As we step into 2024, the cryptocurrency market is buzzing with anticipation for what lies ahead for Solana (SOL). After a rollercoaster ride in recent years, including an astonishing 11,000% surge in 2021, followed by a severe setback during the 2022 crypto winter, Solana made an impressive comeback in 2023, surging over 1000% and reasserting itself as a leading altcoin.

In this comprehensive Solana price prediction guide, we will examine the latest news and developments surrounding Solana, delve into the technical aspects, consider expert forecasts, and offer our own insights into where the SOL token might be headed in 2024 and beyond. Is it possible for Solana to challenge its 2021 highs and potentially become the third-ranked cryptocurrency by market capitalization?

SOL Overview in 2024

As of January 16, 2024, SOL is trading at $98.08 per SOL with a market capitalization of $41,367,539,347 USD. The 24-hour trading volume stands at $2,561,610,179 USD, and the circulating supply is 432,685,054 SOL. Solana (SOL) is a highly scalable, open-source blockchain network designed to support decentralized applications (dApps). Founded by Anatoly Yakovenko in 2017, Solana launched its mainnet beta version in 2020 and has rapidly become one of the fastest-growing layer 1 blockchain platforms in the cryptocurrency market.

Unlike first-generation blockchains like Bitcoin and Ethereum, which can process 10-15 transactions per second, Solana employs innovative technologies such as Proof of History and Tower BFT to achieve lightning-fast transaction speeds while maintaining decentralization. This scalability makes Solana ideal for building dApps, particularly in areas like DeFi, NFTs, Web3, and gaming.

One standout feature of Solana that attracts developers is its low transaction cost, which is less than $0.01 per transaction. In contrast, Ethereum often charges between $2 and $10 per transaction. This cost advantage positions Solana as a viable choice for the next wave of Web3 users who find Ethereum's high gas fees prohibitive.

Solana's native cryptocurrency, SOL, plays a central role on the blockchain. It powers the network, covers transaction fees, incentivizes validators, and can be used for stake pooling. Currently, there are 566 million SOL tokens in circulation, with new tokens minted annually through inflation rewards to validate transactions.

Looking forward, Solana has ambitious plans to scale its transaction processing capabilities to over 700,000 transactions per second through upgrades like pipelines, Cloudbreak, and Archivers. If successful, this could propel SOL's market capitalization to rival that of Ethereum, leading to substantial growth in 2024 as adoption continues to rise.

