A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. What should be this vital decision based on? To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets. These include:

- The terminal should function without technical failures, including times of increases in liquidity. Such flaws are observed mainly on web platforms. For supporters of long-term trade, such drawbacks are not significant, but for scalpers, delays in processing trade orders can lead to loss of profits. To avoid such problems, it is recommended to install trading software on a home computer, but this is not always effective.

- Functionality A good trading platform should have enough tools for technical-analysis. When transferring indicators to a chart, developers should have incorporated the possibility to adjust input parameters. It is equally important to use several time periods of the chart for making a trading decision. By the way, according to the method of A. Elder, this method of filtering spurious signals is a key element of the strategy. The program should be able to work simultaneously with several financial instruments, as well as with automated trading systems. A trader should not have difficulty placing urgent, safety or pending orders. An additional advantage of the terminal will be the presence of a window for monitoring trading volumes (a glass of prices) and important macroeconomic events capable of provoking a violent market reaction.

- Trading should be comfortable for the trader, so a good terminal can change the color of indicators, the background or the chart itself. In addition, the first impression of the platform is based on a visual assessment.

- No compatibility issues. If necessary, the trader should be able to install the platform on a mobile device. To do this, developers must take care of the correct operation of the program on any operating system.

- Popular terminals for trading in the OTC market meet almost all the requirements mentioned above. When choosing a specific platform, a trader should be guided not only by the opinion of more experienced colleagues, but also by their own impressions. Below are descriptions of the best Forex trading platforms at the time of this writing. After reading this information, everyone will be able to make an objective decision on choosing a terminal.

It is important to take into account that some of the platforms mentioned are copyrighted by brokers, so trading in them is possible only when opening an account with a particular company.

Ninja trader

Universal trading platform to which it is possible to connect a trading account of any broker. A distinctive feature of this terminal is the ability to analyze cluster charts, which will allow the trader to obtain accurate data on market sentiment.

The development and modernization of the platform is the responsibility of the American company NinjaTrader LLC, headquartered in Denver. The screenshot shows a graph in the NinjaTrader terminal with volume indicators printed on it. It is worth saying that this platform is standard for many investment companies.

There are 2 versions of the terminal: Pro and Lite. Version Pro provides the user with virtually unlimited trading and analytical capabilities, but its use will cost $ 50 per month. The Lite version is aimed at a wider audience. This terminal can be downloaded from the website of the developer. When trading in a demo mode, a monthly fee for using the software is not charged. The trading period on a demo account is not limited. The terminal Ninja Trader can only be used to perform analytical work. It is worth noting that a similar set of indicators in the usual MT4 or MT5 is not provided.

Zulu-Trade

Trading platform, which allows you to earn both by investing in other traders and in independent trading. The terminal has an accessible interface. The official site provides a detailed guide for beginners. There are also instructions for attaching a trading account to the platform. Zulu-Trade is an independent organization that cooperates with many reliable brokers.

Zulu-Trade is ideally suited for passive earnings in financial markets through the distribution of capital among successful traders. There is a demo mode, which without embellishment displays the true capabilities of the platform. Also worth noting is an effective system for monitoring earnings statistics of managing traders. For self-trading I personally found the terminal inconvenient and limited.

Mirror trader

The name of the platform fully justifies its essence. The functionality is largely similar to the previously considered Zulu-Trade.

The key task of the platform is to monitor the transactions of successful traders. The possibility of automatic and semi-automatic trading. The investor decides for which transactions to follow.

Important! Beginners are not recommended to use the features of Mirror Trader. In the early stages, it is more important to devote time to independent trading, and the transactions of other bidders are too distracting, while there are no guarantees of success.

