The year 2020 is gone, but the problems it has brought upon the world and all of the major Forex markets will linger in 2021 as the COVID-10 pandemic is far from being dealt with, while the global economy has only recently begun to recover from the shock.

In these dark times, many of you might be wondering what Forex pairs to trade in 2021, the year that is going to be characterized by more uncertainty as there is no guarantee that the vaccination would pan out and how it would affect the geopolitics and Forex markets. To help you navigate through these troubled waters, we have handpicked 10 major Forex pairs that hold the promise of active price action and significant yields in 2021.

EUR/USD

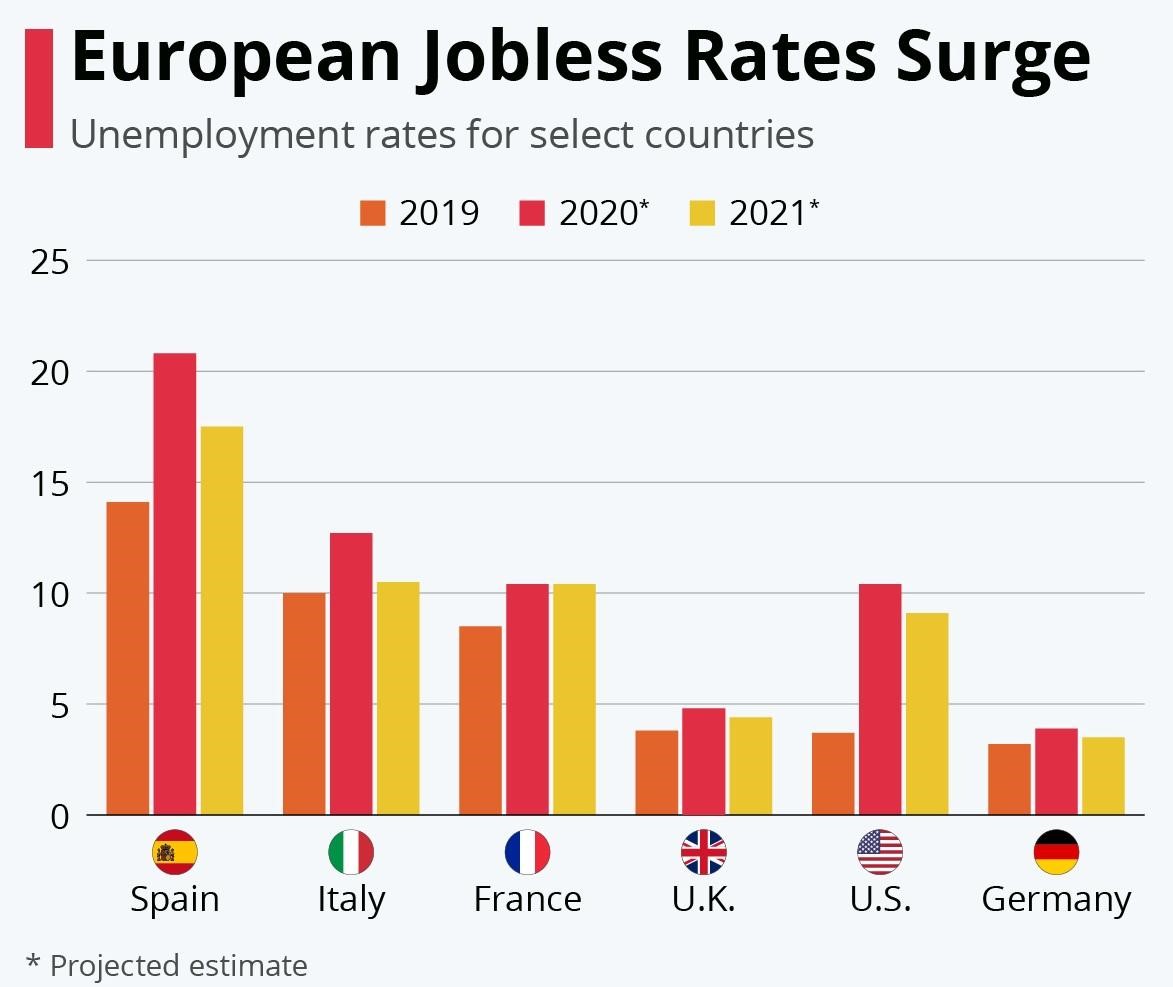

We begin our 2021 price prediction with the analysis of EUR/USD, the major currency pair in Forex that reflects the occurrences in the world’s two largest economic powers, apart from China, of course. The coronavirus crisis has had a devastating effect on the economies of both the Eurozone and the United States in 2020, causing a severe drop in GDP and a sharp spike in the unemployment rate in Western and Southern Europe, as well as the Scandinavian countries, as per data provided by Eurostat.

