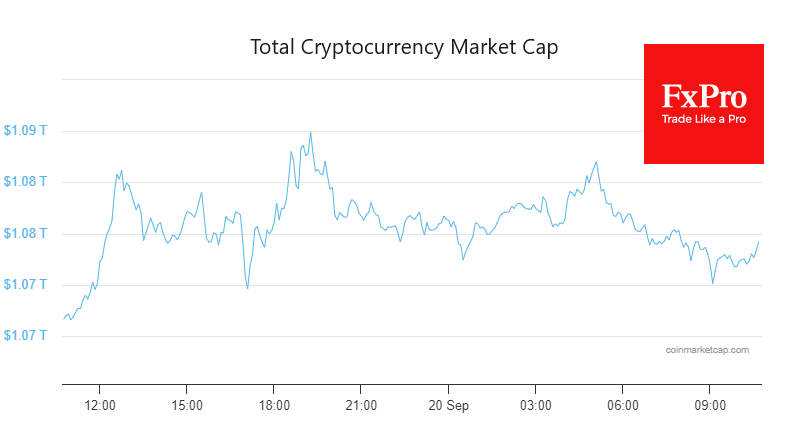

The cryptocurrency market has been hovering around the $1.08 trillion mark over the past day, with trading activity becoming increasingly subdued as the eagerly anticipated Federal Reserve decision approaches. Notably, as the market cap inches toward $1.09 trillion, there has been a discernible uptick in cryptocurrency selling. Bitcoin, in particular, has encountered formidable resistance at the $27.4K level, and its attempts to breach the 50-day moving average for the third consecutive day have been met with staunch opposition. This cautious stance is not unique to the cryptocurrency space; across all financial markets, there is a palpable sense of trepidation in the lead-up to the impending monetary policy pronouncements in the United States, Switzerland, the United Kingdom, and Japan.

From a technical standpoint, the situation for Bitcoin appears somewhat bearish. The chart reflects a downtrend, with the corrective bounce in BTC having formally concluded. The price has dipped below key moving averages, and the short-term oversold condition has run its course.

In a significant development, Bitcoin's mining difficulty has surged by 5.48%, reaching a level of 57.12 T. This adjustment, as per data from Glassnode, has seen the smoothed 7-day moving average reach an impressive 423.4 EH/s.

News Landscape

In recent news, it was reported that trading volumes on the Binance exchange have contracted by 57% over the past week. This downturn in trading activity is attributed to users migrating to other trading platforms that have thus far eluded regulatory scrutiny. In a legal matter, a court decided against compelling Binance's US unit to furnish the SEC with additional information concerning its management of customer funds. Instead, the district judge encouraged both parties to collaborate in resolving the issue amicably.

SEC Commissioner Esther Pierce has voiced her frustration over the agency's hesitance to clarify cryptocurrency regulation. Pierce implored cryptocurrency companies not to abandon the United States, highlighting her desire for the agency to provide clearer guidelines for the industry.

The crypto market is experiencing renewed vigor due to a surge in applications for the launch of spot Bitcoin exchange-traded funds (ETFs). Matrixport believes that these ETFs could act as a catalyst for Bitcoin's growth. Furthermore, Bitcoin's market dominance is inching closer to the 50% mark and is poised for further expansion.

In other developments, Laser Digital Asset Management, a subsidiary of Japan's largest investment firm, Nomura, has introduced a Bitcoin fund aimed at long-term institutional investments. Citigroup has launched Citi Token, a blockchain-based technology and smart contracts solution for business-to-business payments and trade finance. These advancements underscore the continued integration of cryptocurrencies and blockchain technology into traditional financial systems.