US investment bank Morgan Stanley produced a research note yesterday detailing that they see a period where "real" US bond yields rise in the near-term. They're not alone in that call. Like any call, one should not blindly follow it in, but for me the logic and reasoning is always fascinating and is most important.

I don’t trade TIPS (Treasury Inflation Protected Securities) specifically, which would be a direct way to trade the call, but over the past decade we've seen US Treasuries adjusted for expected inflation or ‘real’ yields, being the independent variable, driving the USD, Gold and Tech. It made me consider the USD and more so Gold.

You can find more on US bond markets on the St Louis Fed website, although it's delayed.

Orange – Gold (inverted). Blue – US 10yr real yield

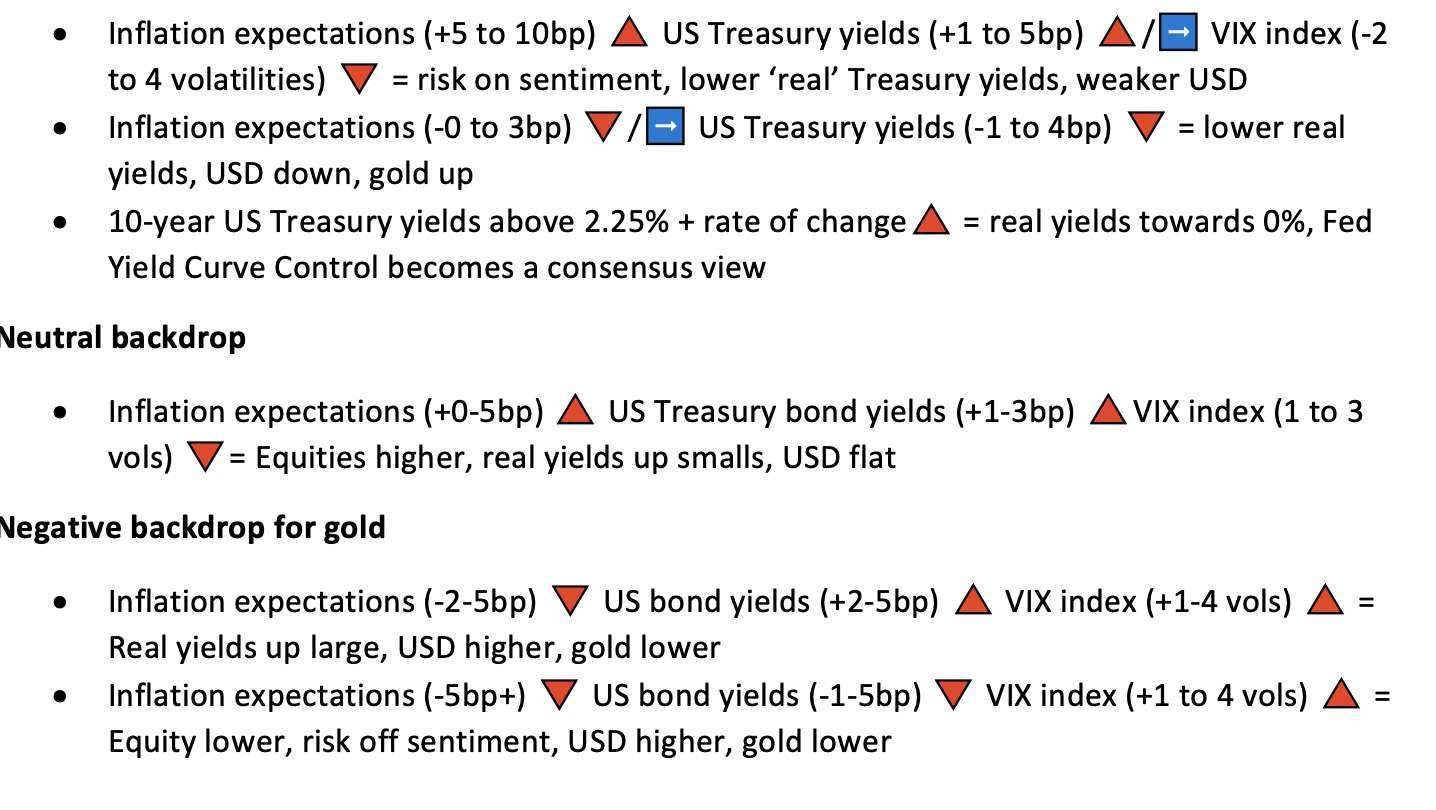

To visualise the dynamics, I've put together a playbook which focuses on the core driver of the Gold market – US Treasuries, real and nominal. The VIX index you can see on the MT4/5 or cTrader platforms is effectively the implied volatility in the S&P 500 over the coming 30 days – a proxy of equity volatility.

Here’s how I see the plays and breakevens equal inflation expectations over the coming 5 or 10 years.

Bullish backdrop for gold (in order of impact)

This may be confusing to some, which is why price action is always the best place to start in this business. For macro heads, this matrix could be helpful and if indeed we're moving into a higher real rates environment, the prospect is of a stronger USD, then a weaker Gold price could play out.