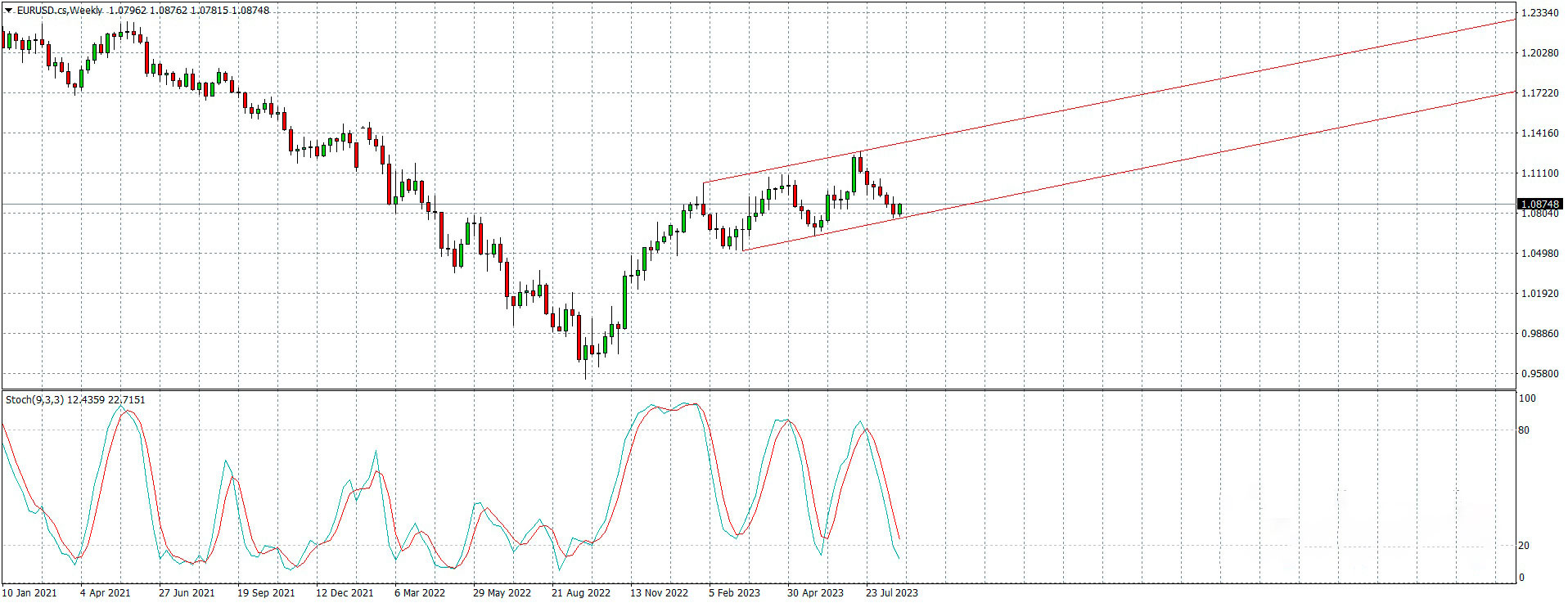

Traditionally, the euro paired with the US dollar is the most popular on the currency market. Today, with the help of experts from forex-ratings.com, we will look into the prospects of EURUSD for September 2023. Situation with the EURUSD Pair at the End of Summer In the final days of summer, the EURUSD currency pair quotes approached the lower boundary of the ascending price channel. The pair's corrective decline began in the second half of July, and now a crucial moment is looming. If the lower boundary, acting as a strong support, is breached, it might be time to dismiss the idea of an upward trend. If, however, there's a rebound, the upward trend will continue, and the price will actively move towards the upper boundary of the channel, which is above the 1.1200 area. Take note of the chart below:

The EURUSD currency pair quotes have approached the lower boundary of the ascending price channel

Fundamentally, the third wave of the pair's decline was based on the aggressive stance of the US Federal Reserve (Fed) regarding interest rate hikes. For those who took a break from trading during the summer, the base rate in the US was raised on July 26, 2023, to 5.50%. At the economic symposium held in Jackson Hole at the end of August, Fed Chairman Jerome Powell spoke about further plans to combat inflation. The target indicators are still far off, so the rate will either be raised or maintained at a neutral level. The European regulator also has plans to tighten its monetary policy, as the inflation rate in the EU significantly exceeds the American one. However, the base rate in the European Union lags behind the American one by 1.25%, which puts considerable pressure on the euro.