Solana's Price History

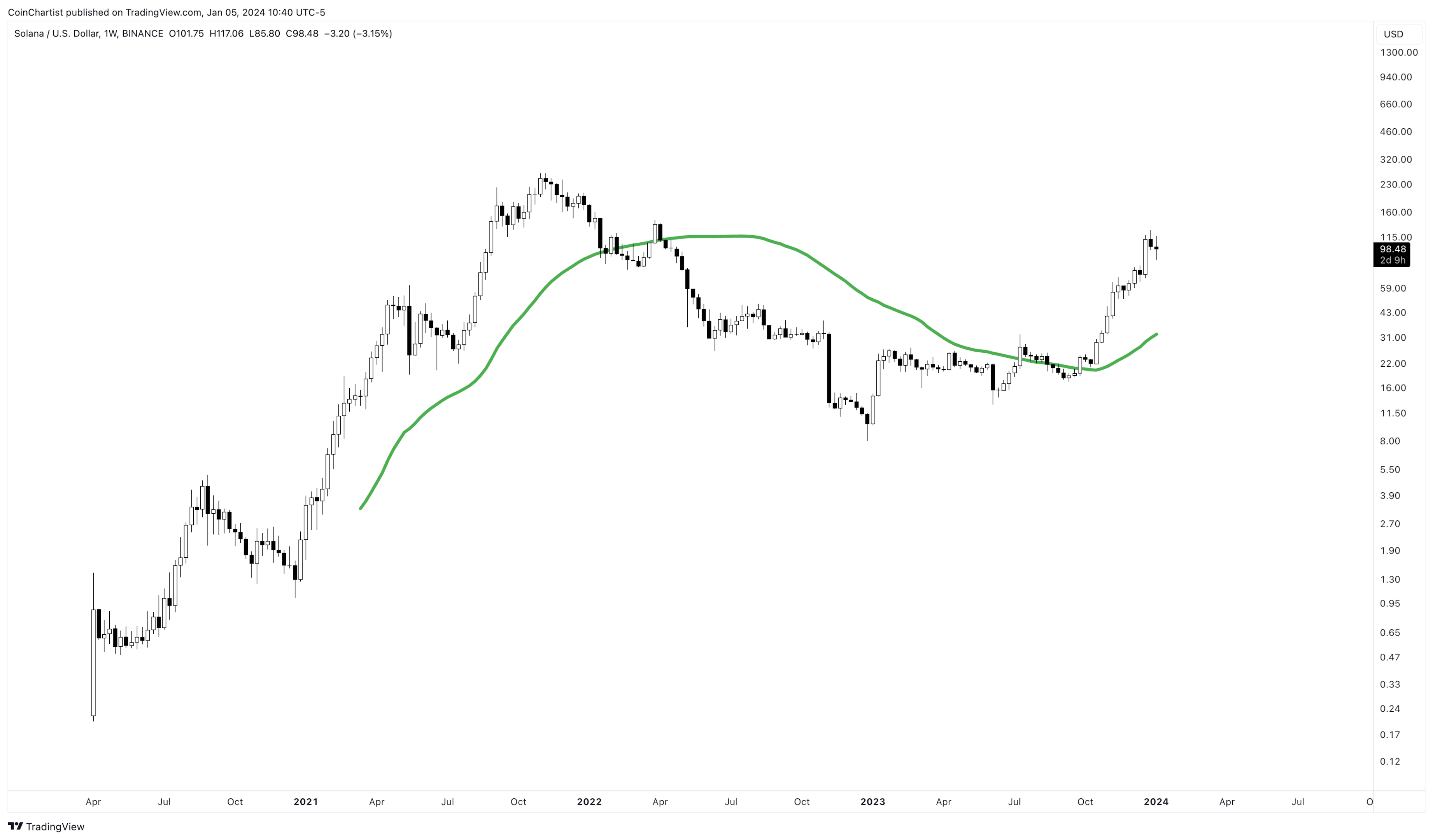

Solana's price journey began when it launched its mainnet in March 2020, with SOL trading at around $0.77. Throughout most of 2020, it remained relatively flat and went unnoticed outside of the crypto community. However, in early 2021, interest and development activity surrounding Solana started to gain momentum, driving up its price. By January 2021, SOL's price had risen to $1.51, and it crossed the $10 mark for the first time in February 2021 during the broader crypto bull market. By May 2021, SOL was trading above $50, and it seemed like it was doubling in price practically every month. In July 2021, SOL surpassed $100 for the first time as developers and investors flocked to the network. The viral success of the Samoyedcoin project on Solana added further momentum. SOL continued to climb, breaking $150 in September 2021 and experiencing exponential growth through October and November.

As the hype around "Ethereum killers" intensified, SOL's price went parabolic, surging over 17,000% throughout 2021. On November 6, 2021, Solana reached its all-time high of $260.06. However, this peak marked the end of the bull market cycle.

Just days after reaching this milestone, FTX, a major crypto exchange, filed for bankruptcy, causing a shockwave in the crypto markets. Equities markets plummeted, dragging cryptocurrencies down, with Solana being hit especially hard due to its exposure to FTX. By May 2022, Solana's price had dropped to under $40, signifying the depths of the 2022 bear market. The final capitulation occurred in December 2022, when Bitcoin plummeted to $15,600. Solana experienced a staggering 97.4% decline from its all-time high, bottoming out at $7.60. Most other altcoins went through similar capitulation, marking the darkest days of the 2022 bear market.

However, Solana started 2023 on a positive note, surging to over $25 in January. Over the next six months, it underwent re-accumulation before becoming a standout performer in the latter half of 2023. Despite the volatile journey, Solana's price at the beginning of 2024 sits around $100 per coin, reflecting a more than tenfold increase from its market low.

Solana Price Predictions by Experts

Several cryptocurrency experts have weighed in on their predictions for Solana's future price:

- Changelly: Changelly predicts that Solana may break above the $180 level, potentially in December 2024, after the crypto bubble has popped. This forecast suggests continued upward momentum beyond the short term.

- CoinPedia: CoinPedia's Solana price prediction suggests that SOL's price could reach a maximum of $200 per SOL in 2024. By 2025, it could climb to $250 per SOL, with the potential for even higher levels, possibly reaching $672. These estimates depend on factors like adoption and institutional investment.

