Tuesday's trading session revealed a striking divergence in financial markets, as traditional equities experienced a surge of optimism while the cryptocurrency sector lagged. This apparent detachment raises critical questions about investor sentiment and market dynamics. While stock markets were buoyant, cryptocurrencies seemed to struggle. The total market capitalization of digital assets decreased by 1.7% over the last 24 hours, suggesting a shift in investor preference from cryptocurrencies to equities. This move indicates a nuanced interplay between traditional and digital asset classes, potentially signaling a reallocation of risk assets in some investment portfolios.

Bitcoin's Volatile Trajectory

Bitcoin, the flagship cryptocurrency, epitomized this trend. After enduring a significant correction, Bitcoin's price momentarily plummeted below the $34.5K mark, triggering a cascade of stop orders. This sharp decline, however, was short-lived. Prices rebounded from these lows, and by Wednesday morning, Bitcoin was trading around $35.6K. This recovery could be interpreted as a sign of resilience or merely a temporary reprieve in a broader downtrend.

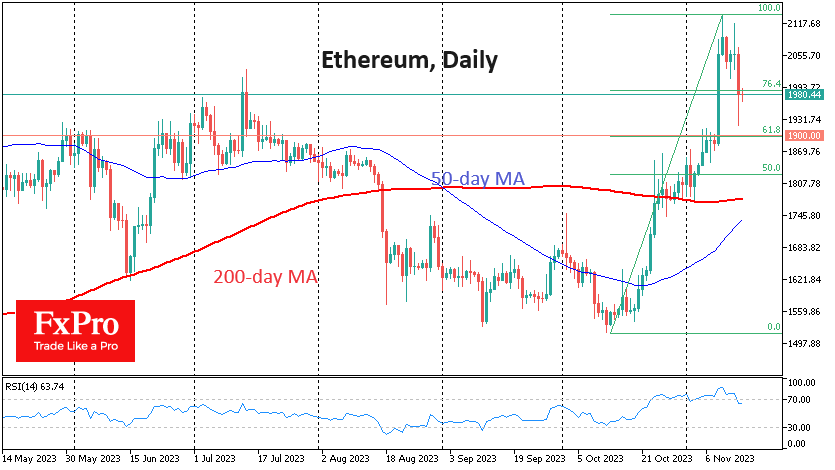

Ethereum's Struggle and Potential Recovery

Ethereum, another major player in the crypto space, also mirrored this volatility. After falling below the $2000 threshold on Tuesday, it made an attempt at recovery early Wednesday. The upcoming formation of "golden crosses" on both daily and weekly timeframes for Ethereum is noteworthy. This technical pattern, historically a bullish signal, could potentially drive increased buying activity.

In the realm of altcoins, Solana (SOL) has emerged as a standout performer. According to CCData, SOL has not only exhibited strong growth in recent weeks but also increased its share of the total trading volume in the digital asset market to an all-time high of 8.85%. The Solana ecosystem's leading meme coin, Bonk (BONK), has recorded a staggering 850% growth in the last 30 days, overshadowing other popular meme coins with larger market capitalizations like DogeCoin, Pepe, and Shiba.

The cryptocurrency market also saw some extraordinary movements in lesser-known tokens. The Grok token, coincidentally sharing its name with Elon Musk's chatbot, skyrocketed by 13,000% within a week of its launch, achieving a market capitalization of $160 million. Such dramatic surges, while indicative of the market's speculative nature, also underscore the unpredictable volatility of the crypto space.

Regulatory and Institutional Developments

On the regulatory front, the crypto market anticipates significant developments. The Chicago Board Options Exchange (CBOE) is set to introduce leveraged futures trading for Bitcoin and Ethereum on January 11, 2024. This move could enhance the institutional appeal of cryptocurrencies. Additionally, Anthony Pompliano of Morgan Creek posits that a simultaneous approval of all applications for spot bitcoin ETFs by the SEC could prevent favoritism and potentially catalyze a bullish trend in the market by facilitating increased capital inflows.

Conclusion: A Crossroads for Crypto

In summary, while traditional equity markets flourished, the cryptocurrency sector experienced a retreat, reflecting a complex interplay of investor sentiment, market dynamics, and regulatory landscapes. Whether this divergence signals a temporary reallocation of assets or a more profound shift in risk appetite remains an open question. However, the undercurrents in the crypto market, from Bitcoin's resilience to altcoins' explosive growth and impending institutional developments, suggest that the digital asset landscape remains vibrant and poised for potential shifts in the near future.