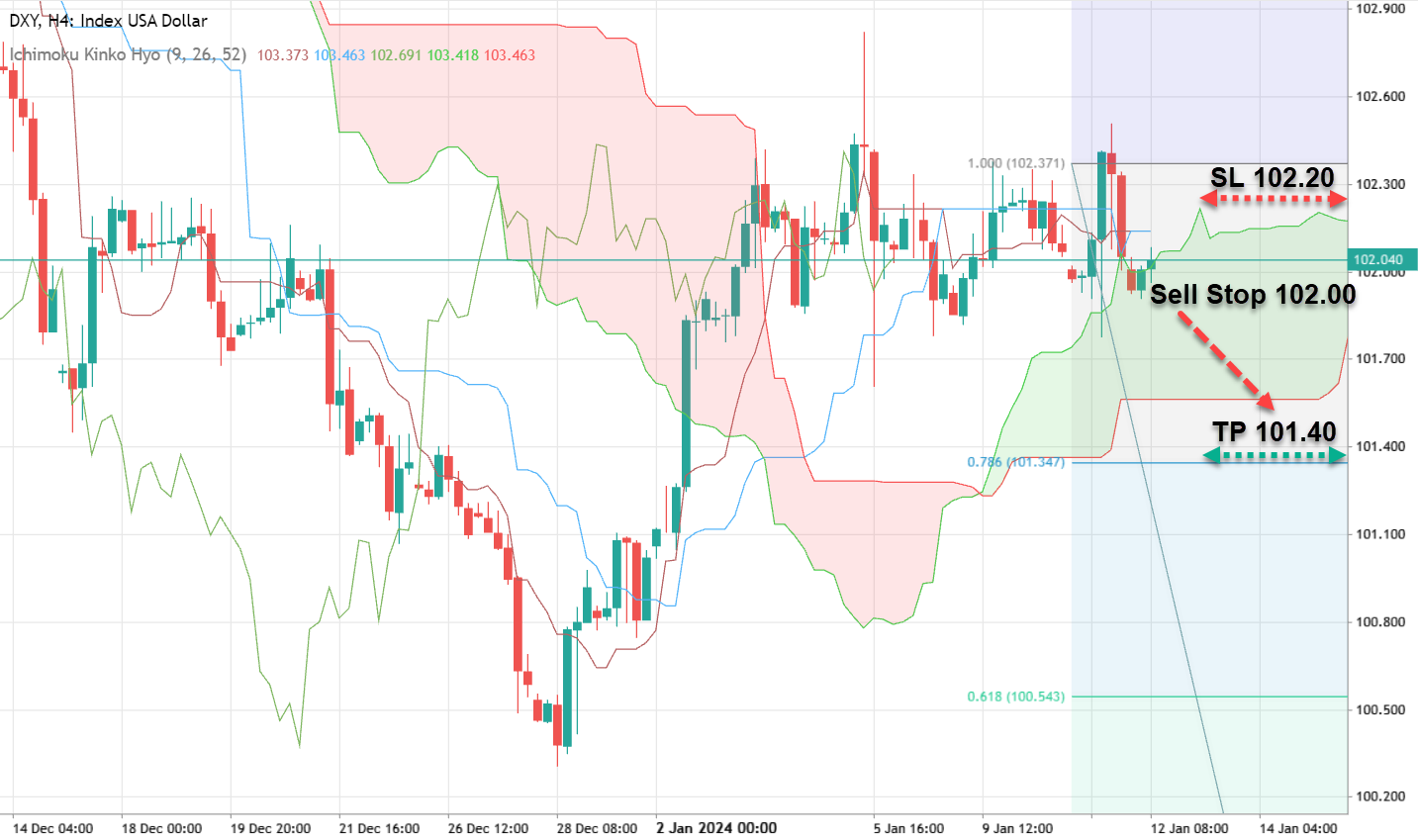

The Dollar Index at 102.00: Awaiting the Impact of Inflation Data: As the dollar index hovers at the 102.00 mark, investors closely scrutinize the latest US inflation figures for December. In particular, attention is focused on the core consumer price index, which excludes volatile food and energy prices. The data reveals a slight dip from 4% to 3.9% in core inflation, potentially signaling a shift in the Federal Reserve's monetary policy stance. A lower core inflation rate may influence the Fed to consider easing its current policy measures.

According to the FedWatch Tool, the probability of a rate cut in March has surged past 67%, up from 61% before the report's release. The significance of this potential policy shift is further underscored as industrial inflation data is set to be published today, which could exert additional pressure on the dollar.

Traders are keeping a close eye on these developments and may consider taking action, such as initiating a SELL STOP order at 102.00 with a Take Profit (TP) set at 101.40 and a Stop Loss (SL) at 102.20, as they gauge the dollar's future trajectory.

EUR/USD: Assessing ECB Comments and Monetary Policy

The EUR/USD pair is currently trading near 1.1000, and investors find themselves without significant economic releases to guide their decisions. Instead, they are carefully analyzing remarks made by representatives of the European Central Bank (ECB). In a recent statement, ECB board member Isabelle Schnabel suggested that sentiment indicators in the eurozone may be stabilizing. She also noted the resilience of the labor market in the face of the ECB's recent policy adjustments. However, she emphasized the possibility of a "soft landing" and a return of inflation to the target level of 2% by 2025, contingent on the ECB maintaining a tight monetary policy throughout the year. In light of these considerations, market sentiment leans towards recommending long positions on the EUR/USD pair.

To act on this sentiment, traders may opt for a BUY STOP order at 1.0980, setting a TP at 1.1050, and a SL at 1.0950, aligning their strategy with the prevailing market outlook.

GBP/USD: Growth and Economic Data Influence

The GBP/USD pair is on an upward trajectory, inching closer to the pivotal resistance level of 1.2800. Today, investors are eagerly awaiting the release of the UK's gross domestic product (GDP) data for November. Projections suggest a potential monthly expansion of 0.2%, a welcome rebound from the previous month's 0.3% decline. Such positive figures could diminish recessionary concerns and provide a boost to the pound. Moreover, the pound's ascent may find further support in the industrial production data expected today, with an anticipated annual increase of 0.7%, further mitigating economic downturn risks. Given these favorable indicators, the pound may breach the 1.2800 resistance level.

To seize potential opportunities, traders might consider a BUY STOP order at 1.2790, setting a TP at 1.2850, and a SL at 1.2770, aligning their strategy with the optimistic outlook for the pound.

In conclusion, the dollar's performance hinges on inflation data and potential shifts in monetary policy, while the euro and pound respond to central bank comments and economic data releases. Traders must stay vigilant and adapt their strategies accordingly in this ever-evolving forex landscape.