Microsoft Corp., an American multinational technology conglomerate currently ranked the third largest company by market capitalization ($1.728T) which actively engages in the development and support of software, services, devices and solutions, shall release its Q2 2023 financial results on 24th January (Tuesday), after market close. Microsoft derived its revenues from three main segments. The first segment is Productivity and Business Processes segment, which include products and services such as Office Commercial, Office Consumer, LinkedIn and Dynamic Business Solutions. The second segment is Intelligent Cloud segment, including various Server Products and Cloud Services, as well as Enterprise Services.

The third segment is More Personal Computing segment, involving Windows, Devices, Gaming, Search and News Advertising. Intelligent Cloud has been the segment that brought the most revenues to the company. In 2022, sales revenue generated from the segment was $75.25B, comprising nearly 38% from the total revenue.

In Q1 2023, Microsoft reported $50.1B in sales revenue, down -3.59% from the previous quarter, but up 11% compared to the corresponding period of last fiscal year. For the last 12 years, the company’s quarterly revenue gains have almost tripled. In the latest announcement, Microsoft sees revenue growth in Intelligent Cloud (+20% (y/y)) and Productivity and Business Processes (+15% (y/y)), whereas revenues in More Personal Computing declined slightly due to falling sales in Windows OEM, Xbox content and services. Consensus estimates for sales revenue in the coming quarter stood at $53.1B, up nearly 6% from the previous quarter, and increase 2.7% from the same period last year.

On the other hand, EPS reported in Q1 2023 was $2.35, up 5.38% from the previous quarter. Consensus estimates for the coming quarter remains flat, at $2.30. In general, despite macroeconomic headwinds, Microsoft managed to cope well with its overall sales last year hit $198.3B, up nearly 18% from a year ago; EPS were last stood at $9.21, a gains of over 15% from 2021.

Like the other big tech companies, Microsoft could not escape from the fate of cutting nearly 5% (or 10,000) of its global workforce by the end of the third quarter this year. The lay off of its employees may result in a cost of approximately $1.2B in the near term consisting above-market severance pay, continuing health care coverage and continued vesting of stock awards for six months.

On a brighter side, the layoffs are taking the tech companies to a more modest future. ChatGPT (Generative Pre-trained Transformer), a chatbot launched by OpenAI back in November 2022 could be a new darling of the IT giants (and probably to many businesses of all sizes in near future). It has the ability to generate human-like text, answering followup questions, challenging incorrect premises and rejecting inappropriate requests, thus giving users a better experience.

Microsoft has already invested about $3 billion in OpenAI since 2019, and currently it is set to invest another $10 billion with an expectation to become more competitive in the race with other Big Tech companies like Google. Last week, Microsoft added ChatGPT to its Azure cloud-computing service to optimize its business operations. There is also a rumor that the company shall also incorporate ChatGPT into its Office suite of application as well as its Bing search engine, further scaling its competitiveness in the market.

On a downside, Microsoft is still facing obstacles in acquiring Activision Blizzard. The company is said to be facing a lawsuit from the Federal Trade Commission in US and also another antitrust warning from the European Union. A failure to close the deal could be ‘disastrous’ as described by Microsoft’s management, that it could lose a big slice of pie from the gaming market.

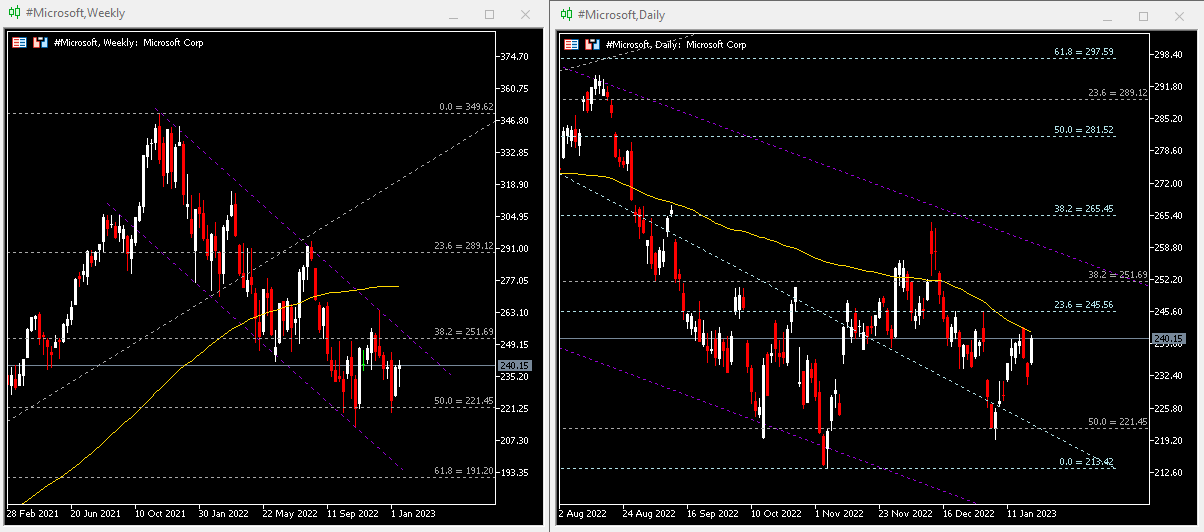

Technical Analysis

Weekly chart displayed #Microsoft (MSFT) share price traded within a descending channel. It has fell over 45% from the peak ($349.62) seen in November 2021. On the daily chart, the 100-day SMA serves as the nearest dynamic resistance. Breaking above it shall encourage the bulls to continue testing resistance at $245.50, followed by $251.70. The latter coincides with the upper line of the descending channel. On the other hand, a price retrace shall bring the support $221 in focus. It is the FR 50.0% extended from the Nov 2018 lows to the Nov 2021 highs. A successful closure below this level may indicate continuation of the bearish trend, towards the next support at $191 and $148.