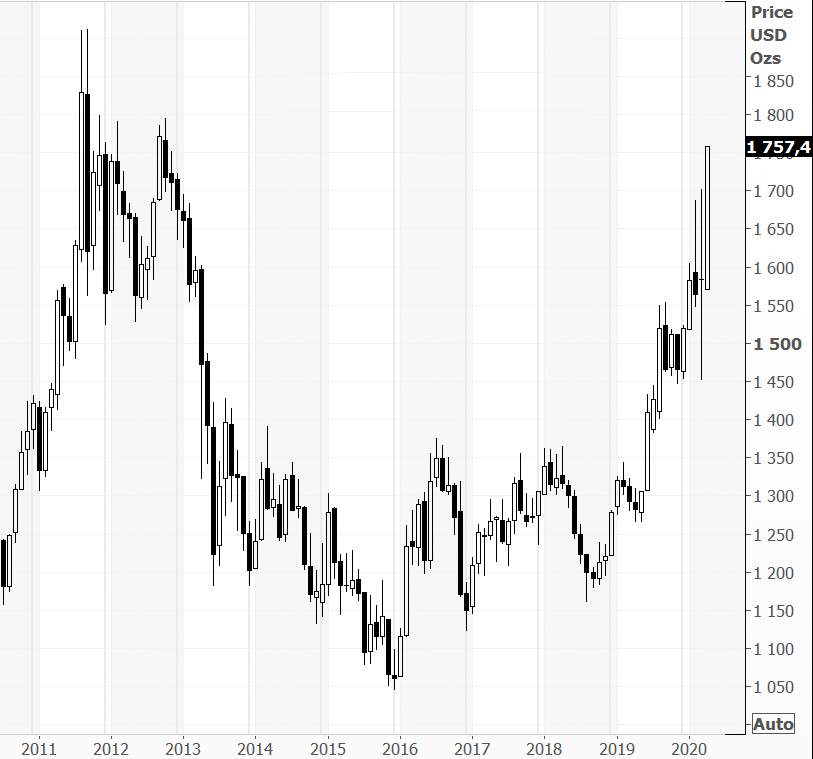

Since the beginning of the year, gold prices have increased by 15.3%, reaching at the moment $1784 per ounce, which is the highest value since 2012.

Why is gold’s price growing?

Now there are two main drivers for gold prices rising. The first one is rate cuts by global central banks and unprecedented incentive measures. Monetary easing can help boost inflation. Yields on Treasuries are close to local lows. Together, these two factors lead to lower expectations for the real interest rate in USD, and this traditionally acts as a powerful driver of gold prices rising.

- The next point is the general tension in the market. At the moment, it is not completely clear how much the spread of coronavirus COVID-19 pandemic will affect the global economy and what the long-term consequences will be. The increased degree of uncertainty provokes investors to pay attention to protective assets, one of which is gold.

- The second factor can be gradually digested by the market as the spread of coronavirus decreases and with the support of the economy by the world Central Banks - all this will contribute to the growth of investor confidence in the future, and the need for protective assets will gradually decline.

At the same time, the first driver may remain relevant for a long period: the long-term consequences for the economy can be quite serious, which means that soft monetary policy will remain. In this situation, it is difficult to expect a decline in gold prices in the medium term. On the contrary, the rise in precious metal quotes can continue, given the scale of lower interest rates and the prospects for inflation.

Who is winning?

The main beneficiaries of rising gold prices are gold mining companies. If the average price of gold was $1450 per ounce in the IV quarter of 2019, it was already $1550 per ounce in the I quarter of 2020. This means that according to the results of the first quarter, the financial results of gold miners can greatly improve.

Gold. What are the prospects?

Since the beginning of 2020, gold prices have added 12%, rising to $1700 per troy ounce and updating local maximums since 2013. The increase in the value of the precious metal was facilitated by the growth of uncertainty in the global economy due to coronavirus pandemic and the easing of monetary policies of world regulators to fight with the consequences of a pandemic.

