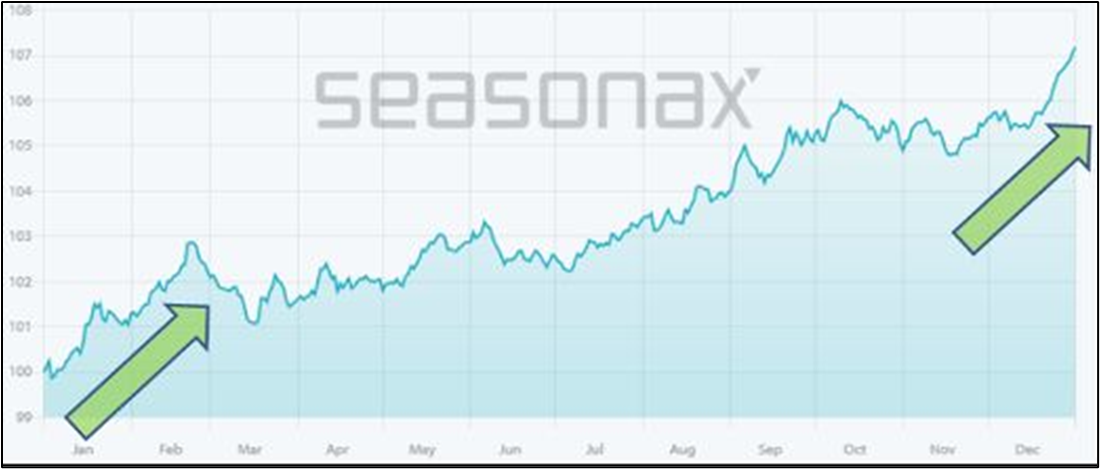

Like the blossom in spring and the harvest at the end of summer, gold shows recurring seasonal patterns or seasonality trends in its market performance. Let's look at how seasonality and cyclicality affect gold prices. A recurring pattern suggests a seasonally driven intense period for gold from the end of the year, starting in mid-December and lasting until about the second half of February. This is supported by research conducted by Seasonax, who analysed 54 years of data.

Gold's upcoming seasonal phase is positive

According to the data, the seasonal interim low usually occurred between 15 and 20 December, and the seasonal median high came at the end of February. There were years with no rise at all, but overall gold has been on the rise for 14 years out of the last 20 during the same two and a half months which amounts to a 70% probability of a price rise during this time.

Average gains over this period ranged from 8.5% to 18%, and the losses were significantly smaller, from –1.6% to –3.3% marking it profitable every year since 2013. The cultural factor and investor sentiment support the rising trend of gold in the reported period as well.

Cultural factors increase the demand for jewellery during specific periods

Indian traditions require gold and gold jewellery to be part of the dowry. About 10 million weddings are celebrated in India every year, and the wedding season usually runs from October to March, when temperatures are more pleasant and religious festivals fall on weekends. That is why year after year the jewellery industry meets almost the entire annual gold plan in a reasonably short period.

"According to Gold Demand Trends Q2 2023 published by the World Gold Council, India was the world's largest consumer of gold in 2022, buying 601 tonnes of gold, accounting for 28% of global jewellery consumption, with China slightly behind at 598 tonnes", said Kar Yong Ang.

The situation with the demand for gold jewellery in China is similar.

Investors are inclined to buy gold after the U.S. FOMC meeting in December

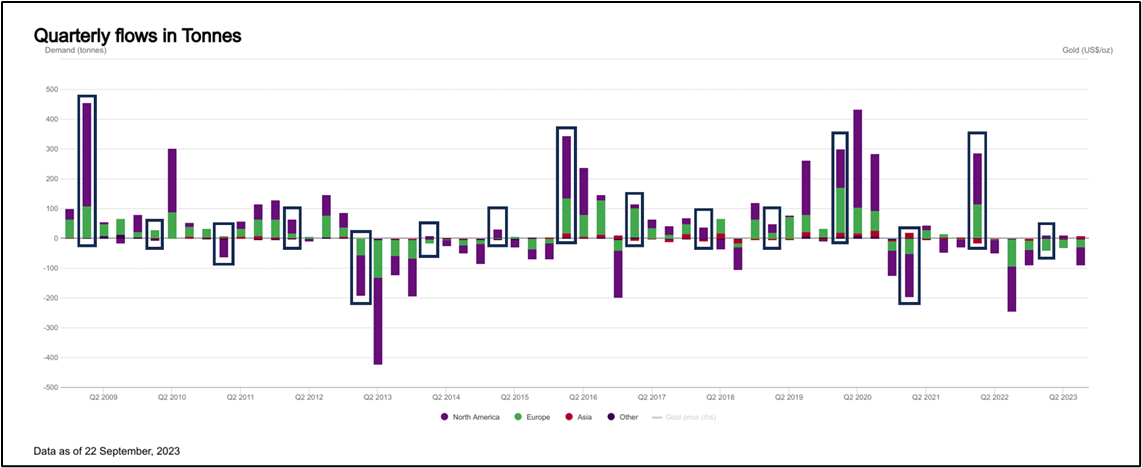

According to the Commitments of Traders (COT) bulletins before the December meeting of the U.S. FOMC, most investors were pessimistic about gold—with 87% of futures traders taking neutral or bearish positions. As a reminder, the seasonal interim low occurred between 15 and 20 December, corresponding with the date of the last FOMC meeting of the year. Gold ETF flows is one more component that correlates perfectly with the already mentioned ones.

So according to the World Gold Council, in 11 cases out of 15, the position of funds grew in the first quarter of the last 15 years—funds bought gold in January, February and March. The seasonality in the changes of gold prices is justified in 75-80% of cases. Therefore, investors and traders use it extensively in their trades. But even though sometimes seasonality works quite accurately, it should never be the sole basis for deciding whether to buy or sell gold.