Last week was tumultuous for BTC, with the shadow of the escalating Middle Eastern conflict heavily influencing market sentiments. The cryptocurrency sphere felt the ripples more than other traditional safe havens like gold, particularly after alarming revelations came to light. Israeli authorities discovered that several terror outfits had been channeling funds through cryptocurrency wallets and accounts. This insight into crypto's darker applications seriously tarnished its reputation, especially considering the heightened geopolitical sensitivities of the moment.

While seasoned investors might not be easily swayed by such disclosures, it's undeniable that this news impacted the larger crypto community. In a strategic move, BTC miners offloaded around 20,000 BTC at the dawn of traditional market operations last Monday. Whether this was a preemptive measure to offset potential price drops due to the ongoing conflict or a necessity to cover operational costs remains a subject of speculation. Nevertheless, the timing was inopportune, prompting BTC to plunge nearly 3%, settling just shy of $27,000 by week's close.

A Glimmer of Hope Amidst Gloom

Yet, it wasn't all bleak for BTC. The week also brought some positive market commentaries. Renowned hedge fund magnate, Paul Tudor Jones, in a CNBC conversation, articulated his growing confidence in BTC, influenced by the evolving macroeconomic landscape and geopolitical shifts. Having previously voiced his bullish stance on BTC back in May 2020 and later in early 2023 hinting at potential headwinds, Jones now seems to be steering back to optimism about BTC's prospects.

Echoing this sentiment, Standard Chartered bank made a noteworthy prediction. They forecast BTC could potentially soar to $50,000 by year-end and even reach a staggering $120,000 by the culmination of 2024. Their projections for ETH are equally promising, with potential valuations reaching $8,000 by the close of 2026.