Gold vs other metals

Against the background of other metals, gold looks stable due to its reputation as a protective financial asset. Copper, aluminum, as well as platinum and silver are regarded by market participants primarily as industrial metals. In the conditions of falling economic activity, demand for them decreases, prices fall consequently.

Gold is traditionally perceived as a protective asset in which you can stay out turbulent times. This reputation has developed historically, and is currently supported by world central banks, which store part of the reserves in this precious metal. About 40% of all gold demand is investment demand, which intensifies during periods of market instability.

The reverse is also true. When sentiment begins to improve and the effects of the crisis are gradually digested, demand for industrial metals begins to grow, and to fall for gold. This leads to lower prices for the precious metal. However, as the situation stabilizes, a decline in demand for gold may not occur due to the actions of the world Central Banks.

Real interest rates

Most global regulators resorted to lower interest rates in 2020 to support the economy and smooth out the negative impact of coronavirus COVID-19 pandemic. Particularly, the actions of the US Federal Reserve are worth paying attention, Fed lowered the key rate from 1.5-1.75 percentage points in 2020, down to 0.25%. Amid falling interest rates, as well as growing uncertainty in the global economy, Treasuries' yields continued to fall. If at the end of 2019, the yield on 10-year securities was in the region of 1.9%, it dropped to 0.7% by the beginning of May 2020.

Traditionally, a powerful driver for gold growth is a drop in real interest rates. Real interest rates are conditionally risk-free returns, for example, Treasuries, minus inflation. The decline in the yield of debt securities with relatively stable inflation in January-February 2020 attracted real interest rates. This is partly why strong gold growth was observed in the beginning of the year.

After the 2008 crisis, there was a strong discrepancy between the dynamics of the real interest rate and the price of gold due to inflationary volatility. During the crisis and the short period after it, inflation was weak, however, market participants understood that this was a temporary phenomenon, and monetary incentives and the restoration of consumer confidence in the coming years would lead to higher prices. This was laid down in gold quotes, which were in an uptrend until 2012. Now the situation may repeat.

In March 2020, monthly inflation (CPI) in the US was -0.4% due to lower consumer activity. Yields on Treasuries remained relatively stable, but the real rate rebounded from local lows in deflationary conditions. In April 2020, the CPI dropped to -0.8% due to the effect of quarantine restrictions. Against this background, it is quite possible the rise in gold prices temporarily slows down, especially after a strong rise in recent months.

In the long run, the potential for growth remains. The real interest rate is held in the negative zone. This means that investors, taking into account inflation, lose capital staying in the Treasuries. To avoid this, market participants can invest in gold, as it is an asset of comparable quality, which at the same time historically “protects” from inflation.

Another long-term factor in support of gold is massive injections of liquidity. Now the global economy is supported by the soft monetary policy of world regulators. This allows investors to smooth out the negative impact of coronavirus. On the horizon of several years, there may be a need to reduce liquidity, since the inflated money supply will not be backed by the real sector. If there are problems with sterilization of liquidity, this can lead to acceleration of inflation, a fall in real rates and another round of growth in demand for gold.

What are the long-term prospects?

Gold is a situational financial tool that is not suitable for every long-term investor. The main problem is that gold does not generate cash flow - you can earn only on the difference in value. There is no need to talk about any magic of compound interest or reinvestment of dividends.

Precious metal can be an interesting asset for portfolio diversification or as a temporary insurance against rising volatility. Gold is also becoming attractive in the face of falling real rates. In a relatively calm time, the metal may not be in high demand and lose to equity assets.

Over the long-term horizon, it is likely that gold may become less popular with investors.

Gold or silver?

