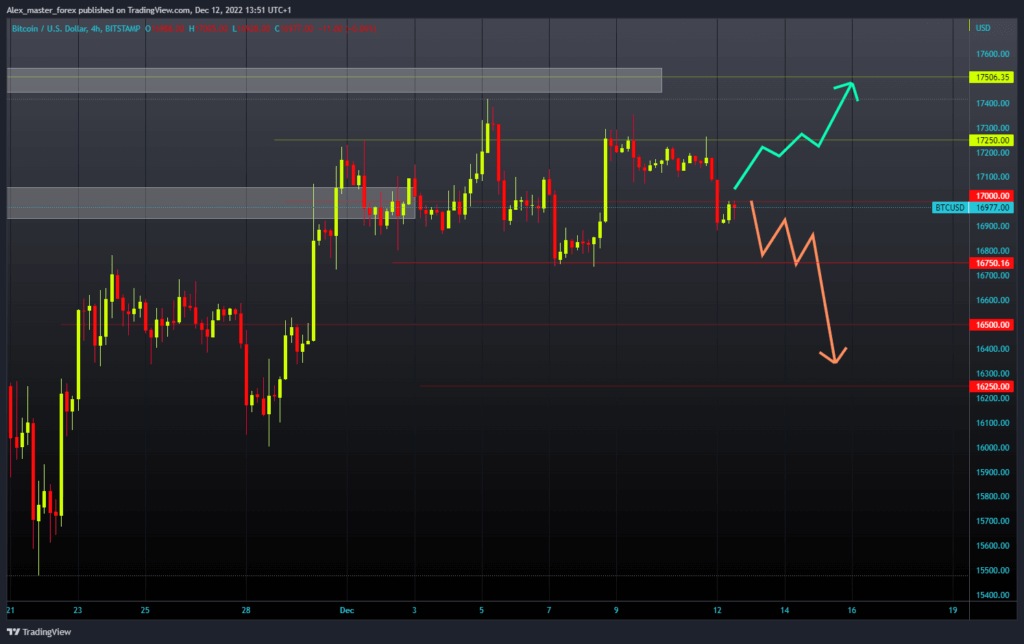

Over the weekend, the price of Bitcoin failed to make a concrete move and move above the $17300 level. Over the weekend, Ethereum encountered resistance at the $1275 level. Over the weekend, the price of Bitcoin failed to make a concrete move and move above the $17300 level. This morning we saw a sharp drop in the price of Bitcoin once again, and we are back below the $17000 level again. Bitcoin is managing to stay close to the $17000 level for now, but the pressure has increased, and another drop to the next lower support could happen.

For something like that, we need inactive consolidation and lower prices until the previous support is at the $16750 level. If we don’t manage to stay there either, continuing the bearish trend is a logical sequence of events. A potential lower target is the $16500 level. For a bullish option, we need a positive consolidation and a return above the $17000 level. Then we need to hold up there and start a new bullish impulse. Potential higher targets are $17250 and $17500 levels.

Ethereum analysis

Over the weekend, Ethereum encountered resistance at the $1275 level. The price failed to break through to $1300, and a new pullback to the $1250 level followed. Ethereum is now trying to find support at this level to try to trigger a new bullish impulse. If we see that, the price could rise again to the $1275 level. The future trend will also depend on the consolidation at that level.

Potential higher targets are the $1300 and $1325 levels. For a bearish option, we need a negative consolidation and further price pullback to the $1225 level. A break below would mean that we have the formation of a new lower low and the continuation of the bearish option. Potential lower targets are $1200 and $1175 levels.