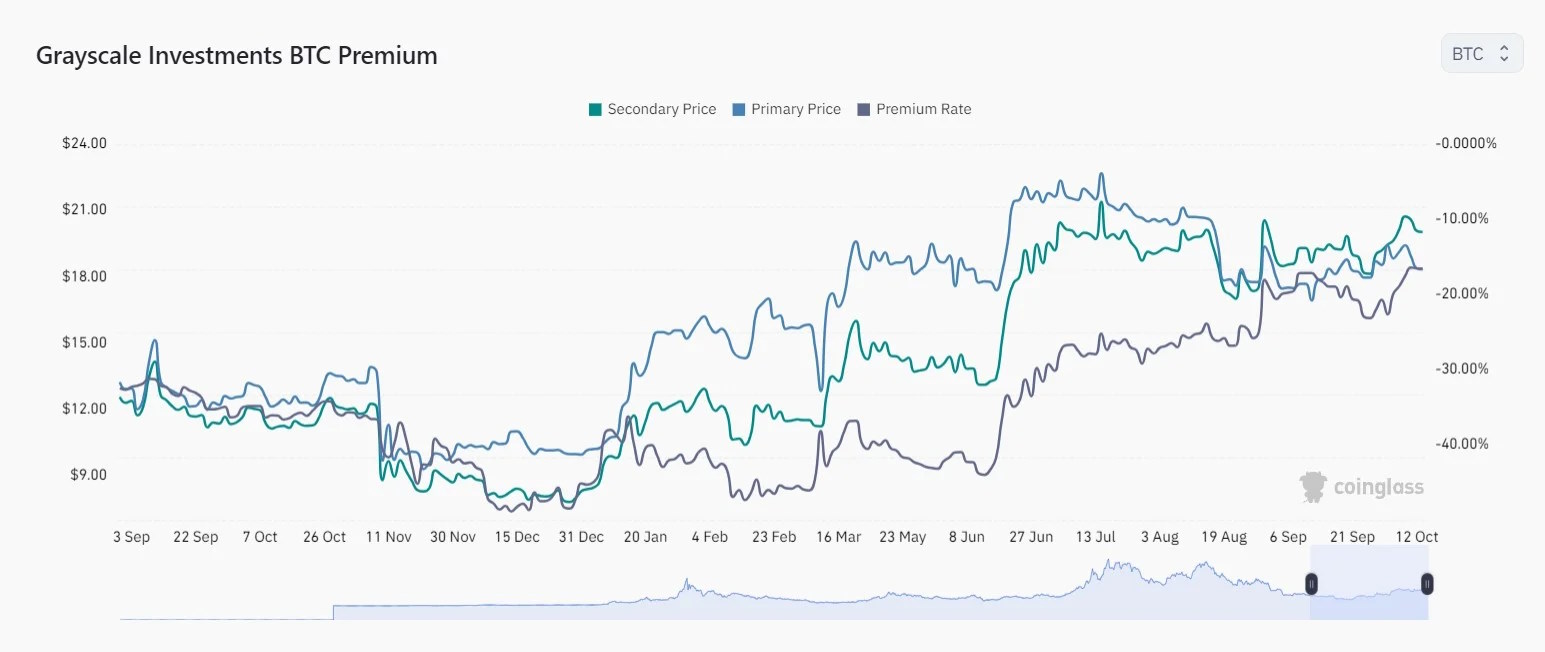

Perhaps the most significant optimism-booster was the recent revelation regarding the SEC's decision pertaining to Grayscale’s application to transition the GBTC Trust into a spot ETF. This crucial development indicates a mandatory review of Grayscale’s request. The market's response was evident: the GBTC discount reduced from a previous 43% in mid-June to the current 16.5%, reflecting increased bullish sentiments.

BTC: A Beacon of Promising Risk-Reward

Current metrics indicate that BTC is presenting an unparalleled risk-reward scenario compared to traditional financial assets, as elucidated by the Sortino ratio. Signs of an oversold crypto market are emerging. Indicators suggest that retail traders are veering more towards short positions, and the pervasive market chatter emphasizes mounting concerns about inflation and a looming crypto bear season. Yet, such conditions could be ripe for a short-term price revival.

Adding credence to this belief, the weekend unveiled a spike in BTC whale wallets, with 16 new wallets amassing between 100 to 1,000 BTC. This substantial surge demonstrates the whales' strategy to capitalize on the current price dip, contrasting starkly with the prevailing pessimistic retail trader sentiments.

INK's Resilience Amidst Market Volatility: A Dive into Whale Movements

A Rough Terrain for LINK The past week witnessed a dramatic downturn in the cryptocurrency market, with LINK feeling the pinch with a near 20% price depreciation. Such significant price corrections often lead to panic selling or, in crypto parlance, "dumping" of assets. However, when it comes to LINK, the story unfolds quite differently.

Betting Big on LINK Instead of a massive exodus, the larger holders of LINK, often referred to as 'whales,' showcased a contrarian stance. Rather than liquidating their positions, these whales took the opportunity presented by the market dip to expand their portfolios. This behavior was especially evident among whale wallets holding between 100,000 to 10 million LINK, which exhibited a spike in their acquisition rates.

The metrics elucidate the strategy clearly: there's been an increase of 6% in the number of addresses within this bracket when juxtaposed against data from mid-September. Such a trend suggests a robust confidence in LINK's long-term potential and a strategic approach to capitalize on short-term market anomalies. Deciphering the Whale Logic The accumulative behavior of LINK whales raises intriguing questions about their market perception and strategy. One possible interpretation is that these major players foresee a potential rebound or appreciate the inherent value and utility of LINK, regardless of temporary market fluctuations. Their actions could also be driven by the belief that the price correction was an overreaction, and LINK remains a strong asset in the long haul.

The Broader Implications

For the broader LINK community and potential investors, the whales' behavior can serve as a beacon. Their increased accumulation, in the face of declining prices, potentially signals an underlying strength in LINK's fundamentals. It could also be an implicit endorsement of LINK's future prospects and its role in the ever-evolving decentralized finance (DeFi) landscape.

In conclusion, while market volatilities remain an inherent characteristic of the cryptocurrency domain, the actions of informed and significant stakeholders often provide valuable insights. For LINK, the past week might have been tumultuous in terms of price, but the increased accumulation by whales suggests a silver lining and a story of resilience and long-term vision.