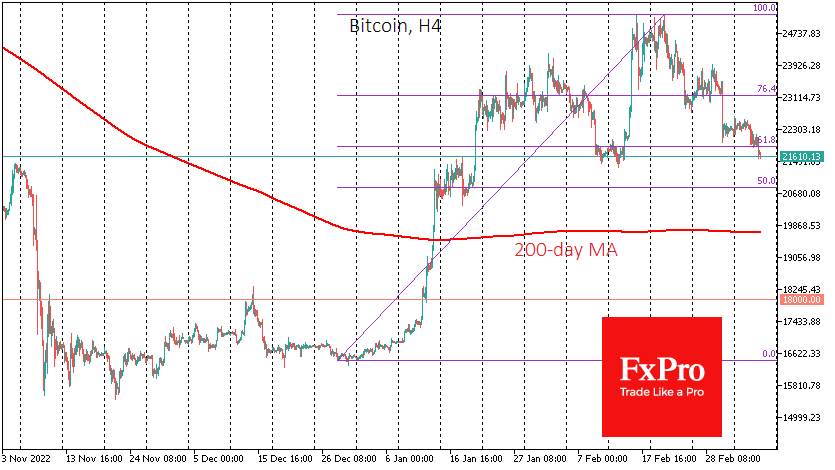

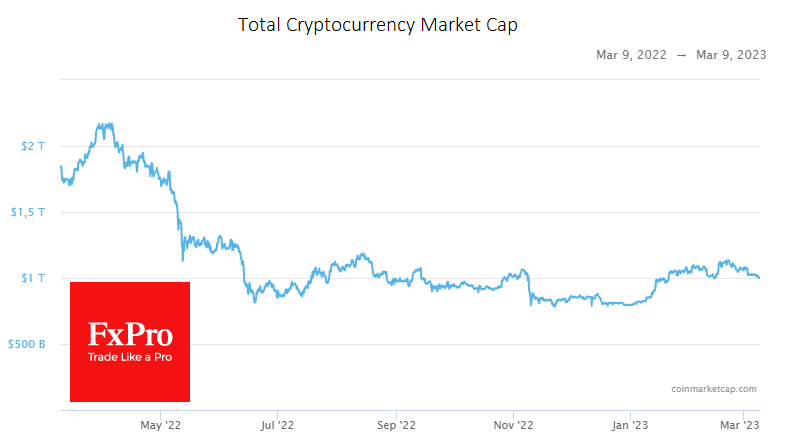

The total capitalisation of the crypto market is back below $1 trillion, down 1.1% over the last 24 hours. We note that sellers drive the market during periods of reduced liquidity - in the early hours of the Asian session, as was the case today. Bitcoin lost $300 in a sharp move to $21.7K, approaching the February lows and the critical signal level of $21.5K. A break below this level would change the status of the current events from a "typical correction" to a "methodical sell-off".

In that case, the road to $18K for bitcoin is open, and the capitalisation of the entire crypto market could fall back to $820B, as the rally from the beginning of the year would look like a blip in a bear market, not the start of a long uptrend. Many, including ourselves, saw the latter scenario as the main one until the end of last week.

Background to the news

Eric Pearce, CEO of One River Digital Asset Management, believes that the fall in the crypto market is temporary and that bitcoin has the potential to rise again. The key to the rally, he says, will be accelerating institutional adoption of crypto assets. According to a new Paxos survey, 89% of US crypto investors continue to entrust their funds to centralised exchanges, despite the collapse of several major companies in the cryptocurrency industry. 75% of US citizens are still interested in cryptocurrencies.

US banking giant JPMorgan is ending its banking relationship with Gemini, a cryptocurrency exchange Cameron and Tyler Winklevoss owned. According to PeckShield, the US government seized 48,998 BTC (worth about $1.08 billion) from the Silk Road darknet marketplace. The 9,825 BTC went to Coinbase, with the rest going to two new wallets. According to the court ruling, Binance's US unit could buy the assets of bankrupt cryptocurrency lender Voyager Digital.