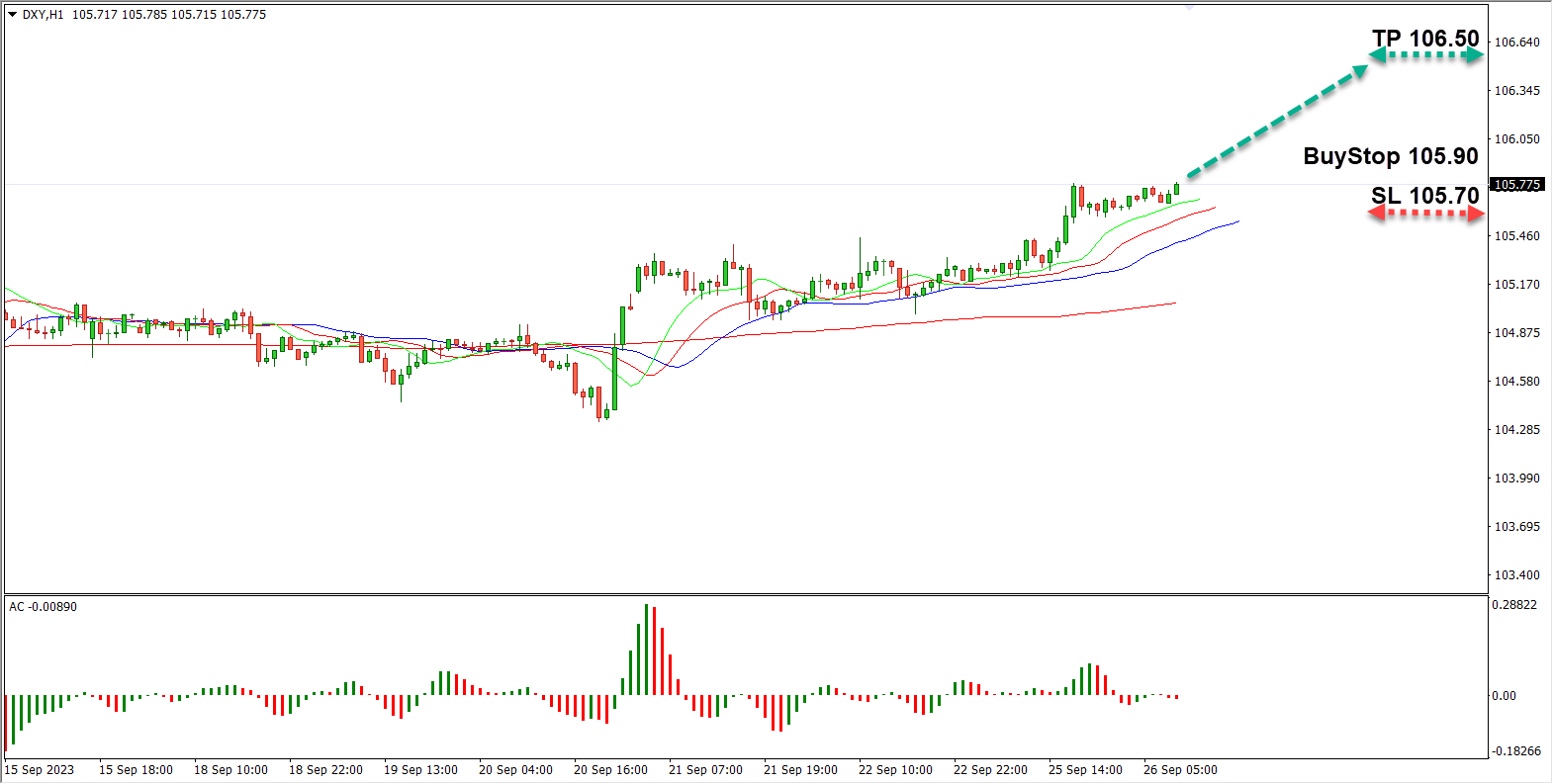

The trajectory of the US dollar is demonstrating an upward momentum, with the dollar index inching closer to the resistance level at 106.00. This ascent is fortified by the resilient data showcasing elevated activity within the US manufacturing and services sectors, unveiled last Friday. The emanating strength in these sectors serves as a reinforcing pillar supporting the dollar's robust stature in the global financial arena. Moreover, market participants are anticipating a further enhancement in the key interest rate by 25 basis points, a decision that could potentially crystallize come November. This expectation is weaving an additional layer of support, propelling the currency's value upward.

Complicating the financial landscape is the imminent expiration of the current budget law at September’s end, a crucial legislative piece delineating the funding contours for the nation’s government. The evolving political dialogue has yet to yield a substantive agreement to ensure governmental expenditure continuity for the year’s remainder. This week is pivotal, marking the final stretch for the negotiation process. The ensuing uncertainties serve as a backdrop against which the dollar's ascendancy could perpetuate.

Trade Strategy: BUY STOP 105.90/TP 106.50/SL 105.70

USD/JPY: Stability amidst Economic Calm

The USD/JPY pair manifests stability, hovering around the 149.00 mark. With a dearth of significant economic revelations, the currency dynamics are primarily dictated by a confluence of external variables. Kazuo Ueda, the Governor of the Bank of Japan, underscored the imperative nature of maintaining an exchange rate equilibirum reflective of fundamental economic parameters. His statement accentuated the regulator's vigilant stance on yen’s movement dynamics, hinting at potential foreign exchange interventions should the yen depict weakening trends. Market consensus suggests a restrained approach by the Bank of Japan, with interventions deemed unlikely unless the pair surpasses the psychological threshold of 150.00. Given this environment, maintaining long positions is advisable.

Trade Strategy: BUY LIMIT 149.00/TP 150.00/SL 148.60

BRENT: Navigating Price Pressures

The oil landscape is characterized by fluctuating trends, with Brent crude oscillating around $91.50 per barrel. The price dynamics are influenced by Russia’s recent policy modifications, temporarily lifting the ban on gasoline and diesel exports. This policy adjustment has engendered heightened anxieties among investors, apprehending potential fuel scarcities in the impending winter season, traditionally marked by peak demand. The concomitant dollar fortification is inducing additional pressures on the oil quotes. Furthermore, the market is bracing for the imminent release of US oil reserve data scheduled for Wednesday. The interim period could witness oil prices challenging the support level of $90 per barrel.

Trade Strategy: SELL STOP 91.00/TP 89.00/SL 91.70

Concluding Analysis

The multifaceted global economic theatre is witnessing the interplay of various market forces, policy adjustments, and speculative maneuvers. The US dollar's resilience, compounded by economic vibrancy and policy expectations, outlines a scenario ripe for sustained growth. Concurrently, the stability in USD/JPY and the oscillating oil prices depict the intricate dance of market elements, economic fundamentals, and geopolitical nuances. Traders and investors are closely monitoring these evolving landscapes, strategizing to align their positions with the unfolding economic tapestries.