How to protect your savings and investments in a financial crisis? How to create a trading strategy capable of generating profits even in non-standard market conditions? How to make a stable income in an unstable market? The science of risk management in the financial markets answers these questions. In this article, we will look at the key trading and non-trading risks and learn how to apply the fundamental principles of risk management to improve your trading performance.

Risk management is defined as a set of targeted actions and decisions aimed at reducing the effect of uncertainty (risk) on financial, operational and other results. In other words, it is a management system that includes identifying, assessing and controlling threats to an organization’s or individual’s capital and earnings.

Risk management in financial markets is the management of trading and non-trading risks in trading and investing. Before we talk about effective risk management in trading, let’s consider the key risks each market participant may face.

Main risks in trading: classification and definition

For convenience, we will divide all risks into two categories: trading risks and non-trading risks. Trading risks include all factors directly related to the trader’s activity and his trading decisions. Non-trading risks are factors that don’t depend on the trader’s decisions but may significantly affect his financial results.

Trading risks

The risk of an “incorrect” market forecast is, by definition, one of the key aspects of every trader’s life. The risk lies in making erroneous trades that turn unprofitable and cause trading losses. We used quotation marks for the word “incorrect” since market predictions are never 100% accurate. They only have a certain percentage of probability. Therefore, if the forecast doesn’t come true, it would be incorrect to call it a “mistake”.

However, there are a wide variety of strategies and approaches aimed at increasing the likelihood of forecasts turning out accurate. For the most part, a trader’s job is to minimize the risk of an “incorrect” prediction.

Earn like professional traders now! Follow daily trading ideas from recognized market experts on the AMarkets website and Telegram. The risk of increased volatility is the risk of losing all or part of the deposit when an asset’s price swings around the average price observed over some period of time. For example, if the average dynamics of the GBP/USD currency pair is 1000 points per day (in a 5-digit quote), and on some day it records a 1500 move, then it is customary to talk about an increase in volatility.

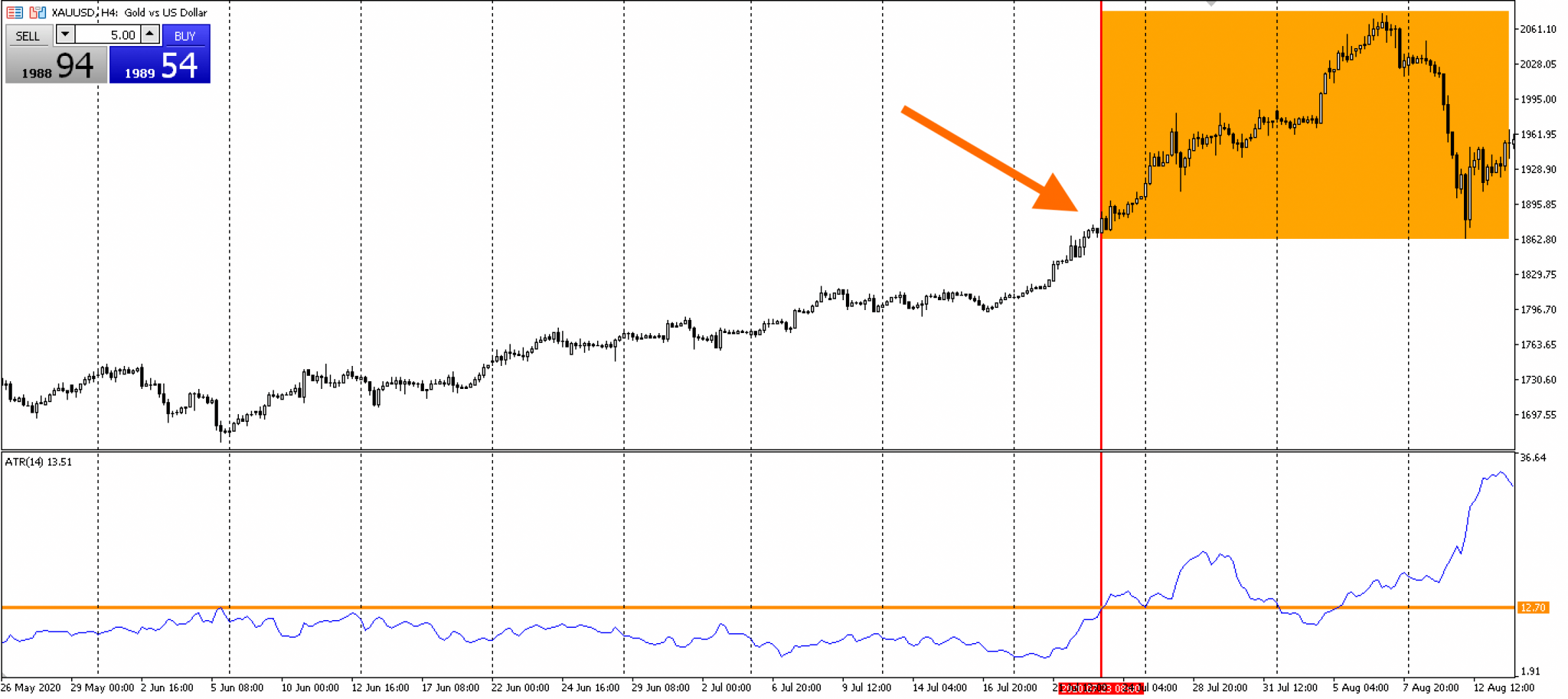

Gold (XAU/USD) and ATR (14) dynamics in the period from May 26 to August 13, 2020, MetaTrader 5 trading terminal, H4 candles. Date: March 7, 2022

The chart above shows an example of increased volatility in gold, estimated using the Average True Range (ATR, 14) technical indicator. The indicator is plotted at the bottom of the price chart (blue line). Traders who don’t account for volatility may not be prepared for sharp spikes and risk incurring losses. On the other hand, those who always calculate volatility can generate higher profits.

