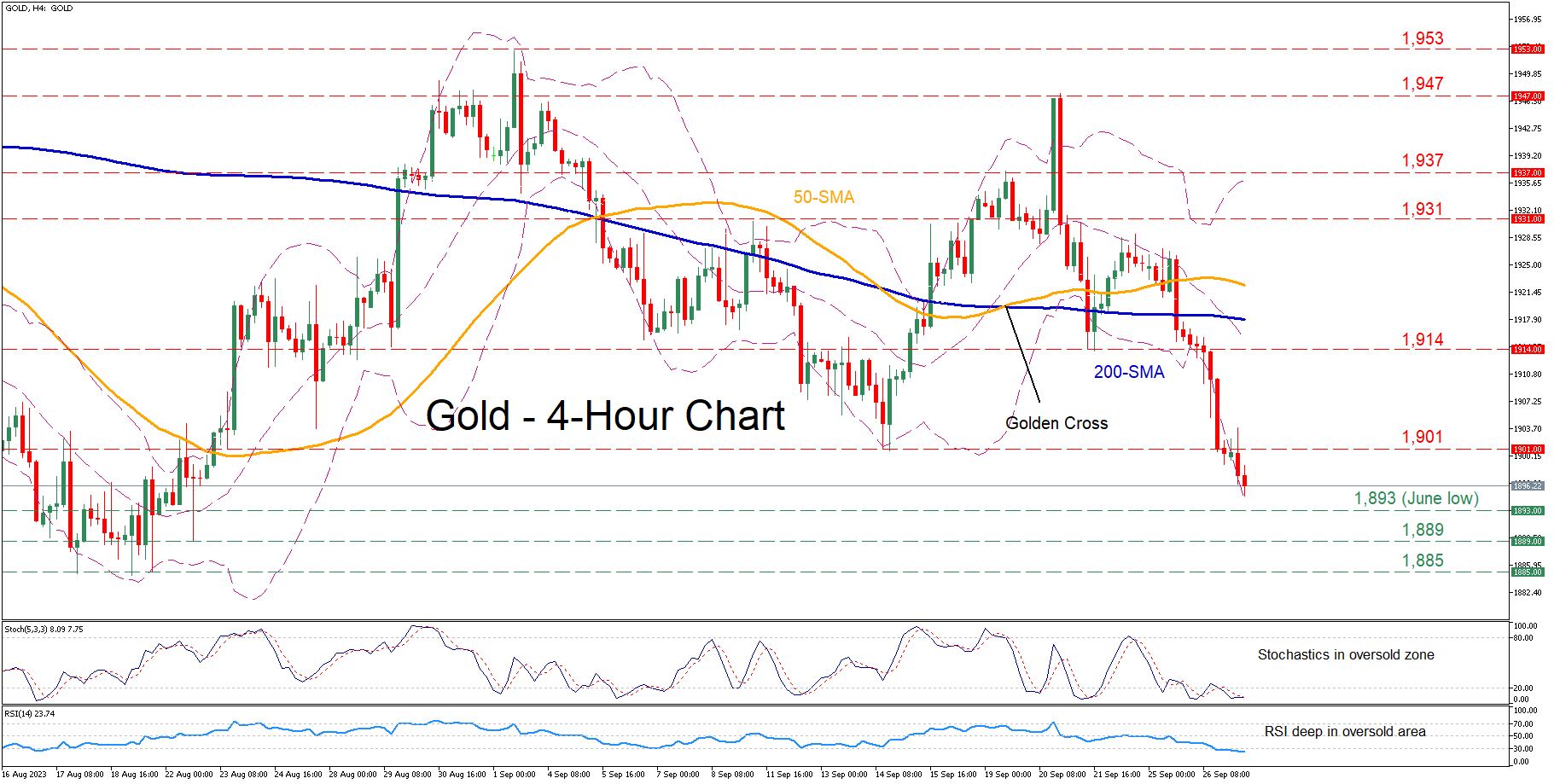

Gold, symbolizing both wealth and security, has witnessed a tumultuous retreat, falling beneath the pivotal $1,900 mark, reflecting a nadir not seen in the preceding month. This plunge has been unrelenting, with no discernible respite in its decline, while the expanding Bollinger bands are indicative of heightened market volatility. The momentum indicators for gold have plunged deep into their oversold realms on the four-hour chart, suggesting the possibility of a precipitous descent being overextended. Amid this downward spiral, the precious metal has violated its 50- and 200-period Simple Moving Averages (SMAs), plunging below the psychological barrier of $1,900. However, given the prevailing oversold conditions, a market rebound seems plausible and should not be dismissed outright.

Potential Support Levels

Should the bearish forces continue to dictate the market, exerting downward pressure, immediate support might be found at the June low of $1,893. If this level fails to arrest the descent, the yellow metal might aim for the August support situated at $1,889. A continued downward trajectory may eventually find a resting point at the August nadir of $1,885, a level reminiscent of the lows observed back in March.

Possible Rebound Scenarios

Conversely, if the markets witness a bullish resurgence, a potential rebound could initially encounter resistance at the September support level of $1,901. Overcoming this immediate barrier could pave the way for the gold price to grapple with the $1,914 level, preceding a confrontation with the September resistance stationed at $1,931.

Market Outlook

The ongoing scenario portrays a relentless bearish onslaught on gold, thrusting its value into extensively oversold territories. The market landscape seems to be permeated with heightened tension and uncertainty, with gold prices dancing to the tunes of multifaceted market dynamics. The question looming large is whether the bulls can muster enough strength to retaliate and steer the market towards a potential recovery.

Conclusion

In conclusion, the confluence of technical indicators and market sentiments paint a picture of a gold market teetering on the brink of oversold conditions. This persistent downward pressure has left market participants contemplating the resilience of support levels and the probability of an impending rebound. Whether the bullish forces can reclaim their lost ground and ignite a market reversal remains a keen point of observation in this unfolding market narrative, underpinned by volatility and oscillating investor sentiments.