Financial markets shouldn’t be traded without a sound tried and tested trading system, and the Forex market is no exception. Making the right trading decisions and finding tradeable setups on the market all depend on the rules of your trading system. Without a well-defined system, entering the market would more resemble gambling than trading, which significantly increases the chances of blowing your account in the long-term.

Given the importance of trading systems in Forex, let’s cover what trading systems actually are and what the benefits of defining a trading system as a part of a comprehensive trading plan are. In addition, we’ll show you a simple Forex trading system that works, based on high-probability price action setups on higher timeframes. Let’s get started.

What is a Forex trading system?

A Forex trading system is a set of rules which define how you’re trading the market. It should include all important points which could potentially affect your trading performance, such as a complete set of rules for identifying trade setups, risk and money management guidelines, types of analysis in changing market conditions, and a way of managing your open positions.

A well-defined trading system is like a road map for the financial market. Without a map, you would likely be lost in the wilderness of erratic price movements and place trades based on emotion, rather than your ratio. Since trading is a highly analytical discipline, hitting the market without a map doesn’t seem like a wise decision.

Benefits of having a trading system

Besides the set of rules which define all actions taken on the market, having a trading system also has some additional advantages which cannot be neglected. First and foremost, trading on strict and detailed rules as a part of a trading system prevents you from placing emotional trades and increases your discipline.

Emotions, such as greed and fear, are well-known enemies of rational trading which often attack beginners – mostly those who don’t have a detailed trading plan. As a result, greed and fear interfere with your trading decisions and cause you to chase the market for trading opportunities, even if no setups exist. Your mind will try to convince you to take a trade in the hopes of obtaining potential profits, without taking into account the risks associated with the trade. Fear, on the other hand, often leads to closing a profitable position too early and letting your losers run, in the hopes that the price will reverse to break even. When using a trading system with strict rules, these mistakes can be easily avoided.

Trend-following trading system on higher TFs

One of the best Forex currency trading systems are trend-following systems which aim to take trades only in the direction of the underlying trend. This way, riskier counter-trend trades based on price corrections can be avoided, and price corrections are only used to enter with a market order when prices are relatively oversold during uptrends, or relatively overbought during downtrends.

This system uses higher timeframes, such as the 4-hour, daily, and weekly timeframes, and utilises a multi-timeframe analysis to identify the overall market trend.

Chart patterns are also an important part of the system, since these patterns are often used to find tops and bottoms of trends and to identify potential trend continuations.

To enter with a long position, all three timeframes (weekly, daily, and four-hour) need to align and to show an uptrend. This might require some experience, as some of the timeframes may contradict each other, even though the overall trend is still intact.

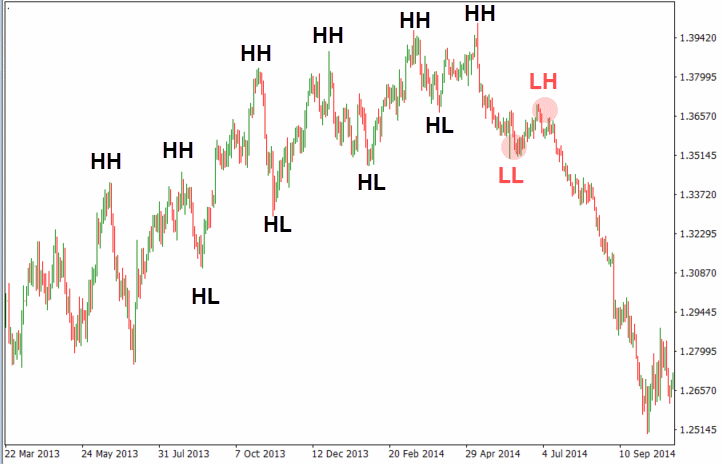

The weekly timeframe needs to form higher highs and higher lows during uptrends, and lower lows and lower highs during downtrends. The weekly timeframe is only used to identify the overall trend in a currency pair, not to spot entry and exit points.

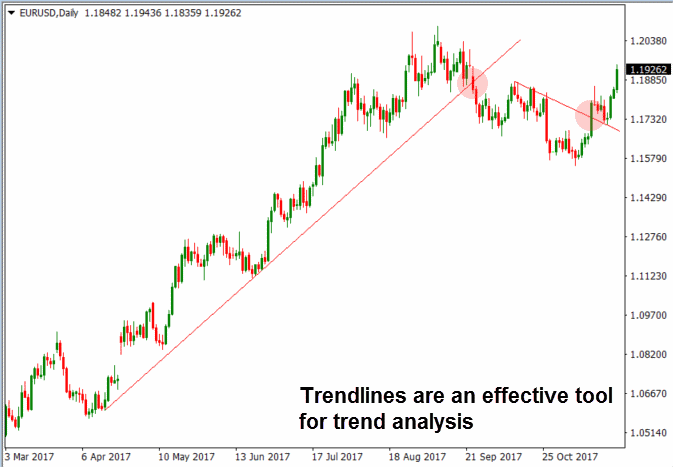

The daily timeframe needs to show a tradeable setup, based on price action tools such as channels, trend lines and chart patterns. All of the tools should confirm a trade in the direction of the overall trend, as shown on the weekly timeframe. Fibonacci retracement tools also play an important role in this system, as we want to buy low and sell high. Multi-timeframe analysis is extremely important, as an uptrend on higher timeframes may look like a downtrend on shorter timeframes.

If the daily chart is in a downtrend, but the weekly shows an uptrend, make sure to draw a Fibonacci retracement tool to identify the potential levels where the correction might end on the daily timeframe. Everything between the 38.2% and 61.8% Fib retracement levels can be a good point to enter in the direction of the overall trend.

Finally, zoom-in to the 4-hour chart to find potential entry and exit levels for the trade, as well as stop loss levels. Recent swing highs and swing lows, horizontal support, and resistance levels, channels, and trend lines (from the daily timeframe) can all point to levels to enter into the trade. Since a complete trading system also factors in risk and money management, make sure that your trade setup returns a satisfying reward-to-risk ratio of at least 1 or preferably higher.

Back-test your trading system

As always, it’s extremely important to back-test any Forex trading system before putting it to work on a real account. Simply scroll your chart to a previous period and disable the function “Scroll the chart to the end on tick incoming” (if you use MetaTrader 4/5).

This will prevent the chart from returning to the most recent date with each change in price. Once you scroll the chart to a previous period, try to find trade setups that align with the rules of the trading system described above and analyse how they would have performed. It’s a good idea to keep a trading journal along the way and make regular retrospectives of each trade to find the best performing setups. Make sure to back-test dozens, if not hundreds of trades in order to get familiar with the trading system, before moving on to a real account. This will ensure that you trade only with Forex systems that works.