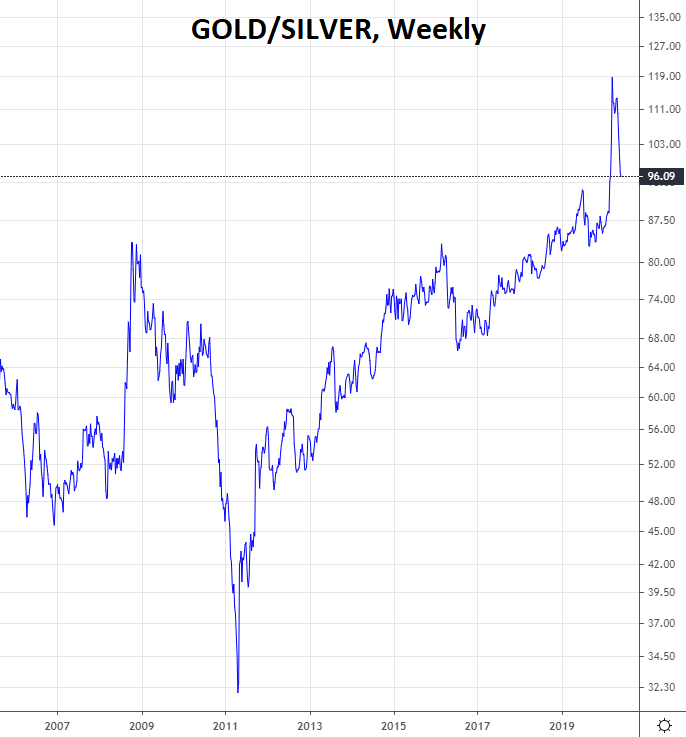

The COVID-19 pandemic: social restrictions, business shutdowns, falling markets and GDP all led to large-scale monetary and fiscal support measures, followed by a sharp rise in gold against silver. Many investors expected to see a full-blown and protracted crisis in the financial markets, a surge in inflation. However, this did not happen apparently, and the actions of the regulators could put an end to the long-term trend of advancing gold quotes over silver.

More and more countries are gradually getting out of quarantine. Activity in the manufacturing and services sectors is recovering, which means that demand for the “more industrial” of the two precious metals - for silver - is growing.

Gold / Silver Ratio

The ratio of gold to silver set a historic high in March, about the same time as the actions of the Fed and other central banks reversed the negative dynamics in the stock market. The proportion then reached the level of 126x, now the figure has already fallen below 100. If we consider February as the beginning of the active influence of coronavirus on the markets, then it is necessary to drop another 8% for the full restoration of Gold / Silver to the pre-crisis level.

Correlation

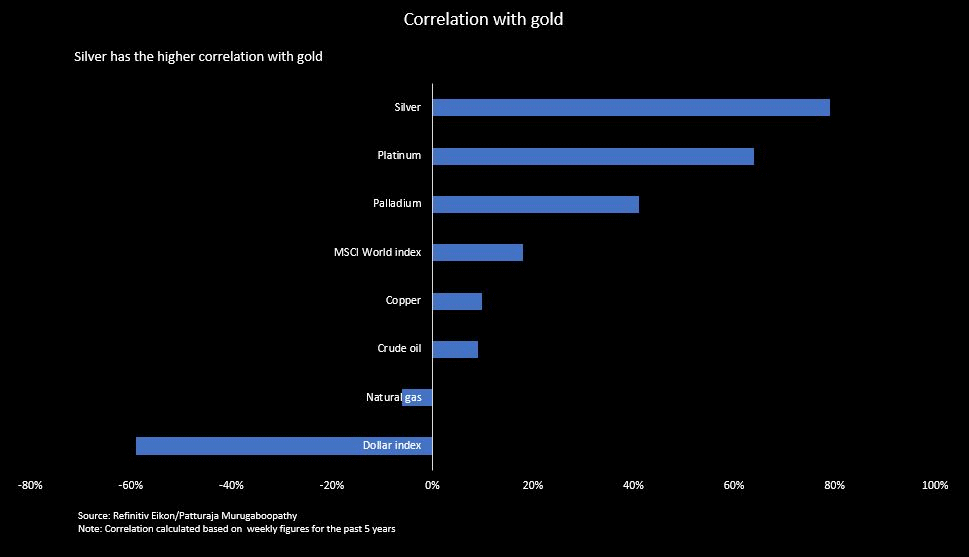

Gold and silver are precious metals that have long been considered “true” money. That is, the value of these metals is based not only on industrial applications, but also on the collective “faith” of investors in unconditional internal value. Hence the historically high positive correlation of these metals and the negative correlation with the dynamics of the dollar (DXY Index). 5-year metal correlation data from Refinitiv is presented below.