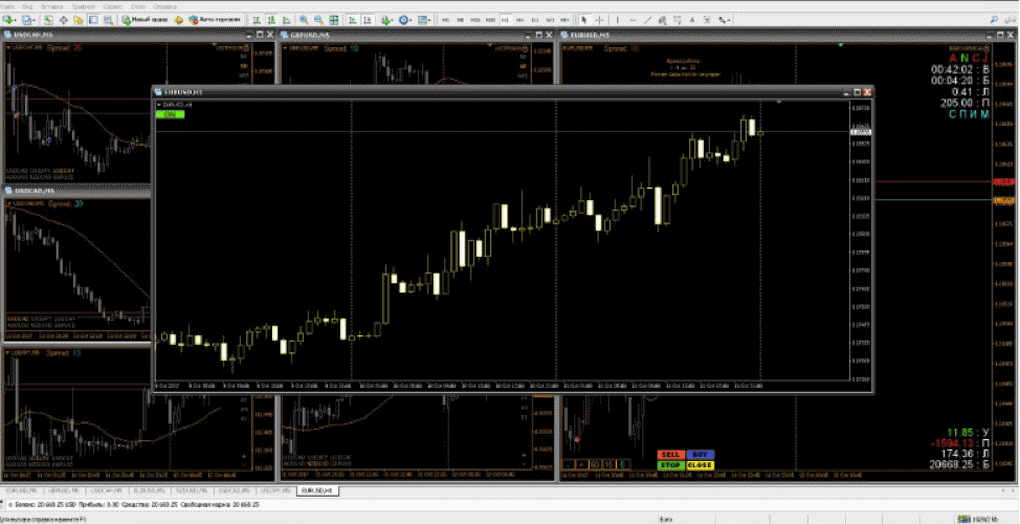

MetaTrader 4

The platform was developed by MetaQuotes Software Corp in 2005, but this terminal even today has the right to be called one of the best. Distinctive features of MetaTrader 4 include:

- High performance;

- Favorable environment for the implementation of any trading ideas and to develop their own strategies;

- The developers provided the editor of MQL4 trading advisors (a later version of this editor is provided in the MT5 platform), which allows users with the necessary skills to automate the trading process;

- If necessary, the trader will be able to install in the terminal any custom indicators that are not included in the standard set of analytical tools, as well as any trading programs, scripts;

- There is a flexible setting of price charts;

- The platform is adapted to the most popular operating systems (windows, mac OS, Android, iOS, Linux);

- Impeccable trading account security.

MetaTrader 4 is still used by most brokerage companies to provide services in the online trading industry to a wide audience.

MetaTrader 5

Innovative trading terminal from the company-developer MetaQuotes Software Corp was released in 2010. The platform has a lot of common features with the previously considered MT4. In the new version of the MetaTrader terminal, developers managed to significantly expand the functionality of the platform:

- 21 timeframe instead of 9.

- More than 70 tools for computer market analysis.

- The ability to customize sound notifications when forming a trading signal.

The ability to trade is not limited to currency pairs. In addition, the trader will be able to open transactions in the futures market, as well as to trade in goods and stock assets.

A glass of prices has been integrated into the terminal, which will allow the trader to more objectively evaluate pricing prospects.

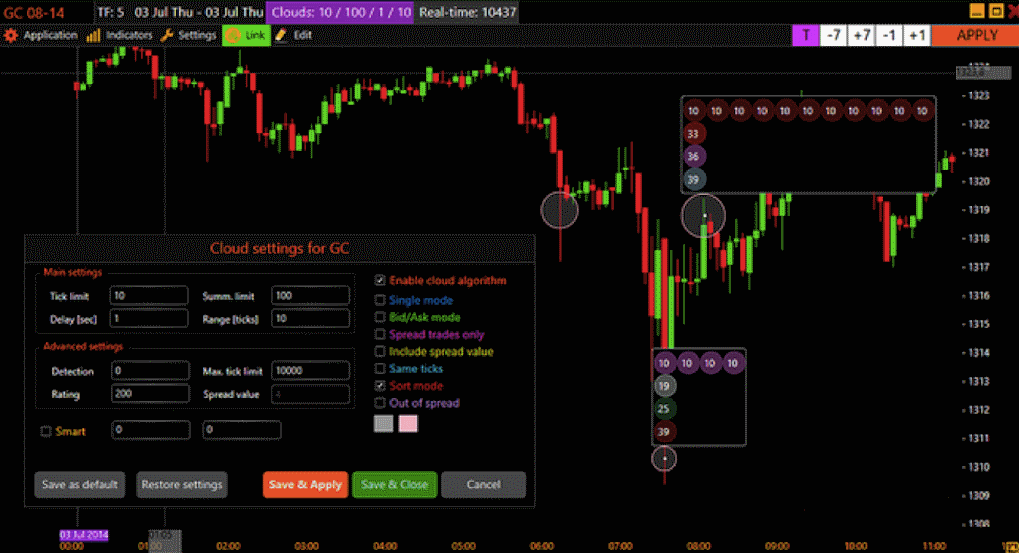

ATAS

The developers are positioning the platform as a terminal for professional trading, the monthly cost of which will cost 69 EUR.

