In the dynamic world of global finance, central banks play a pivotal role in shaping currency values. This was recently exemplified by the Bank of England's (BoE) decision to maintain its key interest rate at 5.25%, in stark contrast to the Federal Reserve's more dovish approach. The BoE's move, marked by a hawkish inclination among three of its nine members favoring a rate hike, has notably extended the British pound's rally, underscoring the nuanced interplay between central bank policies and currency markets.

The BoE's commentary on its decision highlighted the ongoing uncertainty surrounding inflation dynamics, particularly concerning robust wage growth and rising service prices. This cautious stance reflects a broader trend in monetary policy, where the Federal Reserve often leads the cycle. Historically, the dollar has gained strength at the onset of policy tightening and weakened when signs of easing emerge. The recent reactions of GBP/USD to the meetings of the Fed and the BoE vividly illustrate this principle.

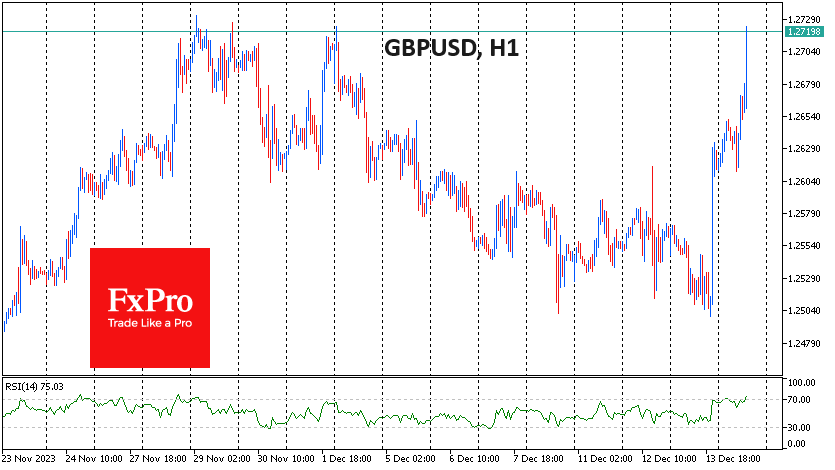

The Fed's signals of potential policy easing have softened the USD, while the BoE's inclination towards further tightening has bolstered the GBP. These dual forces converged within a span of 16 hours, propelling GBP/USD upwards by 1.7%, surpassing the 1.27 mark. This surge marked a return to the highs observed two weeks prior and placed the pair in a significant resistance zone that has persisted since August.

However, the current rally's momentum appears somewhat overextended, and the currency market might enter a phase of consolidation or correction as the year-end approaches. This potential shift could be influenced by various factors, including ongoing economic data releases, geopolitical developments, and further adjustments in central bank policies.

As traders and investors navigate these complex dynamics, the role of central banks in influencing currency values remains a critical aspect of global financial markets. The contrasting approaches of the Fed and the BoE, as seen in their latest decisions, continue to shape the landscape of forex trading, offering valuable insights into the intricate relationship between monetary policy and currency fluctuations.