What is the difference?

Silver is more actively used in industry, and gold may be in demand during economic and financial shocks. During the recession or shortly before it, the growing trend of the Gold / Silver ratio accelerates. After passing the peak of the crisis, the opposite trend is observed as a rule. That is, if we assume that inflation during the crisis period and for some time after will remain suppressed, and the recovery in production continues, silver may show more interesting dynamics paired with gold.

Support for silver may come from specific industries. It is actively used in electronics and microelectronics, medicine, jewelry, photo-video segment, chemical industry, as well as in "green" energy. Yes, silver is used in the manufacture of solar cells. According to some estimates, the cost of metal in the cost of a solar panel reaches 6-10%. The trend towards greening the energy industry has only recently been gaining momentum.

Silver and gold are interchangeable in some industries. Obviously, 100 ounces of silver per 1 ounce of gold can significantly increase production efficiency.

Investment demand

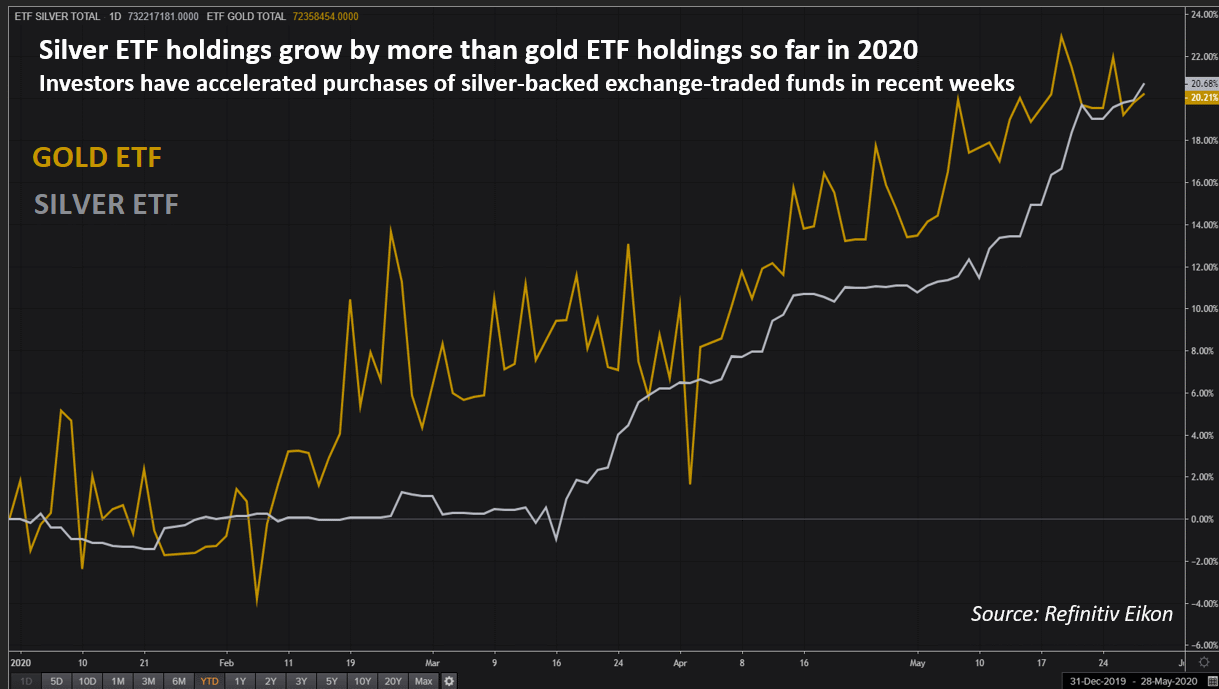

Investment demand for silver is also growing. If you look at the dynamics since the beginning of 2020, ETF assets for silver, as well as for gold, began to grow in March. By April 2020, the Fed had used all possible instruments to flood the market with liquidity, which spurred demand for any precious metal.