For these funds, the trader receives complete information on trading volumes on the futures market. The cost of unlimited use of the program is fixed and amounts to 1790 EUR. There is a test period of 14 days. With most experienced traders, this terminal is used exclusively as an analytical tool. The noteworthy volume indicators are really integrated into the ATAS platform.

SB-Pro

The terminal is a full-fledged, independent analogue of the previously reviewed ATAS platform. The difference is only in the cost of use. Developers do not provide a monthly fee. To work with the platform, it is enough to buy its full version for 100 USD.

In terms of functionality, the terminal is not inferior to more expensive counterparts, such as ATAS or VolFix. Sb-pro is used by traders as an analytical tool and deserves the attention of beginners, since the analysis of cluster graphs can be called one of the most effective.

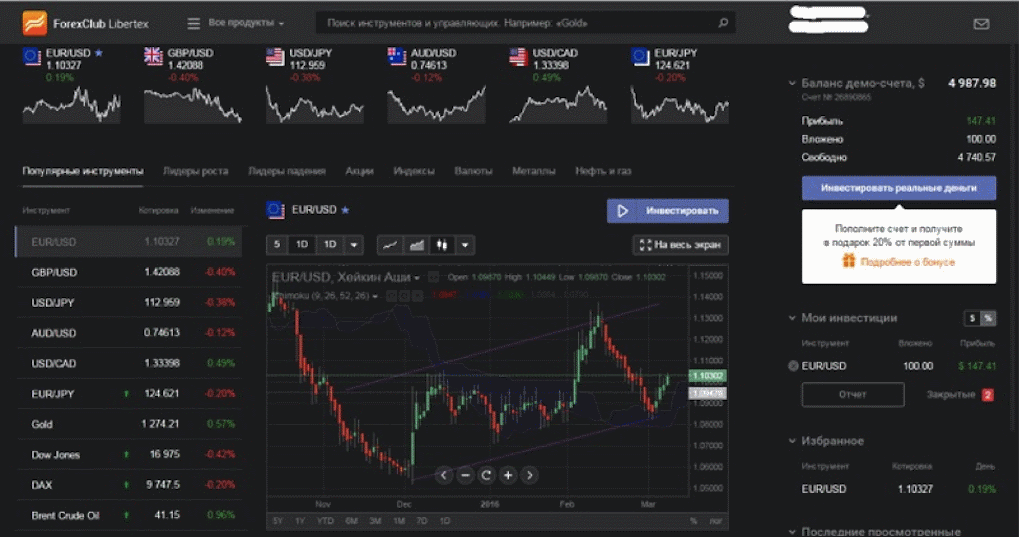

Libertex

This terminal was awarded the title of the best trading platform Forex 2014 at the international exhibition of innovative technologies in the online trading industry Forex-Expo.

Distinctive features of the platform are:

- The ability to trade stock assets, commodities, cryptocurrencies and currency pairs from one account;

- The trading process is simplified as much as possible, so novice traders will not have difficulty operating;

- Both independent trading and investing in successful managers is possible;

- Convenient risk control service when investing in a PAMM - multiplier.

- Adapted to the most popular operating systems.

Currently, trading on the Libertex platform is possible only after registering an account with Forex Club.