Youth unemployment rate in 2020. Source: Eurostat

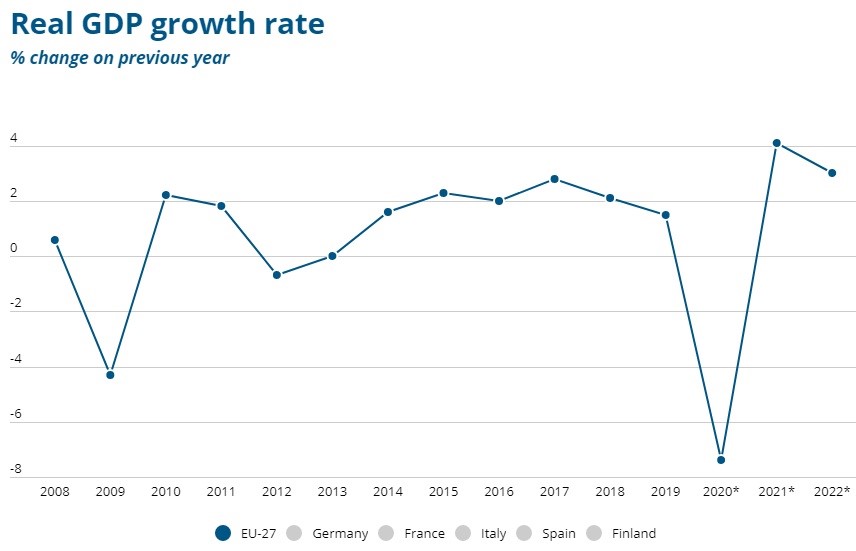

The GDP has seen a huge decline as it had plunged from 1.5% to -7.4%, which marked the most severe recession in decades, worse even than that during the 2008 global economic crisis. The pandemic had hit the service sector the hardest, especially the accommodation and food services, as the total turnover in this sector had declined by 55.4% in the EU and as many as 57% across the Eurozone.

EU’s GDP growth rate. Source: Euro Commission

The emergence of the mutated type of COVID-19 in the UK that started to spread rapidly across Europe and led to the second iteration of lockdown didn’t do any good for the EU economy either, whereas the controversy-filled presidential elections in the United States, and the uncertainty around the next stimulus package and Biden’s domestic and foreign policies have kept EUR/USD in the bearish zone.

However, the rollout of vaccines from Pfizer and Moderna and the beginning of the all-encompassing vaccination across the European countries and the US should provide at least a partial solution to the COVID-19 crisis, the results of which should become evident in Q2 and Q3 of 2021 through the partial revival of GDP growth in both countries, though experts predict the economy to recover to the pre-pandemic levels no sooner than 2022. The GDP recovery will surely offer a bullish incentive for the EUR/USD pair, but it could be diminished substantially by the growing inflation, the reckless fiscal policies that take the form of blunt money printing, and the soaring national debt that plagues the United States.

From the standpoint of fundamentals, the 2021 outlook for EUR/USD is moderately bullish, but don’t expect any explosive rallies from that Forex pair, especially in Q1 of this year.

1-month EUR/USD chart. Source: Tradingview

Now, let’s analyze the situation around the most traded Forex pair on the monthly chart. Here we see that the price had actually made an escape out of the descending channel, within the confines of which the price had existed since 2008, the beginning of the global recession.

The first sign of downtrend reversal came when the buyers had successfully defended the level at 1.100 during the period of unprecedented selling pressure that reflected in a huge bearish trading volume and the subsequent emergence of an ascending wedge, which offers this market an additional bullish bias. In addition, the MACD indicator is now the most bullish since late 2017, which gives us enough reason to believe that in 2021, this major Forex market will see the rise to 1.4 on the backdrop of partial economic recovery after the pandemic subsides. But prior to that, the price might go for the retest of support at 1.150 or consolidation around 1.2 since there’s not enough bullish volume right now to support a significant move to the upside.

GBP/USD

The British economy and its national currency suffered greatly in 2020 due to the coronavirus pandemic, the tedious Brexit negotiations that were filled with prevarication and uncertainties, and the inefficient fiscal efforts that have mostly narrowed down to money printing, hence the growth of inflation.

All these factors played a substantial role in pushing the GBP/USD market, which is widely regarded as one of the most volatile Forex pairs as it had been traded last year within the range of 2,000 pips, to the multi-year low at 1.14, upon which the price has made a relatively weak recovery to the current 1.35.

The vaccination program that was launched in the UK before the end of last year has shown promise, although the country remains in the state of lockdown with the economy operating at only about a half of its capacity. The appearance of the mutated coronavirus strain that caused a lot of concern didn’t affect the market much, which is a positive signal for GBP/USD in 2021, especially if the price manages to hold the support at 1.3.

