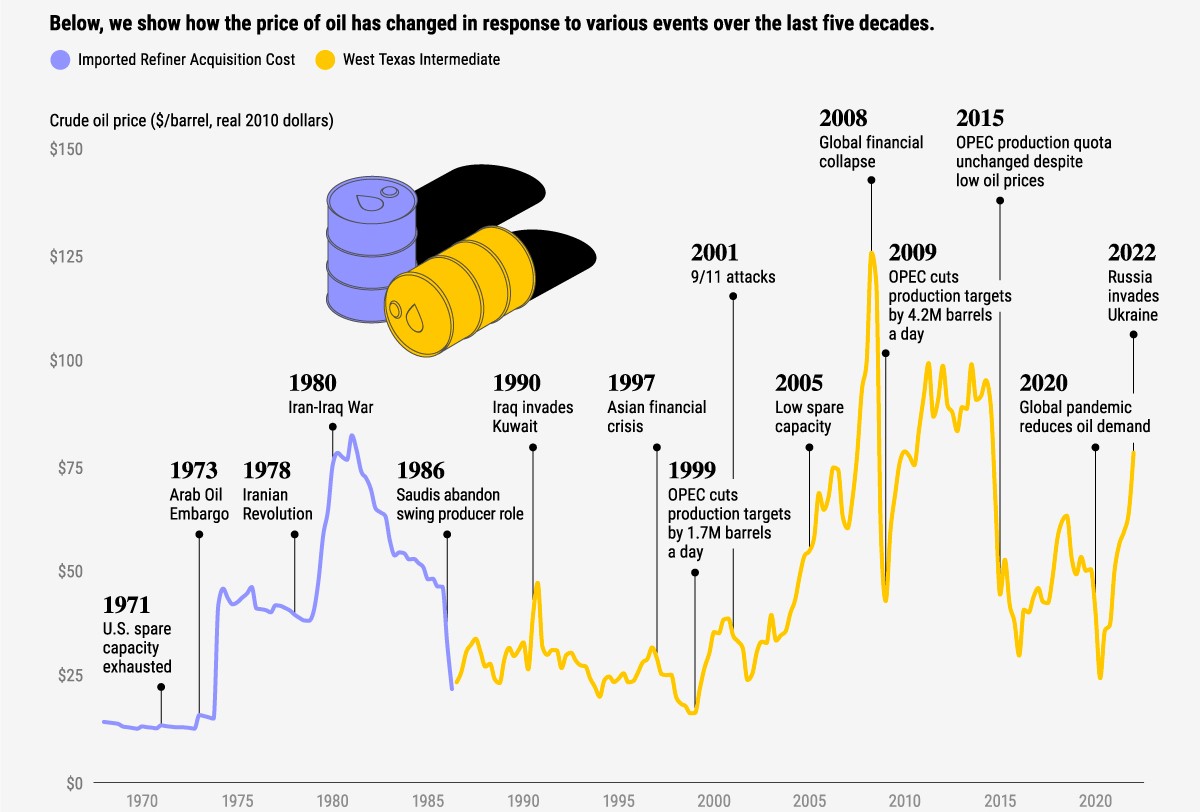

The oil and gas industry encompasses different types of oil, such as crude oil, no-lead gasoline, natural gas, and heating oils. Among these, crude oil remains the largest and most widely traded sector, sourced from various points of origin worldwide. Due to its extensive trading volume and diverse sources, crude oil is susceptible to geographic, political, and economic factors that make its market highly volatile. This volatility presents both risks and opportunities for traders interested in capitalising on the oil market.

