All traders occasionally encounter the phenomenon of price gaps and might get confused. Gaps are encountered in all financial markets and most often appear on Monday, at market opening. In this article, we will explain what a gap is, what types they are, and why they appear. A gap is a price rupture on the chart, defined as a significant displacement of the opening price of a new bar from the closing price of the previous bar. Technically, this price gap can appear at any period: from a minute to a weekly time frame. In the forex market, all of these gaps are considered full-fledged and are taken into account when trading. However, this can't be said about the stock and commodities markets, where the gap is considered valid only if it appeared on a daily or higher time frame.

You can see the gap only on charts, which show the opening and closing prices of the periods. And there are two types of charts: bars and Japanese candlesticks. On all other types of charts, the price gaps are not displayed, because they are built mainly only on the closing price (lines, ticks, Renko, etc.).

The gap can appear at any time, but the most significant is the gap formed over the weekend. That is the gap between the market closing price on Friday and the market opening price on Monday. The frequency of such gaps appearance depends on the market volatility, in most cases, they appear not more than twice a month.

The Causes Of Price Gaps

The main reason for price gaps is a sudden change in the balance between supply and demand. The emergence of a large number of bids to buy or sell without counter orders creates a lack of liquidity and shifts the current price, thereby balancing. The culprits of instant balance shifting are large urgent orders and the triggering of accumulation of volumes at some price levels. And if the broker does not have enough liquidity in this range, this is where the gap occurs.

There are several reasons for the occurrence of a gap:

- Publication of economic news;

- The publication of important economic indicators, especially noticeable when the real indicators are very different from the expected ones;

- Terrorist attacks, disasters, man-made accidents, and natural disasters;

- Accumulated volumes at the joints of sessions and periods (week, month, year), expiry dates of options, or closing large deals;

- Information holes in the quotes flow, this is a purely technical aspect and very rare as brokers receive liquidity from several sources.

Types Of Price Gaps

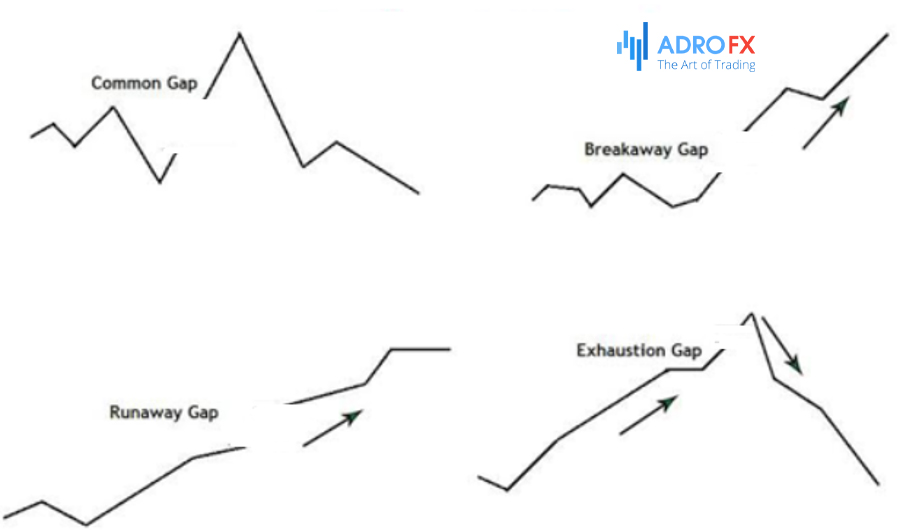

The following types of gaps can be distinguished in the financial markets:

Different types of price gaps

Common gap – a price gap accompanied by a small trading volume, which means the low interest at the time in this asset. Typically, common gaps appear in the middle of a trading session or a quiet market. They close quickly, without any subsequent effects on the market, and therefore are of no interest. Breakaway gap is a price gap formed during the trending market. With a rapid trend, it is often formed several such gaps, one after another. This type of price gap can be considered significant, and its appearance shows that the trend will continue. The price movement doesn't meet the resistance, and at every strong price level, it makes a gap. Usually, these gaps are not filled, and when you try to fill them, the price meets strong resistance or support at the base of the gap.

Runaway gap is essentially the same as a breakaway gap, but without breaking out a significant price level. It is formed mainly in the middle of the trend and has a high trading volume. The formation of this price gap means that the trend is strong and likely to continue.

Exhaustion gap indicates the end of the trend and its soon reversal. The price gap can be called an exhaustion gap if it has a high trading volume and was formed after a protracted movement.

Trading Price Gaps

The classification described above explains the gaps well, but it is not enough for precise identification and further actions. For example, the runaway gap can easily be confused with the exhaustion gap, and therefore traders can mistakenly enter the market. When working with the price gaps, you should first analyze the causes of their occurrence, to determine the general mood of the market. It is necessary to analyze how the gap corresponds to the strong levels of support and resistance. And only after that, you can decide what type it refers to and whether it is worth opening a position. It should be remembered that a gap sometimes turns into a market panic without a clear direction.

One should not place pending orders on Friday, hoping to catch a good movement on Monday. If the pending order finds itself in a gap, it will not work at best, and at worst, it will be executed at an unprofitable price. The same applies to Stop Loss, if the stops hit a gap, the position will be closed at the first available price. And as we understand, the closing will take place at a price that is not profitable for the trader.

In most cases, the gap is closed on Monday, that is, the price returns to the Friday closing price. And this pattern can be used in your trading, but again, only after a thorough market analysis.