Despite the recent enthusiasm surrounding the ETH futures ETF, its launch didn't meet market expectations. The surprisingly modest trading volume of a mere $1.92 million, distributed across six funds, raised eyebrows and concerns alike. Last week's insights suggested potential profit-taking behaviors that could push ETH prices lower; this manifested more aggressively than anticipated.

Influential crypto investor, Justin Sun, only added fuel to the fire by divesting 20,000 ETH, causing a domino effect in the market. Traders, in a bid to anticipate and pre-empt a possible price decline, rushed to sell their ETH holdings. This, combined with the revelation that last year's FTX hackers had begun selling off their stolen cache, contributed to ETH's price slide against BTC.

Yet, the silver lining remains. Recent data illustrates a significant movement of 110,000 ETH off exchanges, signifying increased investor confidence in the cryptocurrency's long-term potential. Despite external pressures, the demand for ETH is resilient, demonstrated by the largest outflow since August and a record accumulation of non-exchange ETH.

BTC: A Resilient Performer in Times of Uncertainty

Amidst the sea of volatility in traditional markets, BTC has emerged as a stable anchor. The potential SEC approval for spot BTC ETFs has played a role in this, but the stability goes deeper. Key figures, such as former Blackrock directors, have projected confidence in imminent SEC approvals, and the interim US House Speaker, Patrick McHenry's pro-crypto stance, has momentarily eased regulatory apprehensions.

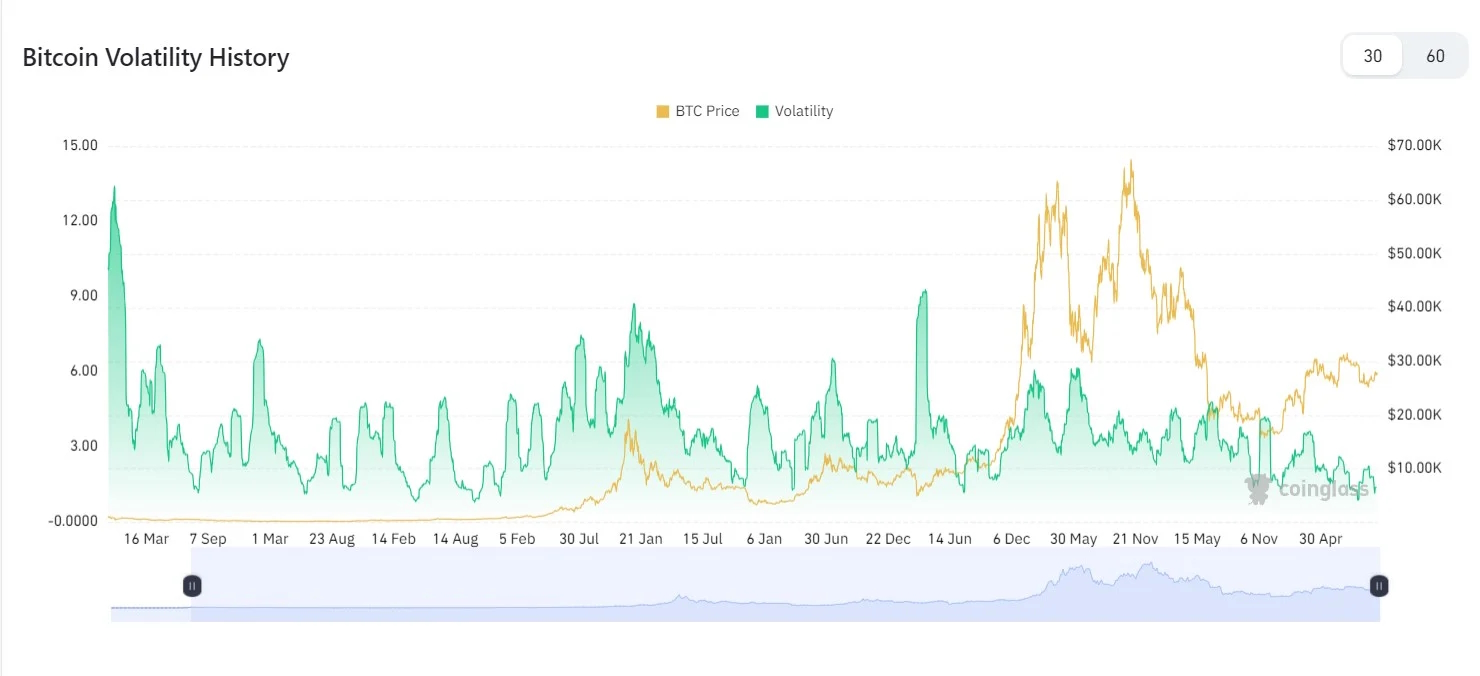

The decoupling of BTC from traditional macroeconomic influences suggests its increasing maturity as a standalone asset class. Historical volatility metrics for BTC hint at a potential price surge, affirming its status as a safe haven during global economic unease. This sentiment is further strengthened by the resurgence of wrapped BTC transactions. The frequency and volume of these transactions have often heralded bullish phases in the crypto market, reinforcing optimism around BTC's trajectory.

Altcoins: A Mixed Bag of Hopes and Hurdles

The crypto realm isn't limited to the BTC and ETH narrative. Altcoins, once dominant players, are striving to find their ground. AVAX, for instance, saw a revival due to the launch of a new dApp, Star Arena, prompting blockchain activity. However, the resurgence was short-lived due to subsequent security breaches.

Ripple's XRP also witnessed fleeting attention. Although Ripple Labs celebrated its official status as a regulated digital payment provider in Singapore, ongoing litigation with the SEC tempered any price rallies.

Traditional Markets: Uncertainty Amid Global Events

The fluctuating sentiments in the job market have kept traders on their toes. Discrepancies between expected and actual job numbers have led to volatile reactions in the stock market. While the S&P and Nasdaq ended in positive territory last week, the Dow succumbed to a minor setback. The forthcoming FED meeting in November is poised to provide further clarity on the market direction.

Commodities also faced challenges. Gold and Silver prices dropped, and oil prices tumbled significantly due to unexpected surges in US gasoline inventories. However, the escalating conflict in Israel has reintroduced volatility, particularly in oil and precious metal prices.

Looking Ahead: A Tumultuous Landscape

As the world monitors the Middle Eastern conflict, its potential repercussions on the US market are undeniable. Immediate reactions have already surfaced, with oil prices rising and US stock futures showing pessimism. Upcoming events, such as the release of FED meeting minutes and statements from FED representatives, will offer additional insights into the economic landscape. Inflation metrics, such as PPI and CPI data releases, will also be pivotal in shaping market sentiments.

In conclusion, as traditional markets face mounting uncertainties, BTC's resilience underscores its growing reputation as a safe haven asset, providing investors with a glimmer of stability in turbulent times.