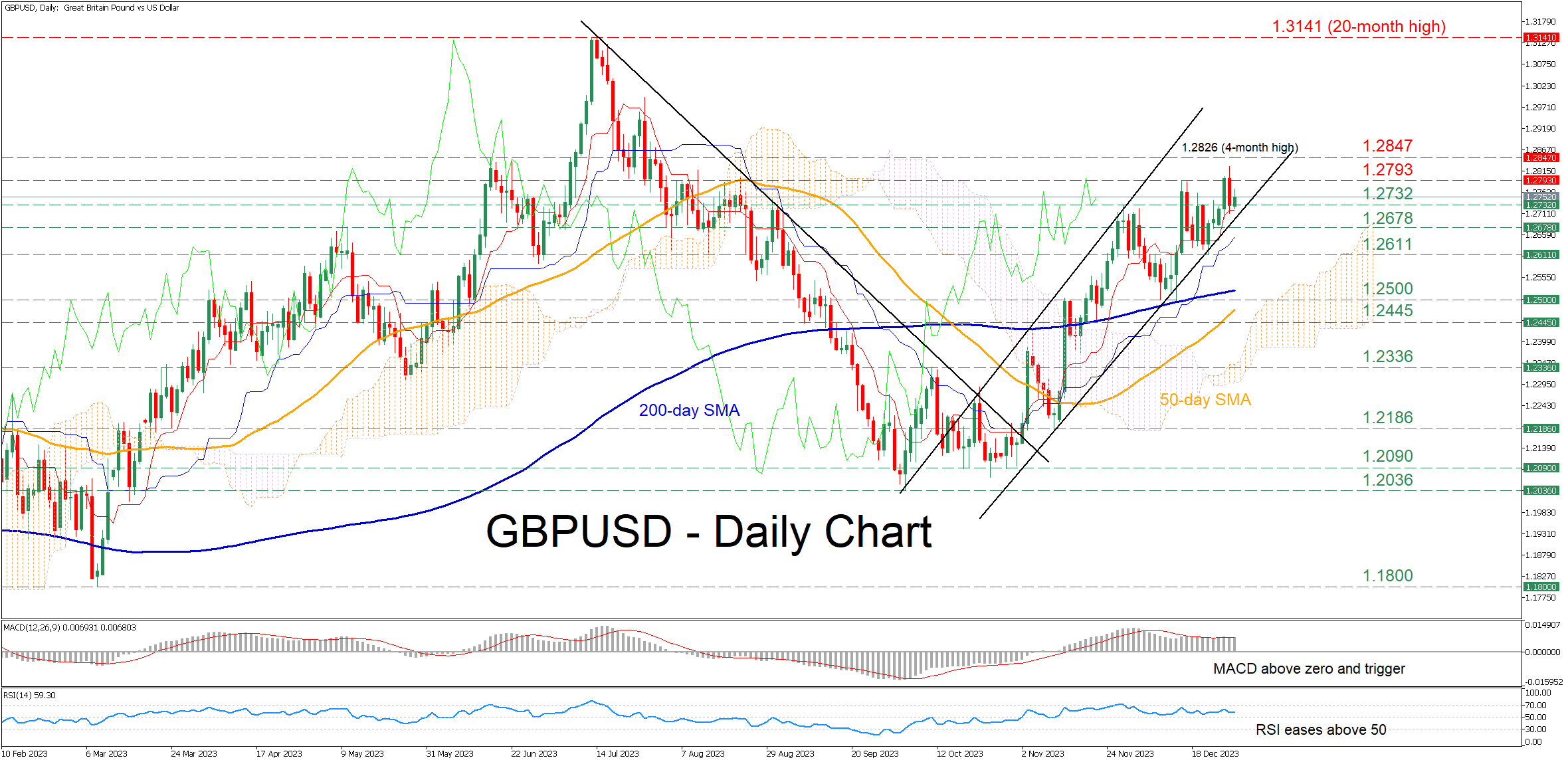

Resilient GBPUSD Maintains Upward Trajectory After Hitting a Four-Month High. The GBPUSD currency pair, widely observed in the forex market, has recently moderated its gains after marking a significant four-month high. This development comes amidst a broader bullish trend, indicating a resilient upward trajectory for the currency pair. The recent performance of GBPUSD reveals a compelling narrative of bullish persistence. The pair has been tracing a significant upward pattern, marked by consistently higher highs, a clear indication of robust buying interest.

This trend commenced with a notable break above a critical descending trendline in early November, signalling a shift in market sentiment.

As the pair reached the four-month peak at 1.2826, it did not merely signify a transient spike but hinted at an underlying strength in the bullish momentum. The imminent formation of a golden cross, a technical event where the 50-day simple moving average (SMA) crosses above the 200-day SMA, reinforces this bullish outlook. Such a crossover is often perceived as a bullish signal by market participants, suggesting a potential for further upside movements.

Momentum Indicators Align with Bullish Outlook

Analyzing the momentum indicators provides additional insights into the currency pair's trajectory. Both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), two widely used technical indicators, are positioned in their positive territories. This alignment indicates that the bullish momentum has substantial backing and is not merely a speculative spike.

The potential for the bulls to overcome recent minor setbacks and target the recent resistance level of 1.2793 is high. Breaching this resistance could pave the way for a retest of the four-month peak at 1.2826 and possibly extend gains towards the June high of 1.2847.

Support Levels to Watch in Case of Reversal

Conversely, if the GBPUSD pair experiences a bearish reversal, it is crucial to identify potential support levels that could provide a cushion. The levels at 1.2732 and 1.2678, which previously acted as resistance, may now serve as primary support zones. A breach below these levels could lead the pair towards the recent support of 1.2611, and in a more significant downturn, the December low of 1.2500 could be the next focal point for traders.

Conclusion: Bullish Trajectory Prevails but Caution Warranted

In summary, while the GBPUSD’s advance may have momentarily decelerated, the overall market structure and technical indicators suggest that the bias remains largely bullish. However, traders and investors should remain vigilant, as a decisive break below the upward sloping channel could alter the current optimistic outlook. As always, market dynamics are subject to change, and maintaining an adaptive strategy is key in navigating the forex market.