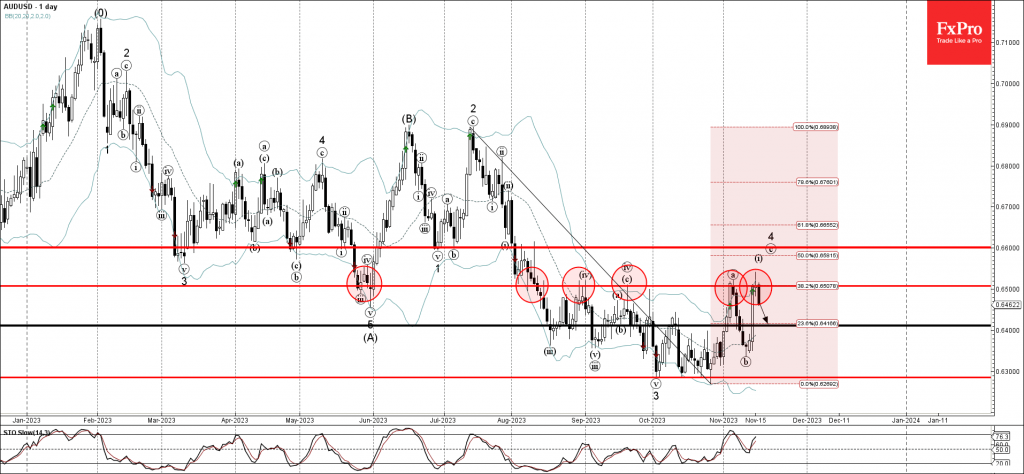

The AUDUSD currency pair has recently showcased a significant technical development, marked by a reversal from a critical resistance level. This shift occurred at the 0.6500 mark, which has historically been a strong point of contention in the pair's price dynamics. Notably, this level served as a robust support back in May and has since transformed into a key resistance, consistently influencing price movements since August. This transformation from support to resistance is a classic example of role reversal, a common phenomenon in technical analysis where former support levels become new resistance levels and vice versa.

This resistance at 0.6500 is further emphasized by its alignment with the upper daily Bollinger Band. The Bollinger Bands are a set of trend indicators that expand and contract based on market volatility, and the upper band often acts as a dynamic resistance in an uptrend. The convergence of the 0.6500 level with this band suggests a heightened level of technical significance, indicating that the pair might be overextended at these levels.

The recent downward reversal from this 0.6500 resistance level has effectively terminated the previous minor ABC correction pattern labeled as wave 4. This pattern, typically seen in Elliott Wave analysis, indicates a temporary counter-trend movement within a broader trend. The completion of this corrective wave suggests that the dominant trend, in this case, a downtrend, may resume.

Considering the current market dynamics, including the clear daily downtrend and the strong bullish sentiment around the USD, it is plausible to expect the AUDUSD pair to extend its decline. The next significant technical level to watch is the support level at 0.6400. This level could serve as a potential target for the ongoing bearish wave. A break below this support could reinforce the bearish outlook, while a bounce from this level might indicate a temporary pause or reversal in the downtrend.

In summary, the AUDUSD pair is demonstrating a clear bearish bias, with the recent reversal from the 0.6500 resistance level signaling potential for further declines. The convergence of this level with the upper Bollinger Band adds to its technical significance. Going forward, the 0.6400 support level will be critical in determining the pair's short-term trajectory, with a breach below possibly leading to an acceleration of the downward momentum.