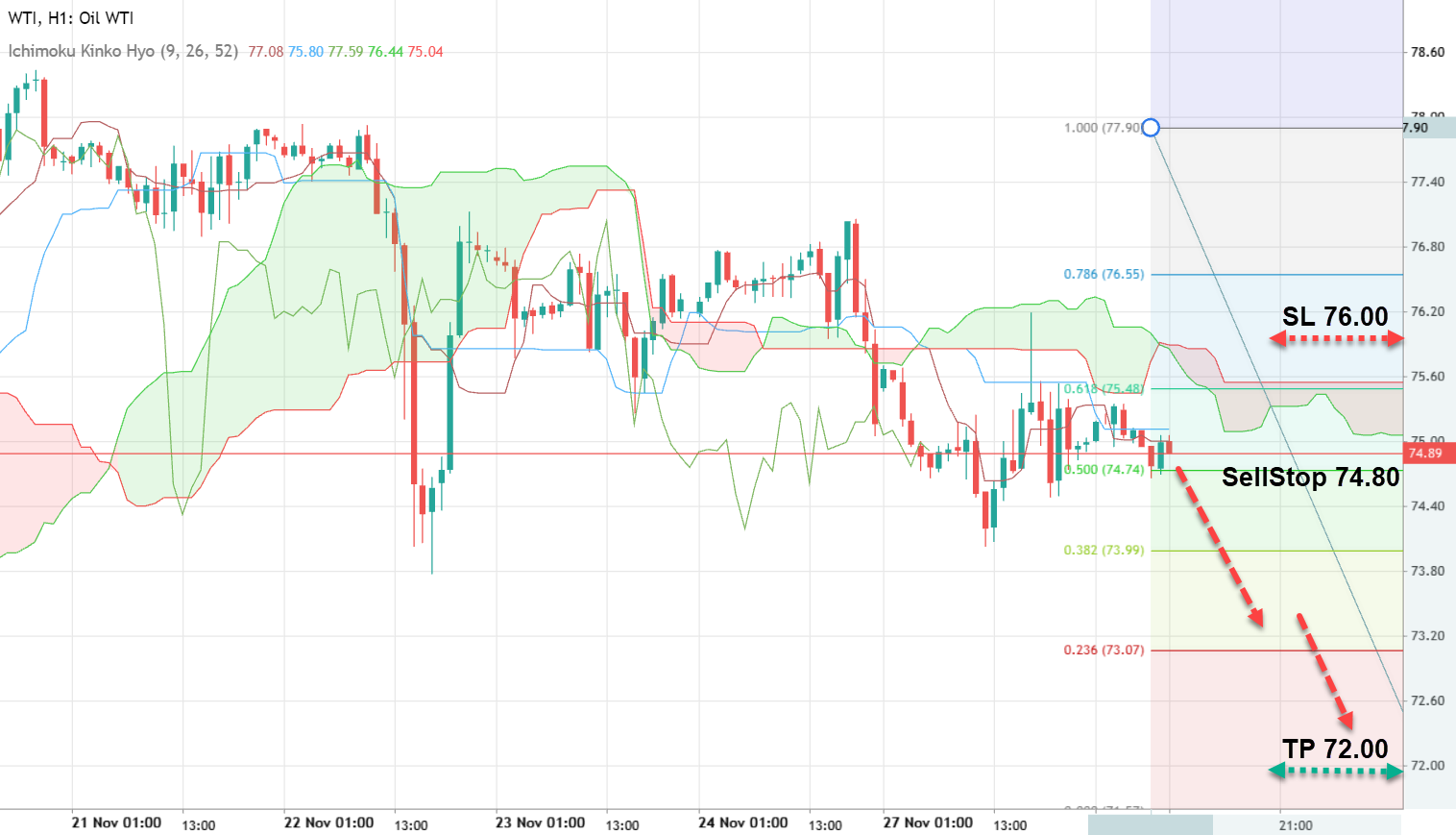

WTI oil, wavering at $74.80, is confronting downward pressure, primarily influenced by a Baker Hughes report that indicated the number of U.S. drilling rigs had stalled at 500, countering investor expectations of an increase. Additional market scrutiny is directed towards U.S. business activity metrics. The S&P Global Manufacturing PMI experienced a dip to 49.4 points in November, breaching below the neutral 50-point threshold into contraction territory. With the OPEC+ meeting on the horizon this Thursday, analysts posit that WTI could be nudged towards testing a support level at $72.50.

WTI Crude Oil: Under the Microscope Ahead of OPEC+ Meeting

Trading Strategy for WTI:

- Sell Stop: 74.80

- Take Profit: 72.00

- Stop Loss: 76.00

Dollar Index (DXY): A Downward Trajectory

The U.S. dollar is exhibiting signs of retreat, hovering around the 103.00 mark. The Dollar Index remains subdued amidst escalating skepticism regarding the Federal Reserve's commitment to further monetary tightening. Following a notable drop in inflation in October, the prevailing sentiment among analysts is that the U.S. central bank might pivot and signal an impending rate cut, currently forecasted for the second quarter of 2024. Compounding the dollar's woes are recent statistics revealing a 5.6% decrease in new home sales in October, reinforcing the bearish outlook.

Trading Strategy for DXY:

- Sell Stop: 103.00

- Take Profit: 102.40

- Stop Loss: 103.30

USD/JPY: A Balancing Act Between Growth Prospects and Policy Stance

The USD/JPY pair is steadfast near the 148.00 level. Remarks from Bank of Japan Governor Kazuo Ueda suggest a tempering of expectations regarding swift inflationary targets, with wage and consumer price increases in Japan exhibiting "positive signs" yet uncertain future growth. These comments are interpreted by investors as signals that the BoJ is likely to maintain its ultra-accommodative policy stance for the foreseeable future. This backdrop may offer the USD/JPY pair a runway for potential growth in the coming days.

Trading Strategy for USD/JPY:

- Buy Stop: 148.60

- Take Profit: 149.50

- Stop Loss: 148.30

Navigating Market Currents Amidst Economic Indicators

As the market digests the interplay between economic indicators and central bank rhetoric, the dollar's path seems inclined towards a downturn, while WTI oil prices face their own set of challenges. Investors remain vigilant, as the upcoming OPEC+ meeting and central bank policies will be significant determinants of future market directions for these key assets.