Regarding the economies of the two regions, both the US and the EU face a multitude of problems, judging by the incoming macro statistics. Even Powell, in his Jackson Hole address, described the state of the US economy as satisfactory.

The situation in Europe isn't better. Additionally, the energy issue is once again looming on the horizon. At the end of August, the price of natural gas began to rise again, peaking at $430 for a thousand cubic meters. To construct the most likely euro exchange rate forecast for September, we will conduct both fundamental and technical analysis of the EURUSD pair.

Fundamental Analysis of EURUSD for September 2023

In our fundamental analysis, we will focus on the upcoming US Federal Reserve (Fed) meeting scheduled for September 20 and the recent statements made by Jerome Powell. As previously noted, the regulator plans to continue combating inflation until it reaches target levels. It was highlighted that the decision to raise or maintain the interest rate will depend on the US economic indicators. What does this imply?

- Firstly, considering that the meeting will take place closer to the end of September, the pressure on the euro will persist until then. Especially since the likelihood of a rate hike by the end of August stands at 88%. A rapid rise in quotes before this is improbable.

- Secondly, the Fed Chairman emphasized that the decision regarding the interest rate would take into account the current macroeconomic data. A considerable amount of such data is expected. On September 1, the US average hourly earnings and non-farm payroll figures will be released. Analysts believe these indicators will show a decline, exerting pressure on the US dollar. On September 13, the US Consumer Price Index, an essential inflation indicator, will be published.

If all these indicators fall short of forecasts, it will support the single currency. Thirdly, a European Central Bank (ECB) meeting is scheduled for September 14, where there's a high likelihood of a 25 basis point rate hike. Such a decision will serve as a supportive factor for the euro. What scenarios are in view? If US macro data is weak prior to the Fed's rate decision, and the ECB raises its rate to 4.5%, then the EURUSD pair could rise to the 1.1000 level and above by September 20. Given the weak statistics, the Fed may decide to freeze the rate. Then, EURUSD quotes might approach the upper boundary of the price channel. In the second scenario, the US macro data could be strong or neutral, and the ECB raises its rate on September 14.

In this case, the pair's quotes may move sideways or along the lower boundary of the price channel. If the Fed, based on strong statistics, raises the rate on September 20, then the likelihood of a fall in EURUSD quotes will be quite high. We will attempt to determine which of these scenarios might play out using technical analysis.

