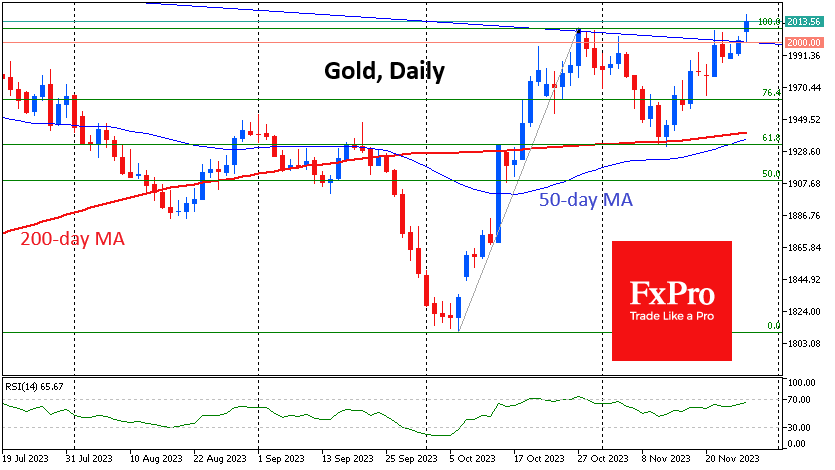

Gold has initiated the week with a decisive push, breaching the $2010 mark and venturing into a domain that has historically posed a resistance level. Over the last few years, gold's ventures above the $2000 threshold have been transient, lacking sustained presence. This characteristic movement signals the market's tentative stance at these elevated price points. The recent surge can be regarded as an excellent display of Fibonacci pattern trading. Starting from a base momentum that carried the price from $1810 to $2010, the subsequent correction aligning with the 61.8% Fibonacci retracement level found support at the 200-day moving average near $1935.

The ascent past the previous local highs could be setting the stage for an extension towards the 161.8% Fibonacci level, which would place the target at around $2130.

Macroeconomic Factors and Geopolitical Influences

Economic and Geopolitical Dynamics: The current trajectory of gold prices is not solely dictated by technical patterns but is also influenced by broader economic and geopolitical forces. The robust performance of the US economy and ongoing geopolitical tensions have sustained the appeal of gold as a safe-haven asset. Meanwhile, the US debt markets exert pressure, making government bonds more alluring due to their yield, especially as they rebound from significant troughs.

Global Reserve Diversification and Market Sentiments

- Reserve Diversification: The heightened interest in gold in recent years may partially be attributed to countries like China or other emerging markets looking to diversify their reserves away from the dollar. While the impetus behind this interest—actual demand versus speculative action—is unclear, it remains a factor in the market's dynamics.

- Buying vs. Selling Stance of Major Players: The crucial question now is whether major net buyers of gold, such as China or Saudi Arabia, will continue their acquisition in the face of contracting trade surpluses or pivot to selling gold to fuel domestic economic growth.

Technicals and Long-Term Pattern Analysis

From a long-term perspective, gold has hinted at the formation of a triple top, traditionally viewed as a reversal pattern. However, the recent swift upward movement since early October casts doubt on the pattern's validity and suggests a potential continuation of the bullish trend. The upcoming movements of gold are set to be crucial in defining its trend for the forthcoming months. The market is perched at a crossroads, with two distinct possibilities: a breakthrough of long-term and psychologically significant resistance levels or the onset of a protracted bear market that could span months or even years.

As such, the unfolding days are poised to be a watershed period for gold, setting the tone for its future trajectory in a landscape where technical patterns, economic robustness, and geopolitical developments all play integral roles.