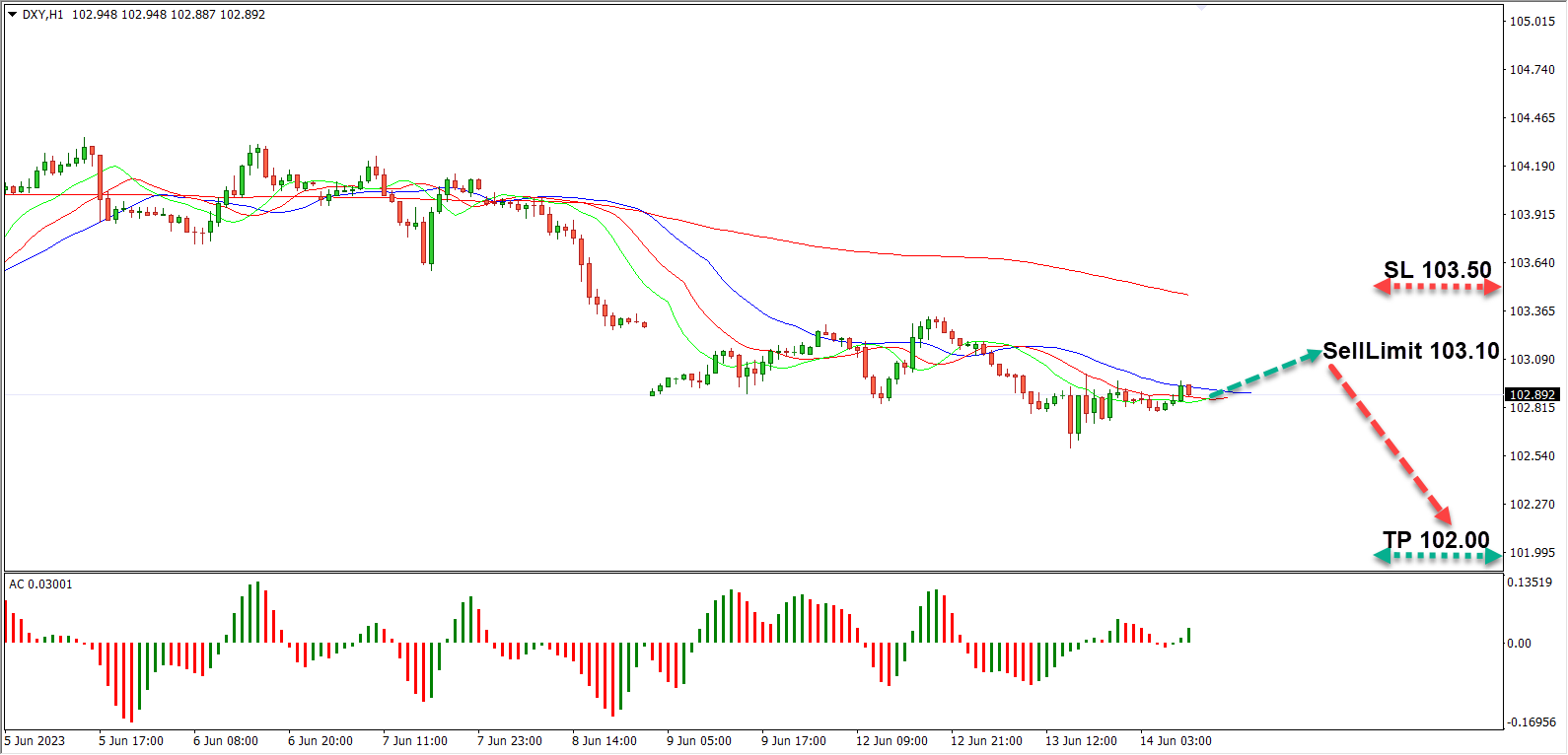

The US dollar index is trading near 103.00. The results of the Fed’s meeting will be announced today. According to the inflation data released yesterday, the Consumer Price Index fell to 4% in May from 4.9%. At the same time, the core index decreased from 5.5% to 5.3%. The slowdown in inflation may be the final argument for the Fed to complete the current cycle of monetary policy tightening. According to the FedWatch Tool, the probability of a rate hike is now estimated at 4%. Given the above, the dollar may hit local lows before the end of the current session. Especially if the head of the Fed, Jerome Powell, announces the possibility of an early rate cut at a press conference.

SELL LIMIT 103.10/TP 102.00/SL 103.50

GBP/USD

The GBP/USD pair maintains positive momentum and is trading at 1.26. The pound was supported by the strong labor market data. Thus, the unemployment rate in the UK fell to 3.8%, while the average wage increased by 7.2% in annual terms. Today, traders will analyze data on industrial production and GDP, which shouldn’t disappoint. In addition, the pound buyers are supported by the possibility of another rate hike by the BoE to tackle surging inflation, which exceeds 8%. Also, the US dollar still retains the potential for decline, which may become an additional growth factor for the pound today.

BUY STOP 1.2650/TP 1.2750/SL 1.2620

BRENT

Oil is approaching $75 per barrel. Recently, the market participants have discussed closed meetings between the US and Iranian authorities. Nevertheless, information about the breakthrough in negotiations wasn’t confirmed. In other words, oil sellers should not wait for cheap Iranian oil to enter the market, which could help offset production cuts by OPEC+. Oil quotes will also be supported by the weakness of the dollar and the expectation of a decrease in US crude oil inventories. The official report from the Energy Information Administration will be published today. Inventories are expected to decline, confirming higher seasonal demand for fuel. Against this backdrop, the rise in oil prices may continue.

BUY STOP 75.50/TP 77.50/SL 75.00