Imagine you’ve thoroughly examined a set of rules and an algorithm of actions that should lead you to a profitable trade. You make sure that every step you take follows a popular professional strategy with hundreds of enthusiastic reviews and… you irretrievably blow your deposit. Who’s to blame—the strategy’s author or yourself? Why the same algorithms work in some cases, but don’t in others? Let’s find out.

Trading strategy always mean instructions that provide traders with a clear understanding of when to enter a trade, when it’s time to exit, and when it’s better to avoid trading altogether. Forex trading strategies take into account timeframes, currency pairs, and lot sizes

Dozens of classic and new original Forex strategies can be found on online forums and websites dedicated to trading. They are often touted as “magic wands” for novice traders and those who look for ways of making money online: from swing trading to scalping. Some strategies really do generate decent profits, but only under specific circumstances not every trader knows how to consider.

Martingale, a popular strategy, is a very illustrative example. This system suggests doubling the size of your trade every time you lose. Of course, it will work at some point. It can even be used to create a simple algorithm for automatic trading. However, the problem with martingale is that there can be seven bearish and bullish candlesticks in a row. Or even eight. The trader’s funds aren’t limitless, and if the number of losing trades exceeds a certain maximum, the series of losses will lead to a complete loss of funds.

Or let’s consider the basic trading strategy with three indicators. We’ll use two moving averages with equal periods and an oscillator. It seems easy: look at the MACD indicator, trade as the moving averages intersect confirmed by the oscillator’s signal. However, if we apply them to the chart, we’ll see false Forex signals.

Any strategy gives many false signals. Only when you’ve worked with it long enough and adapted it to your style, learned to feel its reaction to the price movement—only then you’ll be able to distinguish the important things and pay attention to the parts that seem unremarkable at the first glance. Sometimes fellow traders can point out entry points right before you that you missed. But both traders base their strategies on technical analysis.

The issue isn’t about traders hiding some important aspects of their “100% effective” strategies.

The thing is, any strategy is really a set of measures. It’s totally useless to follow the template and precisely follow the instructions from trading textbooks if you just don’t understand how the market works.

Detailed guideline isn’t a universal solution

When following a trading strategy, it’s necessary to combine different methods of market analysis. The most common ones were described in our previous post.