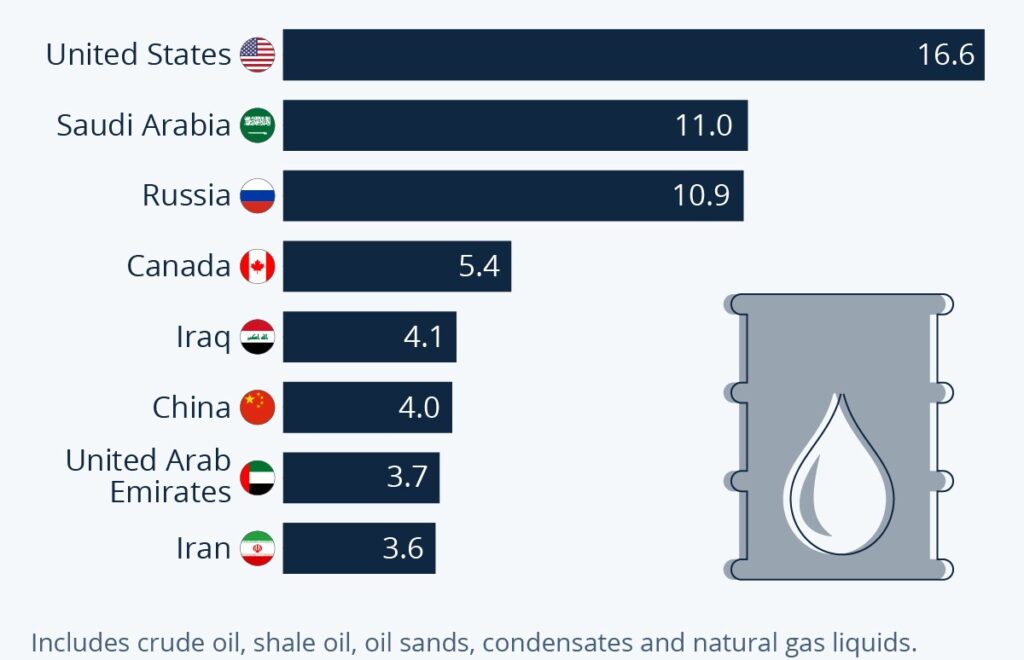

The world’s biggest oil producers (2021) in million barrels per day

Understanding Oil CFDs

CFDs are derivative financial products that allow traders to gain exposure to a market, such as oil, without owning the underlying asset. Unlike physical trading, oil CFDs derive their profitability from speculating on price fluctuations rather than the buying and selling of the actual commodity.

Successful trading of oil CFDs requires a deep understanding of market trends, factors driving price movements, and the ability to predict market dynamics.

What Are Oil CFDs?

Oil CFDs enable traders to access the expansive oil market through leverage, offering increased exposure without the need to possess the physical asset. This increased exposure can diversify investment portfolios and reduce overall risk. Oil CFDs serve as conduits for trading in oil spot prices, oil futures, and oil options.

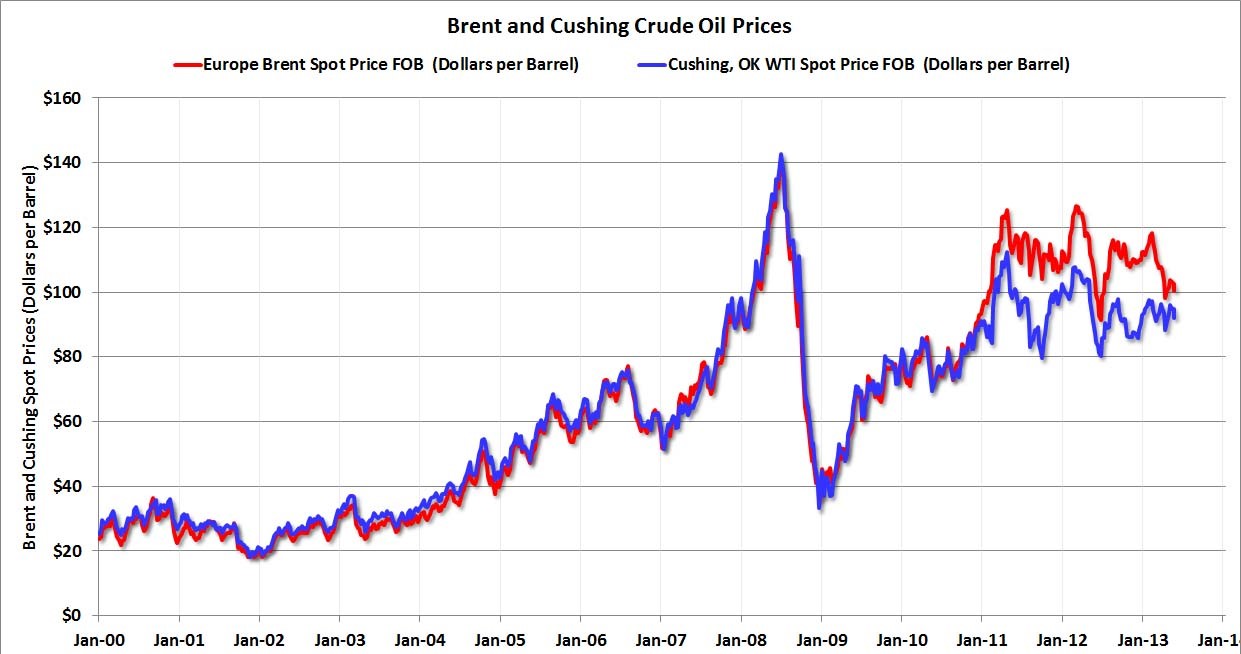

The most commonly traded benchmarks for crude oil CFDs are West Texas Intermediate (WTI) and Brent Crude Oil.