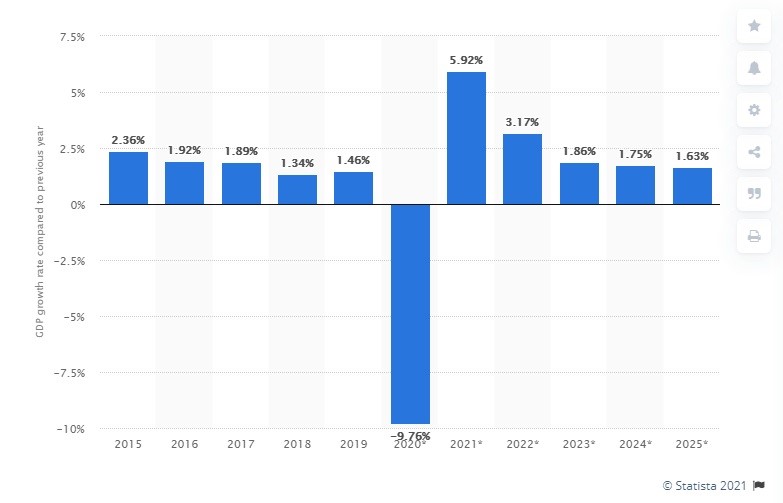

Should the vaccination help contain the pandemic and all of the Brexit-related issues finally get settled, the experts predict a swift recovery of GDP in 2021 and a 5.92% growth after a 9.76% drop last year, which would serve as an incentive for the market under review.

The United Kingdom GDP chart. Source: Statista

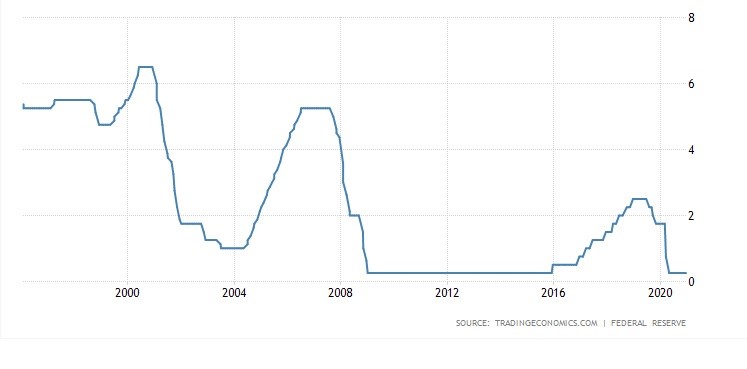

However, the UK economy will recover to the pre-pandemic level only in 2022, while the rate of GDP growth in the following years is going to diminish, as per the prediction chart above. The historically low interest rates at 0.1%, set by the recently appointed head of the Bank of England Andrew Bailey, and doubling down on buying bonds, might have been viable solutions amid the crisis, but their long-term effect on the economy is likely to be deteriorating.

Federal Reserve interest rate chart. Source: Federal Reserve

Add to that the Fed’s determination to keep the interest rate close to zero - it presently stands at 0.25% - and we are likely to see further degradation of USD on the back of the solidifying GBP.

1-month GBP/USD chart

The monthly chart above demonstrates that the market remains deep in the bearish controlled zone below the 99-period moving average while not being able to take out the high of the last bullish swing in 2018.

Our prediction for this Forex pair is based on the assumption that GBP will get bullish in Q1 or Q2 of 2021, after the completion of the vaccination program and resurgence of the economy. We predict GBP/USD to break the current resistance at 1.35 to the upside and climb above the 99 MA.

But before that, the price might briefly revisit 1.28 before making its way to the upside. The recovery of the British economy might force GBP/USD into a minor uptrend in 2021, as suggested by the bullish divergence on MACD, but the price is unlikely to reach the multi-year high at 1.7 this year.

USD/CAD

The coronavirus pandemic didn’t have any mercy on Canada either as the country’s GDP had plummeted by 5.6% in 2020 due to the fact that its entire industrial activity had been brought almost to a halt, whereas the supply chain experienced severe disruptions. At the same time, the unemployment rate has risen by a staggering 69.6% last year, which led to the decline of the Consumer Confidence Index (CCI) by as many as 27.2%.

1-month USD/CAD chart

With the US economy also in the state of massive decline, exacerbated by the unfinished trade war with China, it’s no wonder that the monthly USD/CAD chart demonstrates that the traders’ sentiment throughout 2020 had been bearish with regard to this Forex pair, and this trend is likely to continue in 2021, especially if the price breaks the long-standing support at 1.26 to the downside and dives below the 99 moving average. If that is to occur, USD/CAD might become one of the most volatile Forex pairs in 2021 since the drop would open up a 13% range to the closest support levels at 1.1 or 1.05.

