Forecasting, predicting or even analyzing the market can be a challenging feat that involves mathematics, algorithms, news, awareness of geopolitical happenings and some say a bit of serendipity. Beyond these intrinsic obstacles there is always a higher than normal risk involved when you are inexperienced and unable to interpret such analysis.

An important part of these market “investigations” deal with trends and price actions, some negative and some positive. This article will focus primarily on the price actions of retracement and reversal. Specifically speaking about the their difference and which of the two is more important for you – the trader – to recognize early.

What is a Retracement

Signs of a Retracement

- Retail level

- Decline causes uptake of buying

- Limited largely to candles – sparse if any pattern reversals

- Short interest stays unchanged

- Fundamentals also remain stable

- Observed shortly after gains (large ones especially)

- Candles that show market uncertainty – both long bottoms and tops

The Importance of a Retracements Scope

After you have determined that a Retracement is in fact not a complete price reversal – the next step is identifying the retracements type which usually is broken down three ways:

- Fibonacci

- Pivot Point S&R levels

- Trendline S&R levels

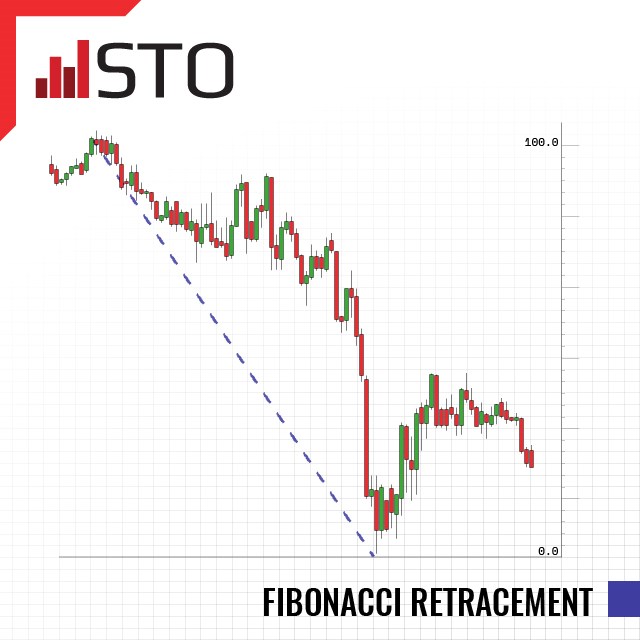

Fibonacci Retracements

Mainly used for the Foreign Exchange Market this retracement, but this is also occasionally used by stock traders and analyst. Usually an automated tool within charting software (like MT4) that allows you to draw a line between two points of a price’s most recent impulse wave.

Pivot Points Support and Resistance

These levels are generally used to gauge a retracement’s scope – a trader will look at the lowest support levels and if the price drops below it might be signs of a full-blown reversal.

Trendline Supports

This is probably the most obvious sign of a retracement vs. a full reversal is the price crossing a major trendline. Of this means that the trends break on a high volume but generally these are used by traders to distinguish reversals or retracements.

Using Stop Loss During Retracements

The primary danger with retracements is that they can turn into full blown reversals putting your capital at risk for loss. Using stop - loss could potentially lower the risk significantly – to do so set your stop-loss levels just below the retracement levels you extrapolate from technical analysis or directly below the support trendline over the long-term.

The most sure-fire way to minimize risk to capital is to of course exit a trade at the sign of retracement before or if it becomes a reversal. At the same time exiting a trade too soon can also hurt your investment due to the loss of earning opportunity – thus another element plays into recognizing a retracement and avoiding the loss due to a sudden reversal: discipline.

Hopefully with the information you received in this article you will be able to trade with more knowledge – if you want explore the markets and watch the prices of currencies, commodities and more start trading with and STO account today to gain access to competitive spreads and the MT4 platform.

This article comprises the personal view and opinion of the STO Investment Research Desk and at no time should be construed as Investment Advice