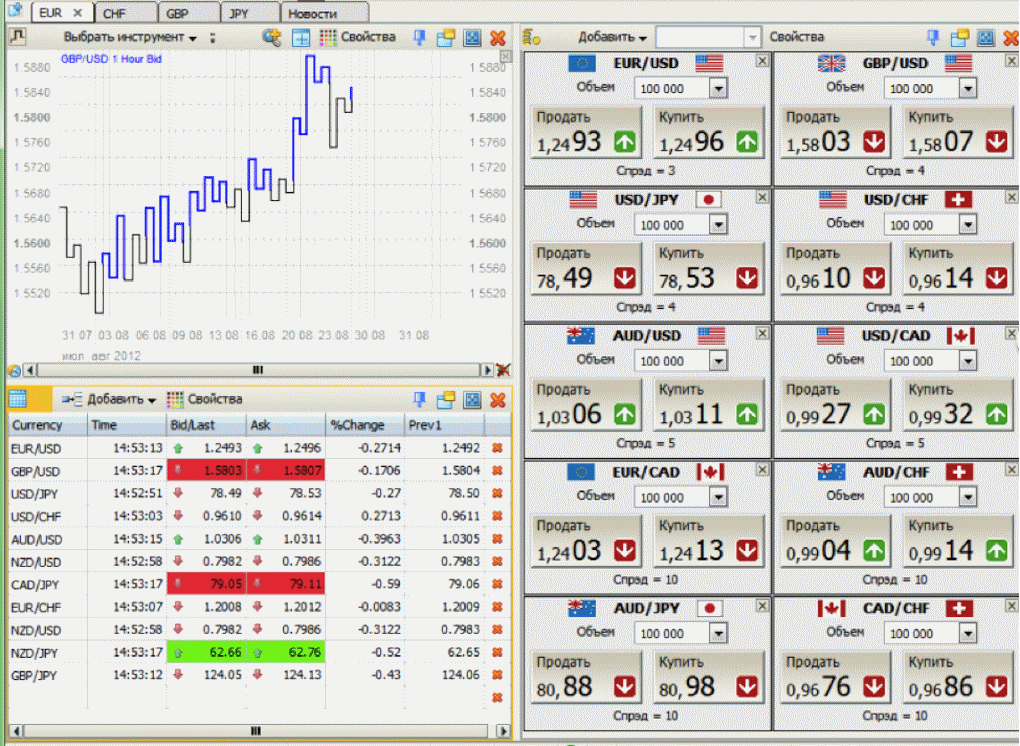

Rumus

A unique trading and analytical platform, access to trade on which the company provides Forex-Club.

Main advantages:

- The possibility of developing unique indicators;

- Access to unique custom indicators and oscillators;

- Many types of display charts, including "Renko", "Kagi";

- Integrated monitoring of significant macroeconomic events.

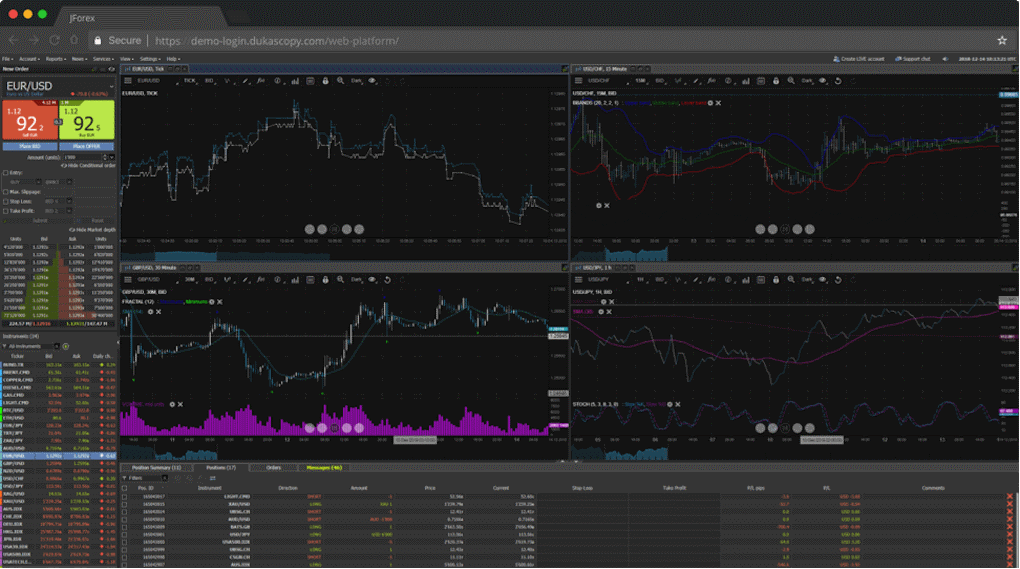

Jforex

The trading platform was developed by specialists of Dukascopy Bank SA and is provided for trading in financial instruments by bank customers.

The use of the terminal is available on the official website of the broker after authorization, and it is also possible to install the platform on a PC. Compatibility problems will not arise, because the developers have adapted the software for the most popular operating systems.

Important! The JForex terminal is almost as good as the usual MT5, but has a convincing advantage. Dukascopy Bank SA is a market maker and liquidity provider, therefore, the most accurate prices and market spreads for liquid assets are provided for clients to trade.

The disadvantages of the terminal include a limited choice of financial instruments, as well as high requirements for the starting deposit. The minimum amount for opening an account is 1000 USD. Another flaw is the inability to integrate custom indicators into the terminal, since all of them are written in MQL5 or MQL4.