One of the major benefits of CFD trading is the ability to trade markets across the world. You no longer have to jump from broker to broker to get global exposure, you can do it by using the contract for difference markets. Forex brokers allow you to get global exposure in a multitude of indices, crypto, currencies, and commodities in one platform.

What Are the Advantages of CFD Trading?

One of the major advantages of CFD trading is that you have the ability to trade multiple markets in various sizes. Instead of going to a futures market and trading an entire contract for crude oil, you have the ability to make smaller trades. Furthermore, you can control a much bigger position with a smaller deposit, all while entering the markets from the same platform.

Leverage

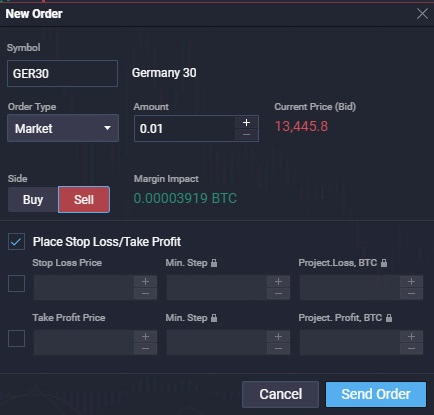

In the CFD markets, leverage is offered. This gives the trader the ability to control a much larger than normal position. This is a position that is backed by margin, which is a portion of the actual trade size and is kept within the account. PrimeXBT loans traders the necessary amount of funds to benefit from the larger size, and is done completely in the background, freeing the trader to focus on trading setups.

Going short

The ability to short a market is one of the major advantages to trading this CFD market. “Going short” is simply betting on the price going lower. For example, if you were to short the US 30 index, and it falls in price, you will benefit. In a traditional brokerage, shorting becomes much more costly and complex. The ease of simply picking a direction to trade is a major benefit.

Trade a vast array of markets from one platform

Forex broker allows you to trade foreign exchange, indices, crypto, and commodities from the same platform. This is a huge advantage to traditional brokerages, which typically only offer one or two of those markets. It is simply a matter of finding your opportunity and taking advantage of it.

Hedging stock positions

Traders sometimes will use the CFD markets to hedge existing stock positions. For example, if you have a large amount of blue-chip stocks in the United States, you may choose to short the US 30, in order to protect your downside. If your stocks do fall, odds favor the US 30 doing the same thing, thereby protecting you financially as you collect profits from your short position in this CFD market.

No Expiration Date

Unlike traditional futures contracts, CFD markets do not have an expiration date. This allows the trader to hang on to the position for much longer than a futures trader, without the hassle of “rolling over” a contract. This allows for a longer-term outlook to be easily expressed, as “buy-and-hold” is possible.

Mitigate Trading Expenses

Bringing down the cost of trading pays big dividends over the long term. This is a major feature of the CFD world, as you typically pay a small spread, and perhaps a very tiny commission for the brokerage itself. This is in comparison to large fees from a traditional brokerage such as larger commissions, data fees, and platform fees.

CFDs Have no Stamp Duty

While CFD trading is not necessarily tax-free, it is exempt from stamp duty. As a general rule, with CFD trading you only pay tax on capital gains. Make sure to check with your local laws.

FAQ: Frequently Asked Questions

- Is trading CFDs a good idea? Each individual case may vary, but if you are planning on trading financial instruments, CFD markets do tend to be a great way to get exposure to a multitude of markets, and in varying sizes. You can be much more granular with position sizing in the CFD markets than you are in other markets. Also, if you are a seasoned trader, you can benefit from the leverage that is allowed.

- Is Trading CFD profitable? It can be. It depends on whether or not you have a robust trading system and the psychology to take the ups and downs of trading. Having a trading plan and a proven trading system is by far two of the biggest factors in becoming a profitable CFD trader.

- Is CFD trading good for beginners? In a word, yes. This is because it gives the trader exposure to multiple markets and allows them to trade in very small sizes. It is much safer to trade an index CFD than it is the trading index futures contract, as the position size can be whatever is appropriate for the account. With a futures market, you have a standardized and quite often expensive contract.

- What are the limitations of CFD? CFD markets are not available for some jurisdictions, including the United States. However, most of the world enjoys CFD trading and the benefits that come along with the market. There are very few limitations, as CFD markets are extraordinarily flexible as far as leverage and position sizing are concerned.

- How long should I hold a CFD? This is where money management and trading systems come into the picture. As CFD markets have no expiry, it comes down to price. If it hits your take-profit level, you will be out of the market. However, the same can be said if it hits your stop loss level. Time very rarely comes into the equation, but if you know of a specific event that may cause drastic moves, you may wish to exit at that point.