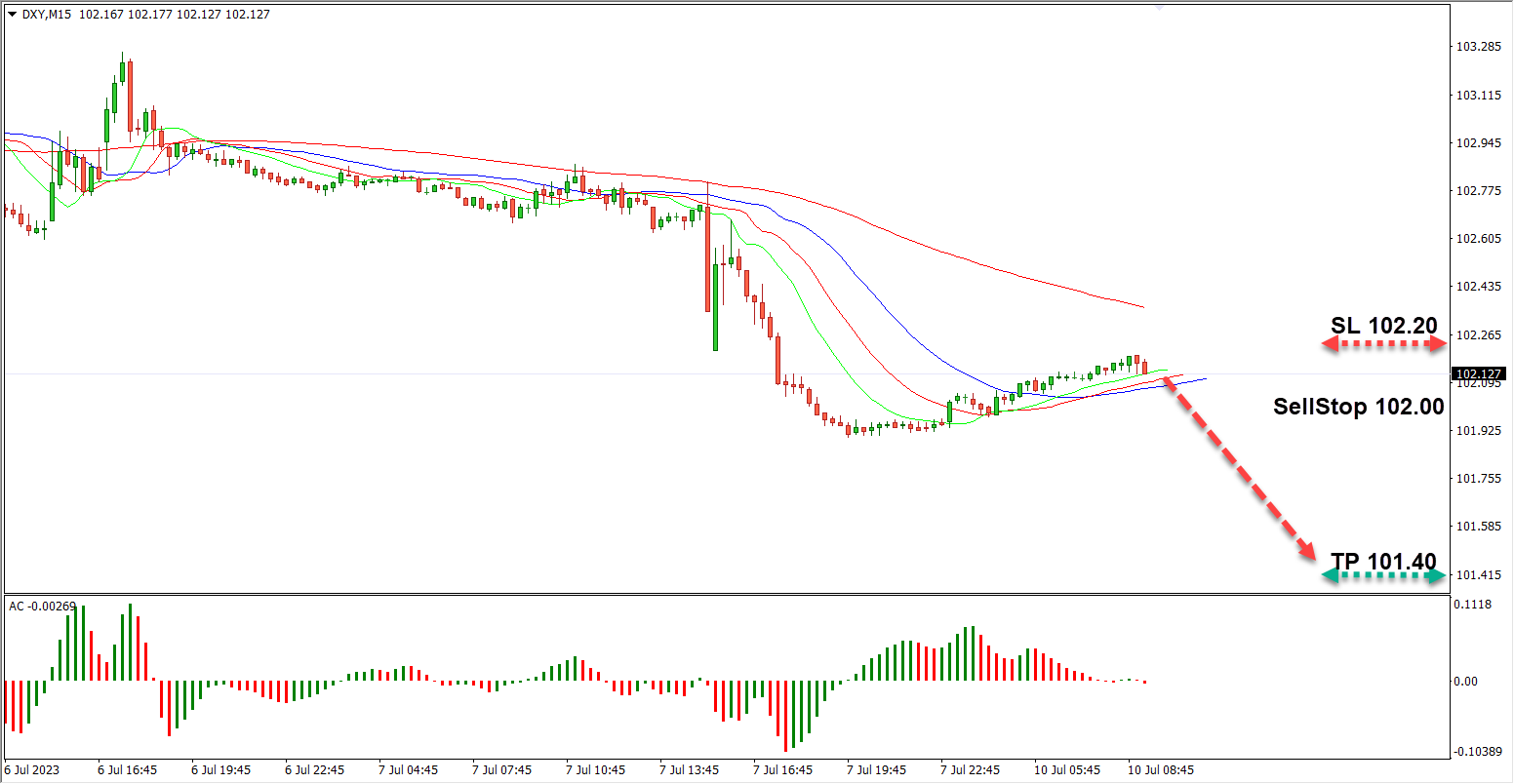

The US dollar index is consolidating near 102.00. Investors ponder June’s labor market data. The unemployment rate fell from 3.7% to 3.6%, while hourly wages increased by 0.4%, more than the forecast of 0.3%. Nevertheless, employment increased by only 209 thousand, which is less than both the expectations of 225 thousand and the May 306 thousand. It is worth noting that weak data suggest that the labor market is showing some signals of cooling, which adds uncertainty regarding the further actions of the Federal Reserve.

Market participants believe that with a further slowdown in the labor market and a decline in inflationary pressure, officials may extend its pause in the tightening cycle. Thus, if the Fed opts for only one rate hike in July, the dollar will continue to decline.

SELL STOP 102.00/TP 101.40/SL 102.20

EUR/USD

The EUR/USD pair is trading at 1.0950. Traders analyze the latest comments from the head of the European Central Bank (ECB), Christine Lagarde. In an interview with La Provence she said that the regulator will not “stand by” if there is an increase in company profits and wages. Officials have reason to believe that some corporations are raising their prices more than necessary to compensate for high costs, while workers continue to demand higher wages, which together increase inflationary risks. Experts took these statements as confirmation of the department’s intention to maintain hawkish rhetoric. Given the above, the growth of the EUR/USD pair may continue.

BUY STOP 1.0980/TP 1.1060/SL 1.0950

BRENT

Brent oil is testing the resistance of $78 per barrel. Prices were supported by the US crude stockpiles data. Oil inventories fell by 1.5 million barrels last week, while total inventories fell to 347.2 million barrels, the lowest level since August 1983, the Energy Information Administration reported. Meanwhile, representatives of the national oil company of Saudi Arabia Saudi Aramco announced an increase in export prices for oil: for buyers from the United States – by 0.1%, for North-Western Europe – by 0.8%. As a rule, higher export prices are the result of increased demand for hydrocarbons, which has a positive effect on oil prices.

BUY STOP 78.50/TP 80.00/SL 78.00