Technical Analysis of EURUSD for September 2023

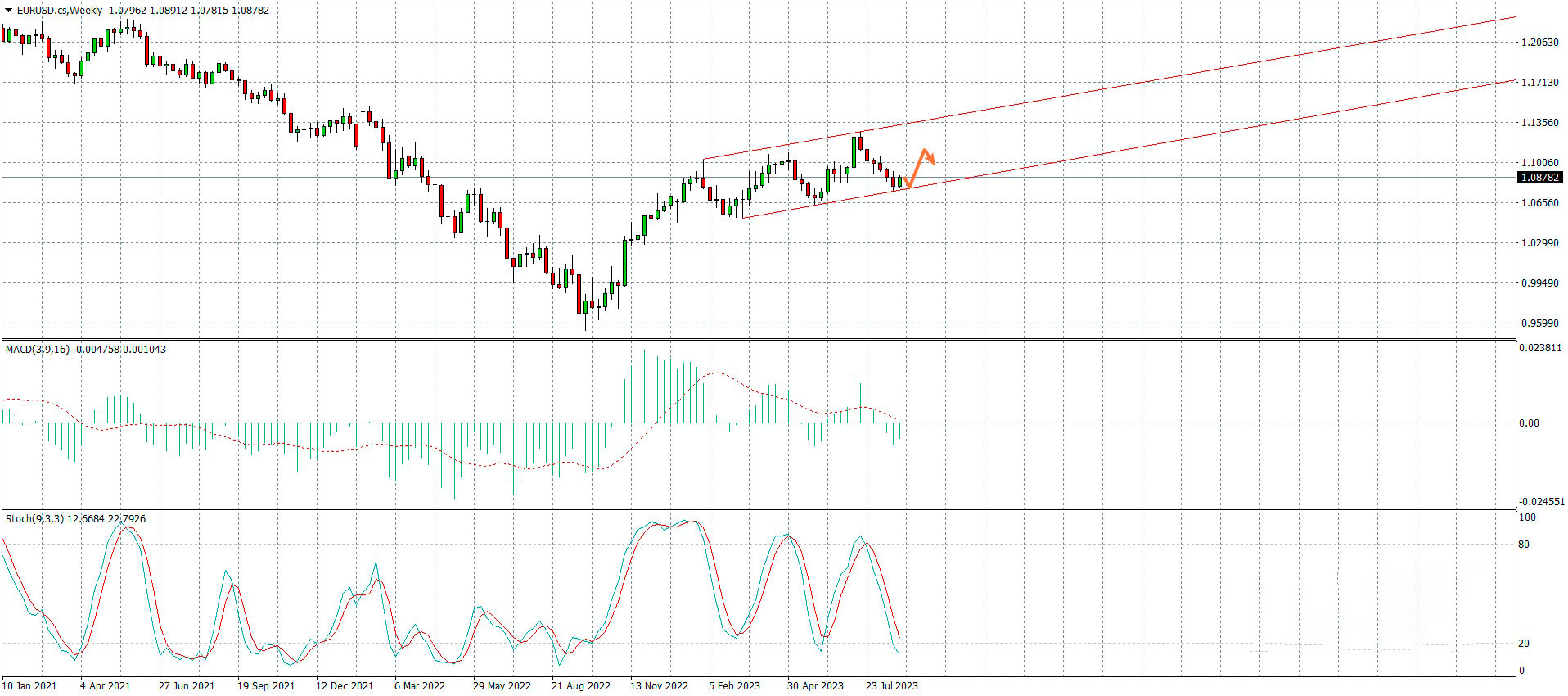

Let's peek into the future using the leading oscillators MACD and Stochastic. We'll conduct the analysis on the weekly price chart of the EURUSD pair. As of the analysis date, both technical indicators are signaling a sell, albeit with some caveats. The MACD histogram bars have started to shrink in the oscillator's negative zone. Meanwhile, the moving average has yet to cross the indicator's zero mark.

This could suggest the onset of a "bullish" signal. Meaning, over the course of a month, the average might remain in the positive zone and the histogram bars might follow suit.

A more definitive technical scenario is observed on the Stochastic oscillator. The fast %K line has already entered the EURUSD oversold zone, whereas the signal line %D remains above the zone's upper boundary.

Currently, it's challenging to precisely discern which oscillator is leading and which is lagging. In 1-2 weeks, the technical picture will become clearer. Based on our interpretation, the chart above depicts the most likely price movement scenario for the pair throughout September. We've based this on the assumption that, at present, MACD is more of a leading indicator where a buy signal will form in the upcoming weeks. As for the Stochastic, the fast %K line will reverse and exit the oversold zone, while the signal line %D may never enter it. This suggests that both indicators will signal a sell. However, early in September, another downward wave to the lower boundary of the price channel is anticipated.

Trading Recommendation for EURUSD

Combining the findings from the fundamental analysis with the technical data, we can infer the following. There are prospects for the pair's growth in September and they are quite favorable. Economic indicators from the US are unlikely to be positive, considering the latest data released on August 29th. The consumer confidence index and the number of job vacancies have both entered the "red" zone. Mid-month, the euro will likely find support from the ECB meeting where there's a high chance of a rate hike. Fundamental factors will align with technical indicator readings. The optimal trading decision would be to buy the euro at the beginning of the month, once the downward wave we mentioned concludes.

Targets will be the 1.1050 level and the area above 1.1200 for a longer-term perspective. It's also prudent not to dismiss potential false breakouts of the lower boundary of the price channel during significant US report releases.