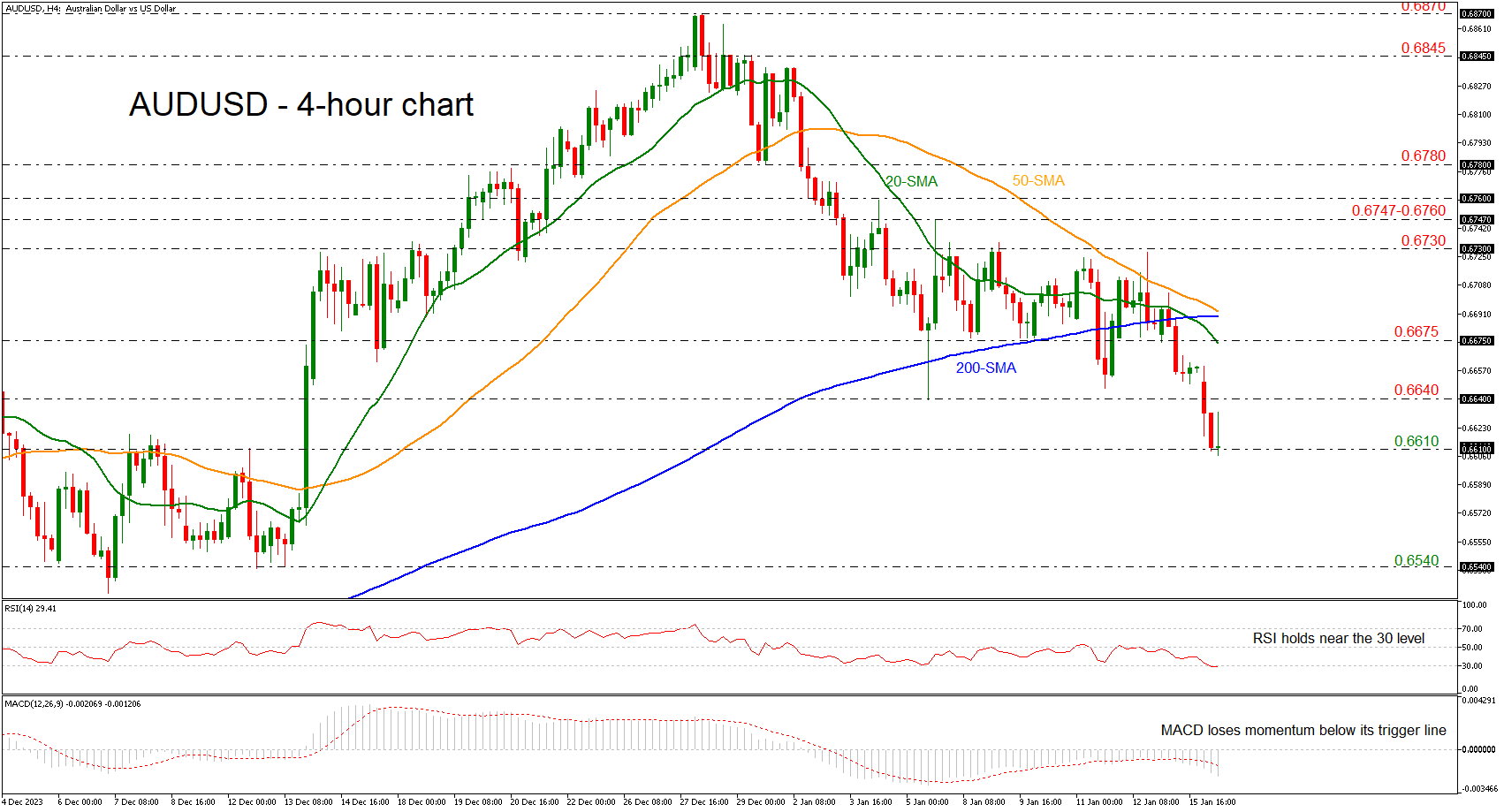

The AUD/USD currency pair has been experiencing a downward trajectory, slipping to a fresh one-month low of 0.6606, indicating a negative wave that initiated from 0.6870. This article will provide a detailed technical analysis of the AUD/USD pair's current situation. Technically, the short-term risk for the AUD/USD pair is tilted towards the downside. The Moving Average Convergence Divergence (MACD) oscillator is extending its negative momentum below its trigger line, firmly residing in the bearish territory. This bearish signal suggests that the downward pressure on the pair remains intact.

RSI in Oversold Territory

The Relative Strength Index (RSI), a momentum oscillator, is currently holding below the 30 level, which typically indicates oversold conditions. However, it's worth noting that the RSI is slightly ticking up, suggesting that the recent sharp decline in the price may have been overdone. The critical question now revolves around whether the AUD/USD pair can maintain its resilience above the key support level at 0.6610.

A decisive break below this level would exert further downward pressure on the pair, potentially pushing it towards the 0.6540 support level, which was last seen on December 13.

Positive Reversal Scenario

On the flip side, traders will closely monitor the 0.6640 resistance level and, more importantly, the 0.6675 barricade. This resistance zone overlaps with the 20-period Simple Moving Average (SMA), the 50-period SMA, and the 200-period SMA, all converging around 0.6690. A successful breach of this resistance area could potentially shift the outlook from bearish to bullish. In such a scenario, the next battleground for the AUD/USD pair could be around the 0.6730 hurdle.

Bearish Cross Alert: It's essential to keep an eye on the impending bearish crossover between the 50-period and 200-period SMAs. This technical event is expected to occur in the next few 4-hour trading sessions and could further reinforce the bearish sentiment for the currency pair.

In conclusion, the AUD/USD pair has experienced a recent bearish spike, but traders remain cautious. A confirmation of the current negative structure would entail a sustained move below the critical support at 0.6610. Moreover, the anticipated bearish cross between the 50-period and 200-period SMAs adds to the bearish outlook. However, traders will closely monitor the mentioned resistance levels for any signs of a potential reversal in the pair's fortunes.