Understanding free float and the main features of their subgroup, low float stocks, is important to many traders. This article provides essential information on this topic to help them trade these instruments better. Dear traders, you can interact with the Blog texts through the marked words and specific spots on the charts.

Are Trading Risks Just a Question of Price?

There is always a certain amount of risk in trading. Most traders understand it as a probability of a price change. Let’s check this logic in the following scenario. If a trader bought Apple stock at $170, and the price dropped to $160, the trader lost $10 in value on the price change. In this simple scenario, the fact and the extent of the loss are clear. However, there are many ways for the price to have dropped from $170 to $160.

First, time matters. The decline could have taken a week, a day, an hour, or even a minute. For some stocks, such quick price changes are a real life possibility. Naturally, if a stock price can change in minutes, the risks associated with that stock are much higher than with stocks that tend to see their prices change in hours or days.

Second, the extent of the change is important. By that, we mean the distance a price traveled in the course of the change. Traders need to estimate how much the price deviates from its average value or to estimate the average value of the price variation. Let’s see how we can do it in the below example.

- On Day 1, the Stock A’s price was $10. On Day 2, it was $15. On Day 3, it was $20. On Day 1, the Stock B’s price was $10. On Day 2, it was $5. On Day 3, it was $20. If we bought both shares on Day 1 at $10, we could get a $10 value increase on each one on Day 3. Therefore, bringing us equal profit, the two stocks would be identical in terms of return. However, from a risk perspective, they are different.

- On Day 2, Stock A was up 50% and about 33.3% on Day 3. Therefore, the average stock volatility was just over 41%. Stock B fell 50% on Day 2, but it gained a whopping 300% on Day 3. So, its average volatility was 175%. As you can see, Stock B was much more volatile and, therefore, more risky. The measure of such risk is called volatility or price volatility. Calculating the standard deviation of the price is at its core. The higher the volatility, the higher the risks. At the same time, high volatility is not always a bad thing because it often opens bigger profit opportunities.

In the previous example with Stocks A and B, a trending strategy would choose Stock A over B because the first one has lower volatility than the second one.

On the other hand, a trader could try making a bigger profit on the higher volatility of Stock B. If a trader opened a short position on Stock B on Day 1 and closed it on Day 2, and then immediately opened a long position, he would earn significantly more on Day 3 than what he’d get just holding the stock all along.

There are trading mechanics aimed specifically at using high volatility. Olymp Trade’s Fixed Time trading mode may be particularly useful during such periods. An important feature of volatility is that it’s not a constant. Volatility can change significantly, and Price shocks are a bright example of that.

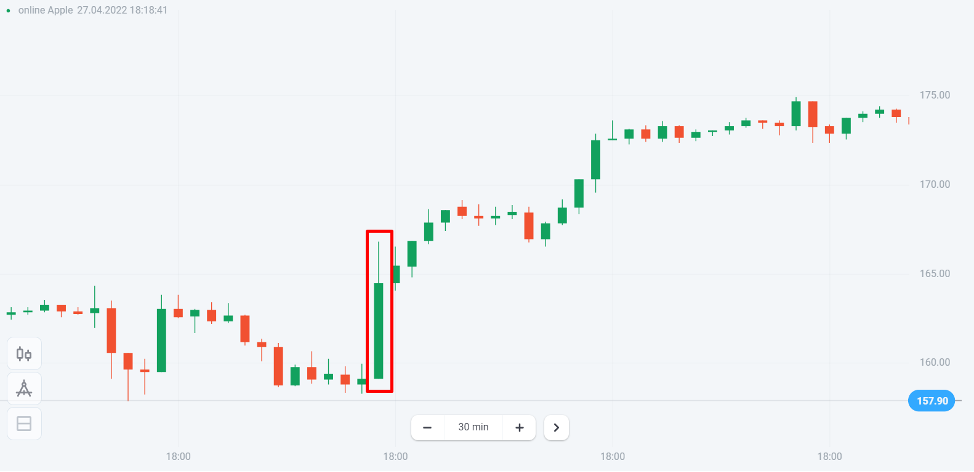

Apple stocks price on a 30-minute time frame reacts to the earnings report

Free Float and Main Features of Trading Low Float Stocks

Mainly, the stock price volatility largely depends on the number of traders involved in trading it and on its volume. Also, it depends on the total number of company shares freely traded in the market. The latter is a free float. Here is an example.

Google has a free float of 45.5%. That means about half of its shares are free float and can be bought and sold. Apple has almost 100% free float shares, and Tesla has more than 80%. The more free float, the less the price volatility will depend on the actions of big market players. Therefore, the higher the free float, the harder it is to move the price and, therefore, the more stable it is. You may find the information about companies’ free float on special sites like Marketwatch or Gurufocus.

Consider the company JW Mays Inc. It’s a US Brooklyn-based real estate firm. While its shares are traded on the Nasdaq exchange, its free float is about 20%. The below chart shows the “choppy” price performance of this stock. On the one hand, gaps are frequent because of the small number of participants involved in trading it. On the other hand, the price stands still on some days due to low liquidity.

JW Mays Inc. on a Daily time frame

How to Best Trade Free Low Float Stocks?

- It is better to trade such stocks with a small amount of money.

- It is not advisable to use Stop Loss because the frequency at which it will likely be triggered may be too high. As this is an intensive type of trading, you can’t just open a trade and leave it for a while. Instead, you need to put your undivided attention into your trades as long as they are open.

- The simpler the technical analysis, the better. Using just support and resistance levels may be enough. Remember that only a small number of traders are involved in trading such stocks.

- While beginner traders will unlikely choose to trade low float stocks, experienced traders are most involved in it. Therefore, should you choose to trade them, keep in mind you will be mostly doing that with the experts in the field.

Wide Choice of Stocks on Olymp TradeThis article was focused on free float stocks and paid specific attention to their subcategory, low float stocks. In the meantime, we recommend traders to keep in mind that each stock has its particular behavior because each represents individual properties and features of a particular business. Therefore, the best approach to trading stocks is to carefully choose them from dozens available on Olymp Trade and thoroughly study them with the many instruments on the platform.