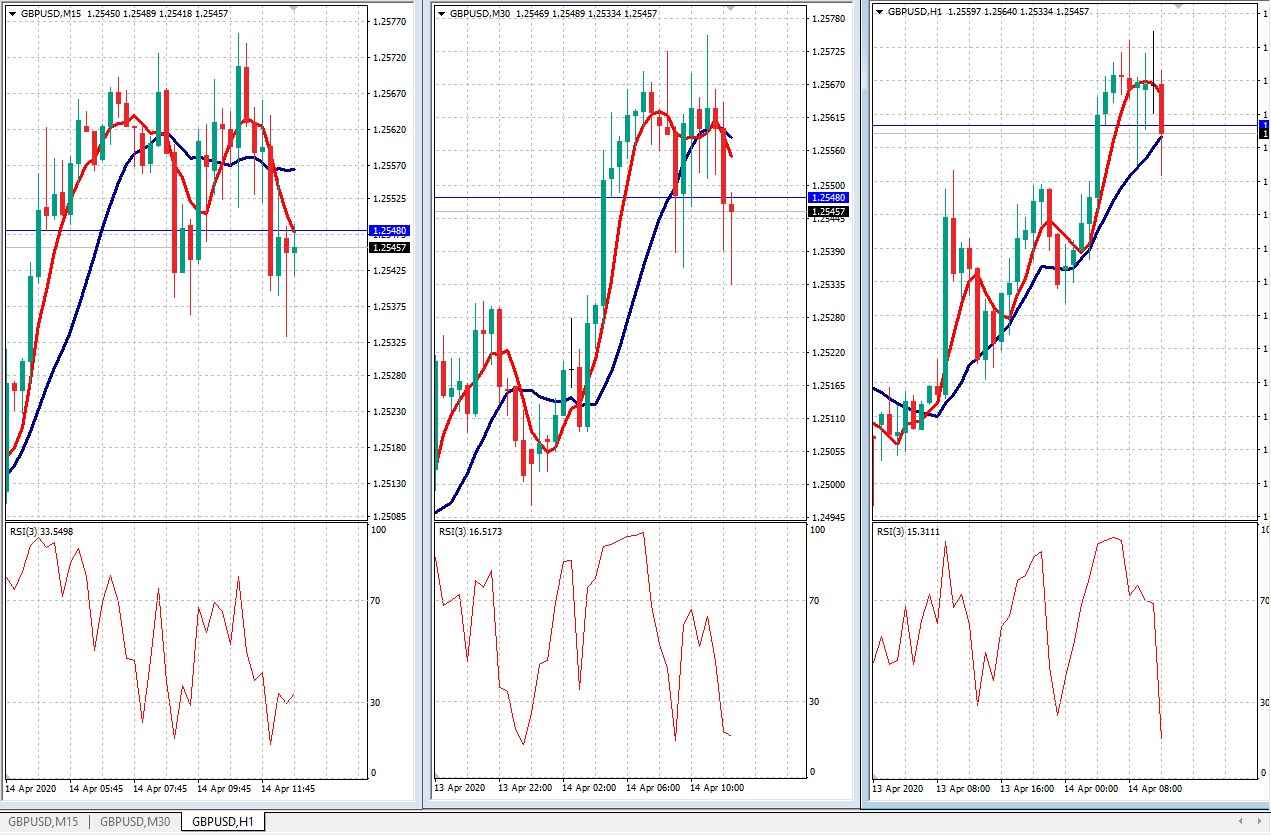

For example, the popular 3-period indicator RSI (Relative Strength Index) should be used on timeframes not older than 1 hour, Simple Moving Average indicators should have values less than 20. Longer periods require using Exponential, and MACD (moving average convergence/divergence) must be restructured. Furthermore, traders have to understand why it’s good to combine this strategy on Elder’s Triple Screen.

An example of Three Indicators strategy on Elder’s Triple Screen, GBP/USD

No method of market analysis is universal, and traders always have to adjust to the current situation and never let things run their course. Constantly studying all factors affecting the market movement, a trader starts acting intuitively at some point.

Of course, it’s possible to write a comprehensive guide to any strategy and include all these nuances, which would result in a doorstopper book.

But even in this case, traders face another problem: money management. It also has a set of specific rules that most market participants can’t adhere to. To make the right decisions and plan ahead, the trader has to know the percentage of their successful trades, which is, unfortunately, not that common among the market players. Wrong techniques, misunderstanding of how the leverage works, lack of a risk management plan can all lead to mistakes. All these factors are closely associated with psychology and the ability to control yourself when trading.

What’s to be done?

Well, we’ve established that blind following the ideas of others don’t help, and templates don’t work. Technical analysis done by two different experienced market participants can be as far apart as a Mercedes and a BMW. They even both may profit as a result, if they looked at different parts and predicted movement of different intensity and length. This can be compared to solving complex math problems by different ways.