The quotes chart shows a significant increase in volatility – to the right of the vertical red line. The orange line on the ATR chart indicates the maximum level for the period to the left of the red line – the value of 12.70. Subsequently, volatility almost tripled and reached 33.63.

The assessment of fundamental factors and advanced methods of technical analysis makes it possible to make profitable trades with a high degree of probability even in such conditions. Before using your trading strategy in live trading, we recommend backtesting it on a demo account and optimizing it using the Strategy tester available in the MT4 and MT5 trading terminals. Capitalize on your ideas by assessing the strengths of each strategy.

Non-trading risks

Currency depreciation risk is the risk that the currency used in investment will fall in value compared to other currencies. Imagine a trader invested money in foreign currency and received a 20% return on investment. At the same time, the national currency strengthened relative to the foreign one by the same 20%. As a result, when a trader decides to withdraw his returns and converts his profit into the national currency, he will be left with an amount smaller than his initial investment.

Geopolitical risk is the inability to withdraw funds from the brokerage account (be it a foreign or domestic broker) and keep trading on the same terms due to the changes in legislation or cooperation rules at the national and international levels.

Restrictions may be imposed against the will of a broker. But if they come from the government, the central bank and other regulatory bodies, the broker will have to obey the laws and make corresponding adjustments to its activity/trading conditions. Broker’s failure to fulfill its obligations. The reasons for refusal/inability to fulfill the obligations can be different: from fraud to geopolitical components mentioned above. Honest brokers earn on commissions and spreads, so they are interested in cooperating with each client as long and fruitfully as possible. Scam brokers, as a rule, attract customers, and once they deposit funds, the fraudsters disappear with the clients’ money.

How to verify your broker’s trustworthiness?

Reliable brokers have a license to confirm that they are operating legitimately and updated information on the regulation of their brokerage activity on their websites. Look at the broker’s background, its experience in the industry, and how many clients and partners it serves worldwide.

Make sure to check customer reviews on sites like Trustpilot. If a broker cares about its reputation, it provides its clients not only with favorable trading conditions but also with high-level customer support.

Risk management in trading: purpose and objectives

The purpose of risk management is to determine the direction of development in an unfavorable situation. The risk manager makes a detailed plan of actions to be taken in the event of an unfavorable scenario.

In trading, this plan is commonly referred to as a “trading strategy” or “risk management strategy”. It contains a large number of parameters: from choosing and optimizing a trading strategy to diversifying trading accounts by account currency. In the next paragraph, we will consider the rules for creating a risk management strategy.

The key objectives of risk management include:

- boost profitability;

- reduce losses;

- risk prevention.

Use one of the most effective tools to analyze your trading strategy: AMarkets’ Trade Analyzer. Get advanced detailed statistics on your trading strategy and practical recommendations on how to improve it.

Risk management strategy in trading: golden rules

Risk management in trading is a set of actions aimed at mitigating risks and the negative consequences caused by market uncertainty. Such situations may include economic crises, force majeure events, excessive market volatility caused by the publication of important macroeconomic data, and others.

Risk management activities involve following specific rules based on the diversification principle, applied in every aspect of work in the financial markets. Let’s consider them below.

Principles of risk management

Diversification of trading instruments. You may have heard the saying: ‘don’t put all your eggs in one basket.’ It has become a valuable metaphor for explaining ways to manage your investment risk among traders and investors. The wider the range of financial instruments you trade, the more chances for success you have.

Do you trade USD/CAD and analyze the macroeconomic statistics of OECD countries? Check out the S&P 500 stock index and explore more market opportunities to generate higher profits.

Diversification of trading signals involves taking into account non-related aspects when entering and exiting trades.

For example, a trader can use:

- Trend indicators to determine the medium- and long-term trend.

- Exchange volumes and market profile to assess support and resistance levels.

- Market sentiment indicator to assess how bullish or bearish market forces are and forecast the behavior of traders.

If a trader can see a wider picture of the market, he will be able to make more rational and weighed trading decisions. Diversification of brokers on a regional basis. The risks associated with brokers have been described above. It is important to note that even if the broker is reliable and fulfills its obligations, it still operates in a particular jurisdiction.

Ideally, you need to have several trading accounts with brokers from different countries to reduce the risks associated with political and economic turmoils.

Diversification of trading accounts by account currency. In the event of rapid depreciation of the national currency, your portfolio carries a higher degree of risk if all your savings and investments are quoted in one currency. Therefore, it is reasonable to distribute your capital among accounts in different currencies and even cryptocurrency, which has recently become a popular safe-haven asset.

How to create a trading strategy following risk management rules?

We have outlined 6 steps to creating a trading strategy in accordance with the risk management rules:

- Set realistic profit targets.

- Make up a list of financial instruments you want to trade.

- Open live accounts with brokers that offer these instruments, taking into account non-trading risks.

- Create a trading strategy for each instrument.

- Identify the weaknesses of each strategy – they pose the main trading risks.

- Optimize your money management and time management strategies to minimize risks.

CME Group specialists suggest following the classic 2% rule, i.e., you should never risk more than 1% or 2% of your capital on any given trade. For example, if you are trading a $10,000 account, the total loss (risk) should not exceed $200 per trade. The Balance analysts say traders should stick to the 1% risk rule. Investopedia experts give another piece of useful advice to achieve success in the financial markets –“Plan the trade and trade the plan.”

Trade, enjoy the process, manage your risks and earn money. Good luck!