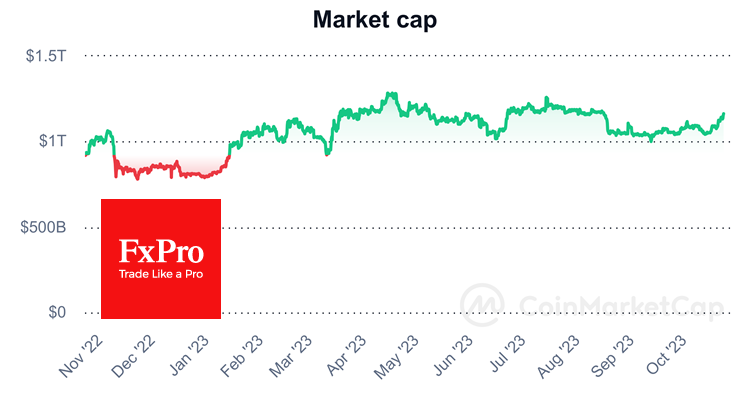

The cryptocurrency market, in its ever-evolving dynamic, is currently under the spotlight as significant movement patterns emerge. In the last week, there has been an 8.3% surge, elevating the market capitalization to a whopping $1.17 trillion. This value is the zenith observed since the plateau experienced between late June and mid-August. What instigated the previous dip in this period was a sharp rise in government bond yields, leading to a global dampening of risk appetite. Interestingly, this once detrimental factor now appears to be fortuitously aiding the crypto world. However, a word of caution is essential here: this advantageous relationship between bond yields and cryptocurrency is sustainable only if stock market fluctuations remain orderly. A pronounced shift towards risk-aversion would likely prompt substantial institutional divestment from crypto.

Bitcoin's Meteoric Rise

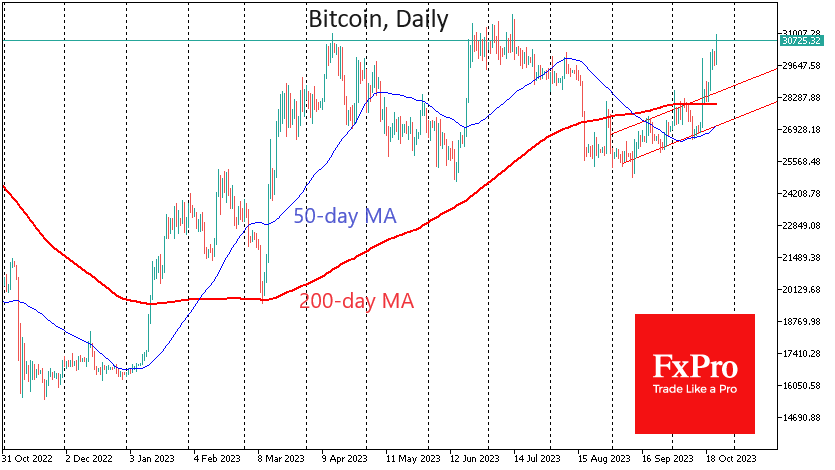

Bitcoin's performance mirrors the larger trend in the crypto market. Recording an impressive 10% spike in just a week, the leading cryptocurrency showcased its most stellar performance in the recent four months. Early this week, Bitcoin prices soared to almost $31K, a threshold that hasn't been touched since July. This trajectory signifies a pivotal juncture for the digital currency. Historically, Bitcoin faced significant reversals around this mark in April and June, with the June 2022 reversal marking a rapid sell-off. However, in a contrasting pattern between January to July 2021, this price point was where active buying was observed. If Bitcoin maintains its momentum and consolidates above the $31K mark, it could corner the bearish sentiments and potentially catapult the price towards the $40K bracket.

News and Predictions

Morgan Stanley, a financial giant, provides an optimistic perspective on the crypto landscape. They opine that the "crypto winter" phase might soon be a relic of the past, with a bullish market possibly emerging by the upcoming year. The scheduled Bitcoin halving in April is anticipated to be the catalyst for this renewed vigor. But Morgan Stanley also injects a dose of realism, highlighting potential market disruptors and emphasizing that the thriving of the crypto sector remains contingent on liquidity. The high monetary costs, currently, act as a deterrent, but fintech platform YouHodler believes that the "crypto spring" is on the horizon, contingent on a smooth economic transition in the US.

Adding to the flurry of developments, Grayscale and BlackRock, as reported by Bloomberg, are in the process of updating their applications to roll out a spot Bitcoin ETF. In a significant legal development, the SEC has chosen to withdraw its charges against Ripple CEO Brad Garlinghouse and its co-founder, Chris Larsen. This decision has been dubbed as a "capitulation" by Ripple Labs' general counsel, signaling a potential turning point in the crypto regulatory sphere.

Conclusion

The current trends and predictions indicate that the cryptocurrency market, particularly Bitcoin, is poised at a critical juncture. With potential regulatory relaxations and optimistic market predictions, the crypto world might be gearing up for a transformative phase. However, as always, investors should tread with caution, keeping an eye on global economic indicators and their potential impact on the crypto domain.