Differentiating WTI and Brent Crude Oil

When trading oil CFDs, it is important to familiarise yourself with the two primary types of crude oil in the global market: WTI Crude Oil and Brent Crude Oil. These crude oils are rated based on their density and sulphur content, which impacts their quality and refining costs.

Brent Crude Oil

- Sourced from oil drilling in the North Sea

- Responsible for setting the price of two-thirds of the world’s traded crude oil supplies

- Defined as a light crude oil, but not as light as WTI Crude Oil

- Typically refined in Northwest Europe

- Brent Crude Oil CFDs are traded over a five-day work week

- Brent can be particularly vulnerable to crises and instability because it is relatively more widespread

WTI Crude Oil

- Sourced from land based oil fields in Texas, Louisiana and North Dakota

- One of the two main benchmarks for pricing of global oil markets, along with Brent Crude

- Graded as ‘Texas light sweet’ oil, both lighter and sweeter than Brent Crude

- Typically refined in Texas and Oklahoma

- Land-based drilling can make shipping and transport of WTI Crude Oil more expensive

- International events and instability have less of an effect on price

- Traded on the New York Mercantile Exchange (NYMEX)

Trading Oil CFDs: Key Steps

To start trading oil CFDs, it is essential to follow a structured approach:

- Step 1. Familiarise Yourself with Live Trading. Choose whether you want to trade WTI Crude Oil, Brent Crude Oil, or both. Practice using a demo account to become familiar with trading tools, indicators, and executing trades in a risk-free environment.

- Step 2. Create Your Oil CFD Trading Account. Once comfortable with the trading environment, open a live trading account, download the trading platform, and deposit funds to start trading.

- Step 3. Manage Your Risk. Establish risk management strategies, including the use of stop-loss orders and limit-close orders, to control potential losses.

- Step 4. Study the Market. Deepen your understanding of the oil market through comprehensive research, including fundamental and technical analysis. Stay updated with breaking news and monitor long-term performance to identify patterns.

- Step 5. Formulate a Strategy. Determine whether you prefer short-term or long-term trading strategies and select an approach that aligns with your portfolio and goals.

- Step 6. Consider Diversification. Explore other CFD markets and assets to diversify your trading portfolio and mitigate risk.

- Step 7. Monitor and Adjust. Continuously monitor your trades, adapt your strategy as needed, and make informed decisions based on the market conditions.

Trading Oil CFD Futures

In addition to trading spot prices, oil CFDs also provide access to oil futures. Oil CFD futures are over-the-counter derivatives based on future contracts. These contracts allow traders to speculate on the future price of oil at a predetermined date. Trading oil CFD futures involves understanding the intricacies of futures markets, contract expiration, and factors that influence their prices.

Pros and Cons of Oil CFDs

As with any trading method, oil CFDs have their own advantages and disadvantages, which you’ll need to weigh up before you get started.

Pros:

Trading oil CFDs requires you to trade with leverage, which means traders only have to place a percentage margin of the full trade value as a deposit. This can give you increased exposure in oil markets and has the potential to maximise your profits.

- Oil CFDs give you the chance to gain full exposure to the oil market without needing to take possession of any physical assets.

- Trading oil CFDs can be thrilling for investors who want to challenge themselves in volatile markets.

- This volatility also opens up more potential opportunities for traders to make a profit.

Cons:

- It’s worth noting that oil CFD trading is not permitted in the US and is taxed, unlike other methods such as crude oil spread betting.

- Leveraged trading can maximise your profits, but it can also amplify your losses. You should bear this in mind and have a strategy in place for mitigating the risks involved with trading oil CFDs.

- The oil market is volatile and requires close monitoring as well as detailed knowledge of your chosen market if you want to trade oil CFDs.

Learn with VT Markets

VT Markets is a provider of comprehensive trading services, offering demo trading accounts using the popular MetaTrader platforms. These demo accounts enable traders to experience realistic trading environments, access powerful trading tools, analyse market trends, and receive professional support. By leveraging these resources, traders can develop their trading style and gain confidence in trading oil CFDs effectively.

Summary:

- Crude oil is the largest and most volatile sector in the oil and gas industry, influenced by geographic, political, and economic factors.

- Oil CFDs are derivative financial products that allow traders to speculate on oil price fluctuations without owning the physical asset.

- Oil CFDs provide increased exposure and can diversify investment portfolios, with commonly traded benchmarks being WTI and Brent Crude Oil.

- WTI Crude Oil is sourced from land-based oil fields in the US, while Brent Crude Oil comes from drilling in the North Sea.

- Trading oil CFDs involves steps such as familiarising oneself with live trading, creating a trading account, managing risks, studying the market, formulating a strategy, considering diversification, and monitoring and adjusting trades.