Bitcoin was down 4.9% on Thursday, ending around $20.7K and trading near $20.8K at the start of the day on Friday. Ethereum lost 6.4% in the last 24 hours, returning to the 1100 area. Altcoins in the top 10 fell in price from 2.9% (BNB) to 8.8% (Polkadot). Total crypto market capitalisation, according to CoinMarketCap, sank 3.5% overnight to $903bn. Bitcoin’s dominance index fell 0.3 points to 44.0%.

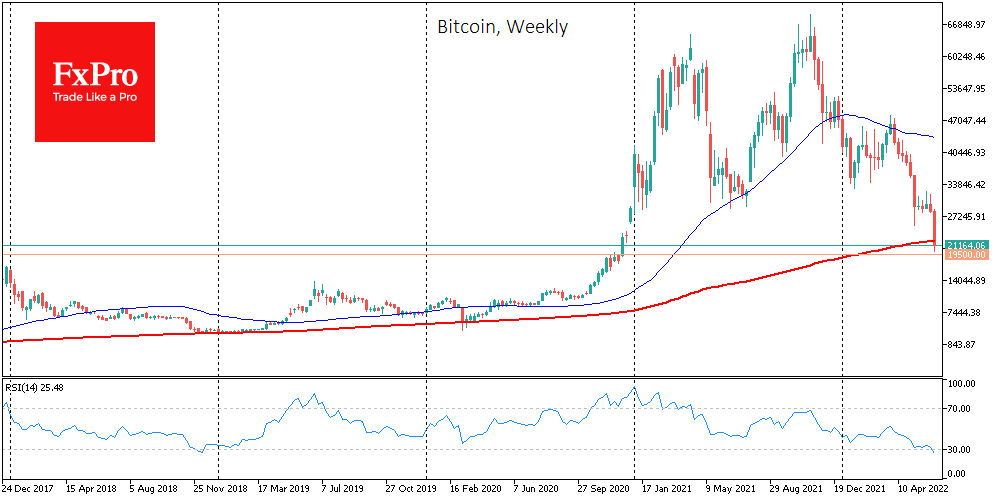

The Cryptocurrency Fear and Greed Index was up 2 points to 9 by Friday. Although we did not see any new intraday lows, Bitcoin closed Thursday with a tenth consecutive day of declines. New lows in stock indices contributed mainly to this. Bitcoin could be uncharted territory in a few days when historical patterns stop working. The bearish focus remains on the circular $20,000 level, the former peak of 2017. At no time in past down cycles has BTC fallen below the high of the previous bull cycle.

Closing the week below $22.3K would also be unique, as it would be the first close below the 200-week average. Bitcoin has previously fallen below this curve more than once but quickly regained some ground, finding ample demand from long-term investors amid a deep and quick sell-off. The latest issue to attract investors’ attention has been the uncertainty surrounding Singapore-based cryptocurrency fund Three Arrows Capital (3AC).

The hedge fund could be the subject of a new scandal amid growing speculation about its possible bankruptcy. Commodity Futures Trading Commission (CFTC) Commissioner Christy Goldsmith Romero called on the US Congress to close the cryptocurrency regulation gap and compared the collapse in the crypto-asset market to the 2008 financial crisis.