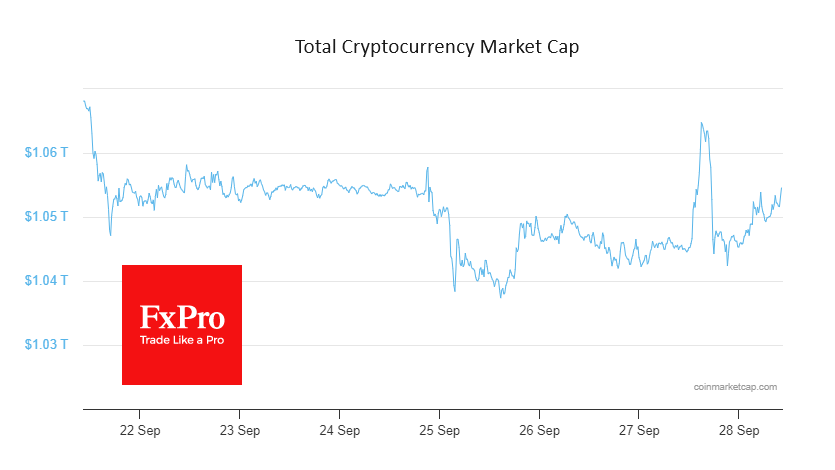

Crypto market capitalisation rose 0.7% in 24 hours to 1.053 trillion. This is a return to the levels seen at the end of last week. Cryptocurrencies saw increased buying when equity markets were under the most pressure and the dollar was gaining momentum. However, this momentum didn't last long. Bitcoin briefly rose to $26.7K but again found resistance at the 50-day moving average, which had already fallen to the abovementioned level. These growth impulses promise to remain a bull trap, offering the best opportunity to sell on the upside.

Cryptocurrencies need banking problems or uncertainty about the solvency of governments to generate sustainable growth momentum. Recent moves in bond markets show that something like this is brewing. But it's too early to call cryptocurrencies a safe haven from the chaos of the traditional financial system.

News background

The SEC has delayed until the 10th of January 2024 a decision on spot bitcoin ETF applications from ARK Invest and 21Shares and until the 21st of November 2023 for Global X Bitcoin Trust ETF. The regulator cited the need for "sufficient time to review the documents". Stablecoins are vulnerable in times of large-scale turmoil in the cryptocurrency market and could cause instability in the broader financial system, the New York Fed said in a study.

Forbes noted that the crypto market had responded positively to global financial uncertainty and remains resilient amid rising bond market volatility. Therefore, investing in Bitcoin or Ethereum could be a safer choice on the cusp of a possible recession. According to the Wall Street Journal, US authorities have been investigating Binance for a year and could face criminal charges and billions of dollars in fines.