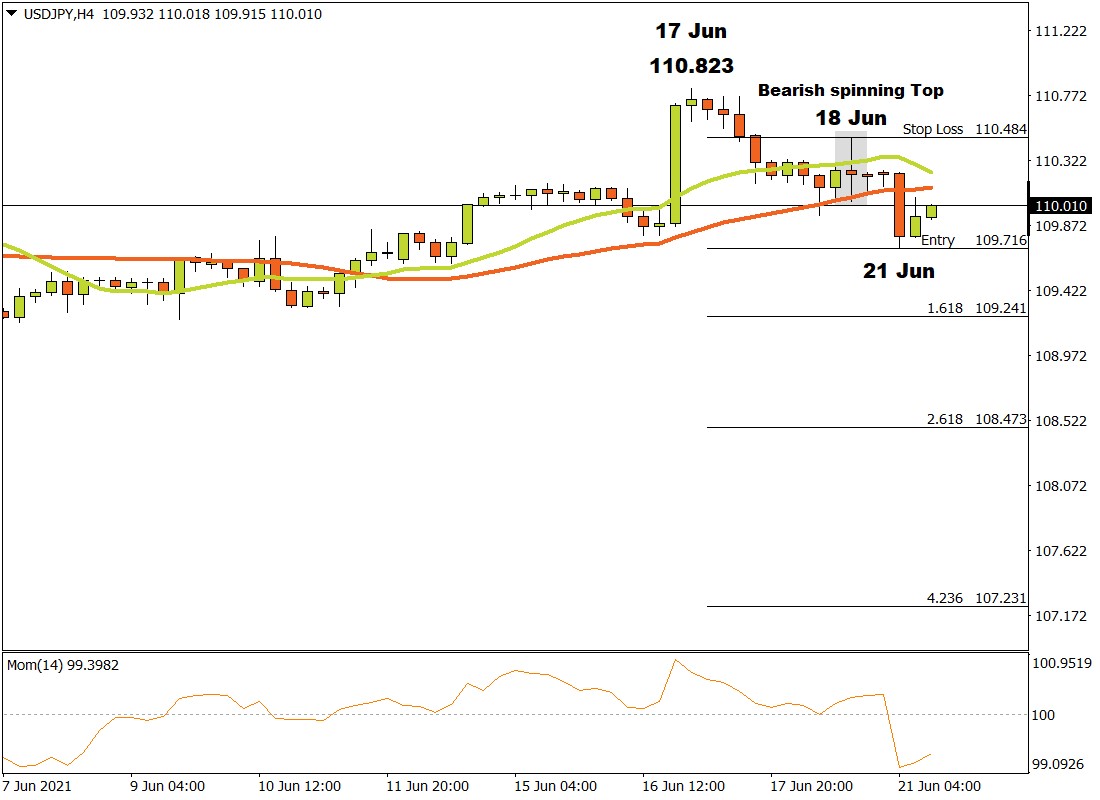

The Yen on the H4 time frame was in an uptrend until 17 June when a higher top was recorded at 110.823. Bears then started to take control and the market broke through the 15 and 34 Simple Moving Averages with the Momentum Oscillator crossing into downside territory as it pierced through the zero baseline. Both technical indicators as well as the lower top that formed on 18 June with a Bearish Spinning Top confirmed that the bears may have exerted enough pressure to push the bulls back. A possible critical support level formed on 21 June at 109.716 and the bulls are currently trying to push the market higher.

In the event that the Yen breaks through the critical support level at 109.716, three possible price targets may be calculated from there. Applying the Fibonacci tool to the bottom of the support level at 109.716 and dragging it to the resistance level at the Bearish Spinning Top at 110.484, the following targets may be considered. The first target can be projected at 109.241 (161%). The second price target may be foreseen at 108.473 (261.8%) and the third target may be expected at 107.231 (423.6%).

If the resistance level at 110.484 is broken, the above scenarios are invalidated. As long as bears are able to continue exerting negative sentiment in the Yen and supply continues to overcome demand, the outlook on the H4 time frame will remain bearish.

For more information, please visit: FXTM