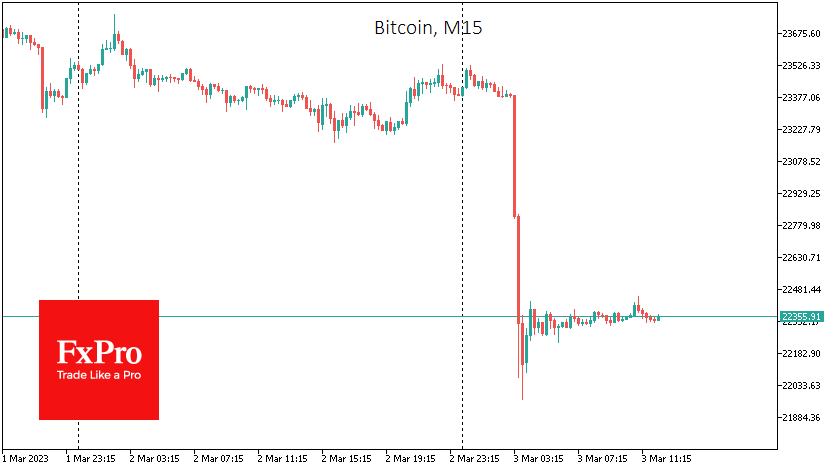

Bitcoin plunged more than 6% to $22.0K early this morning. The plunge into this area came as a market reaction to the potential bankruptcy of Silvergate. The news triggered a wave of stop orders on fears that the situation could cause a domino effect in the industry, as with FTX earlier in the day. Technically, the dip has pushed the price below its 50-day moving average, which does not bode well for the short-term outlook, although this signal will only be reliable at the close of the day. The intraday picture is one of tidy buying after a brief dip. The overall moderately positive sentiment in the global markets supports the buy-the-dip mood.

A return above $22.8 an ounce before today's close could spark further buying. Closing near the lows would be an essential signal to spread fear throughout the crypto market, suggesting a further drawdown to $19.7K in the coming weeks.

News Background

Shares in US holding company Silvergate Capital Corporation, which owns crypto bank Silvergate, plunged almost 49% on news of a delay in publishing its annual report to the SEC. The company said it needed "additional time" to complete its audit. Silvergate Bank has announced that it may file for bankruptcy due to a massive sell-off and an inability to repay its debts. Coinbase, the largest US cryptocurrency exchange, has announced severing its financial relationship with Silvergate Bank.

According to Glassnode, retail bitcoin investors' purchases have outpaced coin issuance. Investors with balances up to 1 BTC ("shrimps") and between 1 and 10 BTC ("crabs") over the past year have bought 105% and 119%, respectively, more Bitcoins that were mined. Ethereum developers have set March 14 as the date for the Shanghai upgrade on the Goerli test network. If the test network upgrade succeeds, the main network upgrade could occur in the second week of April.