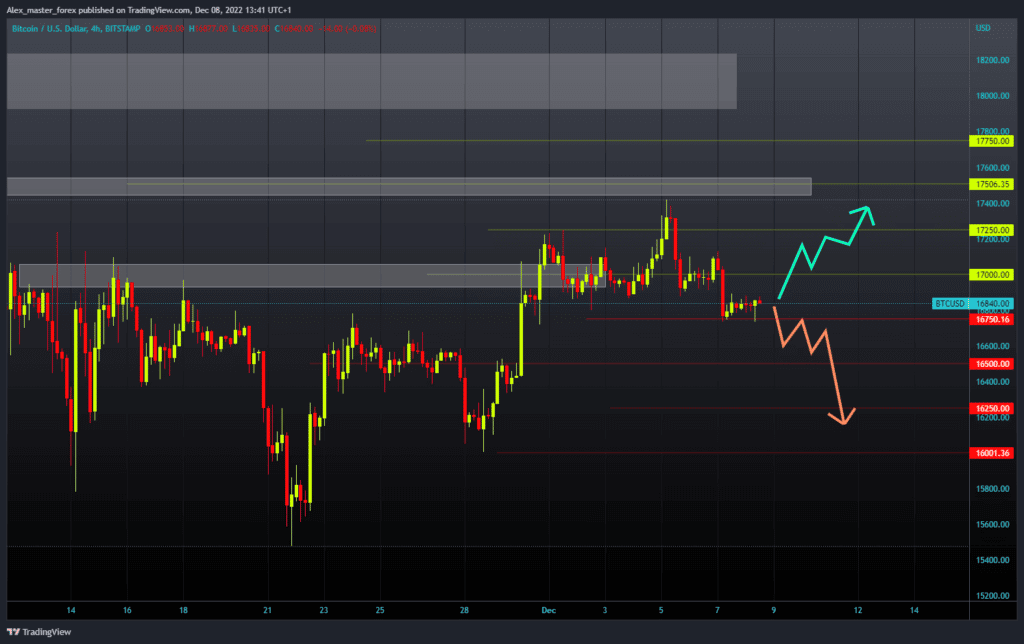

After yesterday’s drop in the price of Bitcoin to $16750, the situation is calm today, and Bitcoin manages to stay above that level. The price of Ethereum could soon encounter a new resistance in the zone around the $1250 level. After yesterday’s drop in the price of Bitcoin to $16750, the situation is calm today, and Bitcoin manages to stay above that level. Since the beginning of the week, we have been in a bearish consolidation with the $17,400 level. for a bullish option, we need a positive consolidation and a return to the $17000 level. Then we need to hold on up there and try to climb above.

Potential higher levels are $17140 previous high, then the $17250 level. For a bearish option, we need a negative consolidation and a fall in the price of Bitcoin below the $16750 level. After that, the price could initiate a new bearish impulse and continue its retreat to lower levels. Potential lower targets are $16500 and $16250 levels.

Ethereum analysis

The price of Ethereum could soon encounter a new resistance in the zone around the $1250 level. Yesterday’s price drop stopped at the $1220 level, and since then, we have been in a minor recovery. We are currently at the $1240 level and are moving towards the $1250 level. This is where we enter a potential resistance zone from which the price could easily trigger a new bearish impulse and form this week’s low.

Therefore, we should break below the support at the $1225 level. Potential lower targets are $1200 and $1175 levels. We need a positive consolidation and a move above the $1250 level for a bullish option.

Then it is necessary to stay up there and, with a new impulse, start the continuation of the recovery of the price of Ethereum. Potential higher targets are $1275 and $1300 levels.