- DigitalCoinPrice: DigitalCoinPrice offers an extremely bullish outlook, projecting a maximum Solana price of $1,956 per SOL in 2033. This long-term prediction is highly speculative, considering it spans nearly a decade, and factors such as market sentiment, regulatory support, macroeconomic conditions, developer activity, and Bitcoin halving cycles can influence trends.

Solana Price Analysis-Based Predictions

Technical analysis, based on price charts, candlestick patterns, and indicators, can offer insights into potential price movements. Here's a technical analysis-based prediction for Solana's future:

- Solana Price Prediction 2024: While forecasting Solana's price in 2024 comes with inherent uncertainties, it appears to be a constructive year. The price chart exhibits a confirmed Three White Soldiers Japanese candlestick continuation pattern, suggesting a potential pullback early in 2024 before resuming the uptrend. This temporary retreat may result from overbought conditions following three consecutive large white candles. The Relative Strength Index (RSI) supports this view, indicating that SOL is significantly overbought. Furthermore, the 50-week moving average shows an upward trend, with SOL trading above the moving average, signaling bullish sentiment.

- Solana Price Prediction 2025: Comparing SOL's price chart to Ethereum's price movement from 2018 to 2021, there are similarities. Both cryptocurrencies experienced significant increases, surpassing the 0.5 Fibonacci level before reaching the 1.414 Fibonacci extension. If this pattern continues, SOL may see substantial gains in 2025.

- Long-Term Solana Forecasts 2026-2030: Long-term predictions for emerging technologies like Solana are challenging. Experts suggest that SOL could recover significantly by 2026, potentially reaching an average price near its previous all-time high of around $260. By 2027, SOL's price may continue to rise, with an estimated average around $500, contingent on addressing any network issues. The trajectory in 2028 could lead to SOL reaching $700, or even $800, if broader crypto concerns subside. In 2029, SOL could see an average price around $1,000, but variations are expected. By 2030, experts anticipate that SOL will be higher, with the extent of the increase depending on market dynamics.

Factors Impacting Solana's Future Price

Several factors can influence Solana's future price, including:

- Network Reliability: Solana's ongoing network performance and stability, as well as its ability to resolve any outages, are critical for price growth.

- Adoption: Widespread adoption of Solana for dApps and projects can drive demand for SOL, potentially boosting its price.

- Competition: Solana faces competition from other blockchain platforms, and its ability to stand out and offer unique advantages will impact its value.

- Regulatory Environment: Regulatory decisions and legal frameworks can significantly affect the cryptocurrency market, including Solana.

- Market Sentiment: Overall market sentiment, investor perception, and broader market trends will influence SOL's price trajectory.

Conclusion: Is Solana a Good Investment, and How Much Will SOL Be Worth?

The decision to invest in Solana should be made with careful consideration of the potential risks and rewards. Investing in cryptocurrencies inherently involves risk, and it's essential to assess whether Solana's network issues have been addressed and your personal outlook on the crypto market.

Solana's future is uncertain, but it is likely to experience price fluctuations. Trading SOL through Contract for Difference (CFD) markets offers advantages such as the ability to profit from both rising and falling prices without owning the underlying tokens, making it an option for those looking to capitalize on Solana's price movements. PrimeXBT offers CFD trading with leverage, providing traders with a more efficient way to deploy their capital and manage risk.

While the predictions discussed in this article provide valuable insights, they should be considered as guidance, not investment advice. Conduct your research and due diligence before making investment decisions. The cryptocurrency market is dynamic, and unforeseen developments can impact prices significantly. Stay informed and adapt your strategy accordingly.

FAQ: Frequently Asked Questions

- How much will Solana be worth in 2025? Solana's price in 2025 is uncertain, but experts anticipate the possibility of it surpassing its previous all-time high of around $260, potentially reaching levels such as $1,000 or higher. However, these predictions are subject to market dynamics.

- What will Solana be worth by 2030? Predicting Solana's price in 2030 is challenging. It could be significantly higher than current levels, depending on adoption, technical improvements, and broader market conditions.

- Is it a good time to buy Solana? Deciding when to buy Solana depends on your risk tolerance and outlook. Considering the recent volatility, it's essential to conduct thorough research and consider your investment goals before entering the market.

- How high can Solana go? Solana's potential price ceiling is difficult to determine precisely. It could experience substantial growth if it addresses network issues and maintains its competitive edge in the blockchain space.

- Does Solana have a future? Solana has the potential for a future, but it faces competition and challenges. Its success will depend on factors like network reliability, adoption, and technological advancements.