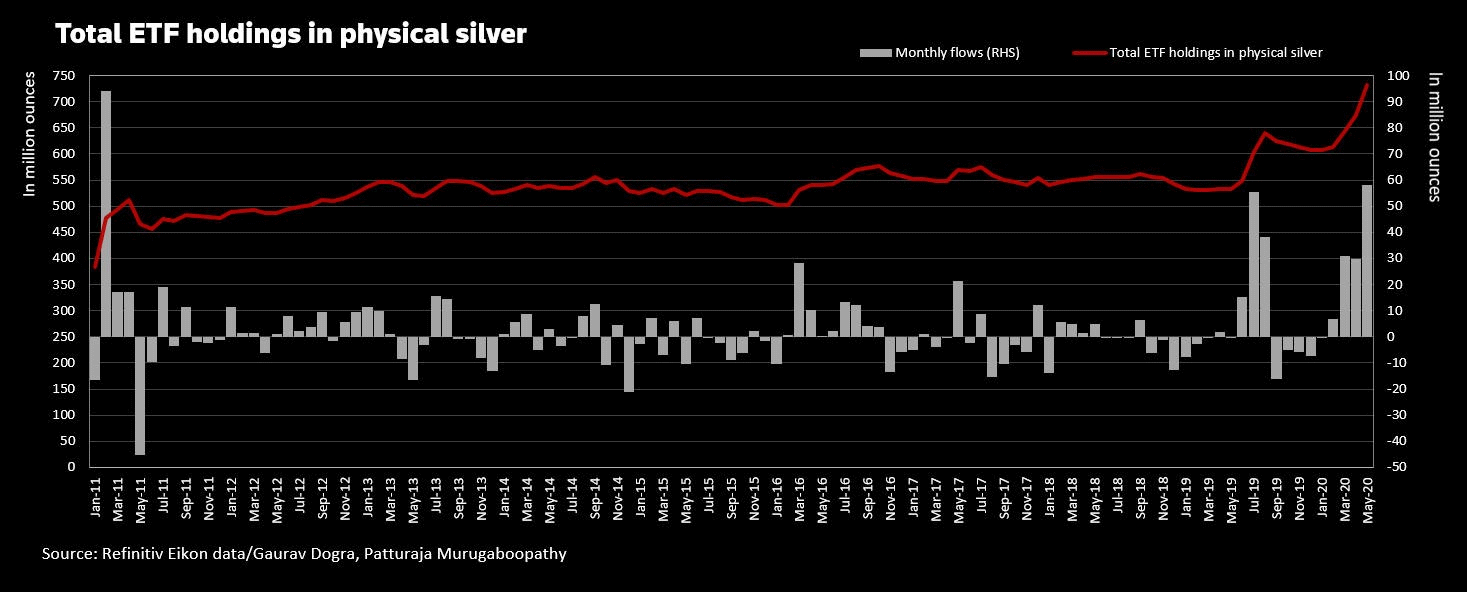

At first, the dynamics of gold and silver ETF assets was similar. However, at the end of May 2020, according to Refinitiv, investments in silver ETFs exceeded investments in funds for gold, which gives another signal for a reversal of a long-term trend in the ratio of two metals.

Let's look at a longer period of time. Physical silver ETFs have been growing since the first half of 2019. On the one hand, this could be insurance against the risks of trade wars, although gold is more suitable for these purposes. On the other hand, during this period, the Fed began to soften monetary conditions and switched to lower rates. That is, investors even then began to stake on the trend change in monetary policy, which means a change in the trend in the ratio of gold / silver.