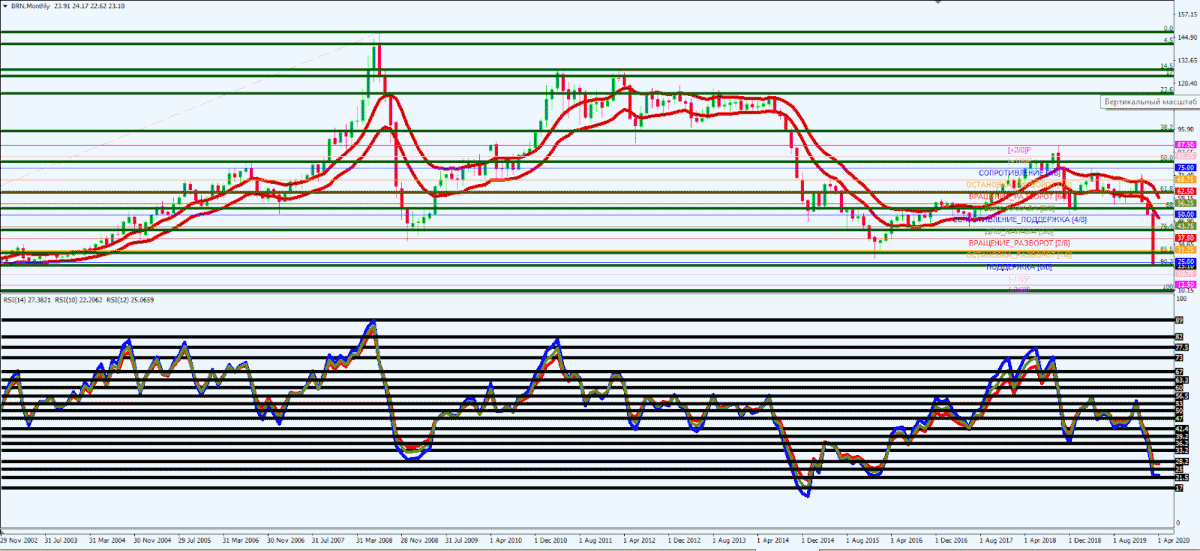

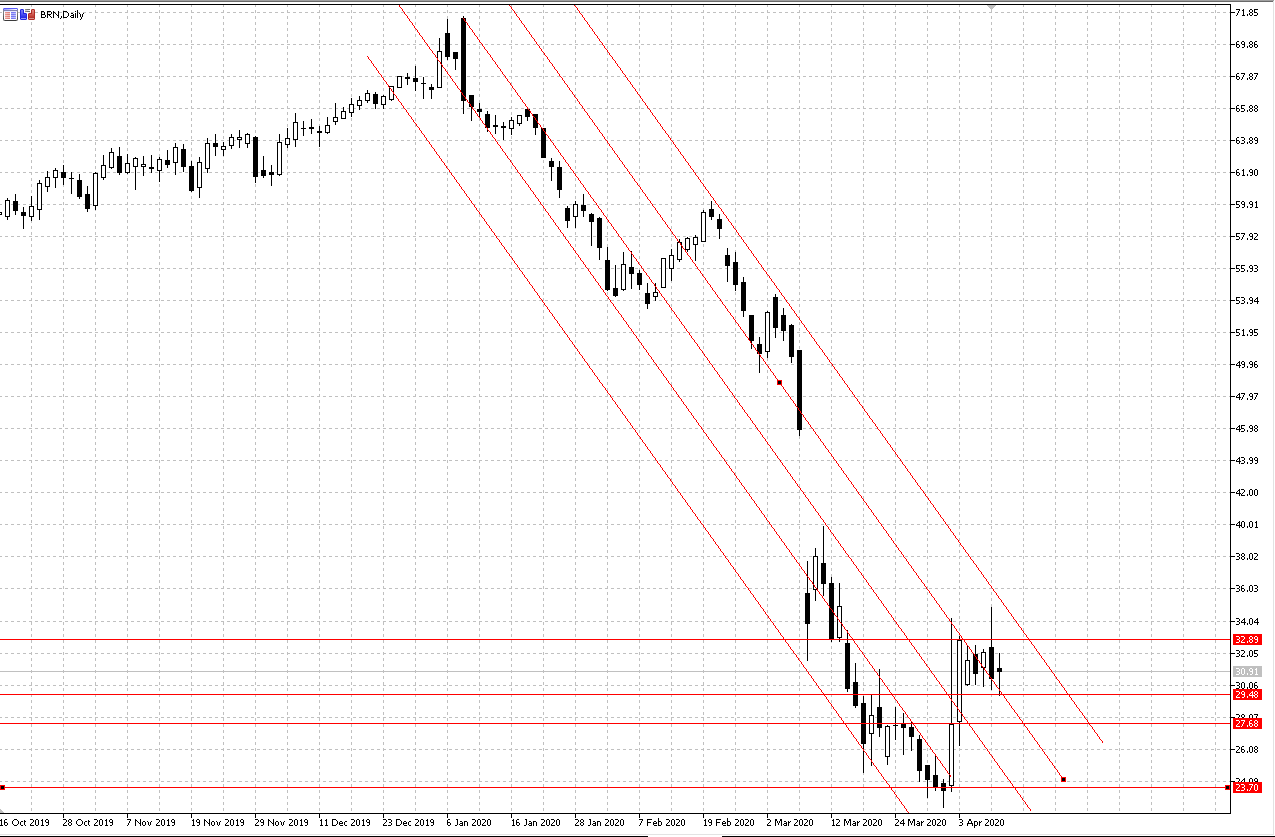

So, in the first example below the chart is almost completely covered by technical analysis indicators. And it’s a functional trading system that’s been used for many years. The second example shows a clean chart with several lines. However, both traders make a profit.

The bottom line: study what others do and use it to create something of your own. To learn this, some go to a trading school, some do it on their own. Adapting a strategy to yourself should be done with regard to your temperament and trading style: contemplative and prudent people wouldn’t do well in scalping, while impulsive and energetic people will find it hard to place medium-term and long-term trades.

Having settled on a strategy, it’s important to form the general idea: dependency or regularity in the price behavior to base your prediction of its further movement. Then choose the currency pairs, timeframe and period, rules of entry and exit, trading lot size, and risk limits.

If all these parameters are set, we recommend testing your strategy on a Micro account with small sums of money and real market quotes, and only then moving to a Standard account with a minimum deposit of $100.

Those who don’t feel confident that they can take into account all risk factors, but want to make money, there’s a simpler way: RAMM copy trading service. This platform is integrated into your Private Office and enables automatic high-precision copying of trades placed by professionals who can use trading strategies effectively.