Our negative prediction is also based on the presence of the double top pattern on the monthly time frame, which is a classic bearish pattern, as well as the behavior of the RSI indicator that is about to break the support at 40 to the downside and start going south to the oversold zone. The prevalence of the selling volume throughout the year also hints that the bears aren’t about to let go of their dominance in one of the most traded Forex pairs.

It’s clear that both Canadian and American economies will see some recovery after the majority of the population gets vaccinated, and the pandemic would start to fade away. The economists predict that in 2021, Canada will see its GDP rise by 5.1%, along with a 15.8% increase of the CCI, whereas the US gross domestic product is expected to rise by 3.6%. However, given the current situation in this market, and the expected decline of the US Dollar Index (DXY) below 90, these positive shifts in fundamentals won’t cause the USD/CAD market to reverse to the upside - at best, it would keep the price in the consolidation zone between 1.22 and 1.26 for a while before the bears take charge again.

USD/JPY

The year 2020 has proven to be very dull for USD/JPY, which previously has been one of the most volatile Forex pairs around. Long gone are the 20% swings to upside or downside - over the course of 2020, this Forex market moved from 112.2 to 101 in a span of two opening months, recovered to 108, and then continued the gradual descent to the current level at 103. But the lack of turbulence isn’t necessarily a bad thing as this particular Forex pair displayed significant resilience amid the ravaging coronavirus pandemic. This was partially due to the fact that the Japanese economy had been falling practically in unison with that of the United States as both nation’s GDPs had shrunk by more than 5% over the past year.

1-month USD/JPY chart

On the monthly chart above, we see that the price stayed below the Kumo cloud of the Ichimoku Cloud indicator, while its lagging span has been heading downward all along. It signifies the presence of strong sellers in this market that play the first fiddle to this day. However, after months of slowly slipping from the level of 112, the price seems to have consolidated around 104, though the RSI indicator was yet to enter the oversold zone to provide additional evidence of the possible reverse. It’s clear that while the price remains below the cloud, there is no sense in going long for a protracted period of time.

According to the estimates provided by the Japanese government, the national economy is set to grow by 4.4% during this fiscal year, which would constitute the swiftest growth rate since 1990. The issuance of the stimulus package of 73.6 trillion yen should also provide the additional incentive for the recovering economy and the national currency by association, though in our opinion, it won’t be enough to push the price above 110 - 112.

The fact that RSI began looking upward for the first time since April of last year also speaks in favor of the partial recovery to the said levels, upon which the market would enter the period of stagnation once the initial growth of both economies slows down and the effect from stimulus packages wears off. A lot will depend on whether the Bank of Japan (BOJ) decided to further cut the interest rates and issue other forms of stimulus, as well as the relationships between the US and China under President Biden, as this directly affects Japan’s imports, hence the value of yen.

USD/CHF

The Swiss Franc, also known as the Swissie, is widely considered as the safe-haven currency due to the fact that Switzerland herself is the global epicenter of banking operations. Therefore, USD/CHF and EUR/CHF, for that matter, have always been the best Forex pairs to trade due to this currency’s relative stability and predictability.

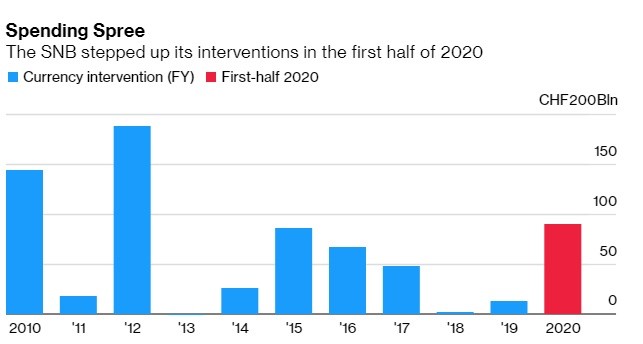

Having the stability trait means that in times of crises, like the European Debt Crisis that began in 2009, or the current COVID-19 pandemic, the money starts pouring into the country, which might seem like a good thing, but in fact, such an influx of capital, combined with the current bearish trend of the Dollar Index (DXY), creates additional problems for the Swiss National Bank (SNB) since it triggers the deflation of CHF, which amounted to 1.2% in 2020, forcing the central banking institution to maintain the negative interest rates and conduct regular interventions in order to keep abreast with the balance sheet of the European Central Bank (ECB) since the value of CHF is pegged to that of EUR at a 1:1.2 ratio. This interconnection creates additional pressure for CHF when paired with USD as the Swiss currency has to fight on both fronts.

1-month USD/CHF chart

This inherent strength of CHF has saved it from going down during the coronavirus crisis, though the USD/CHF pair had still declined by 11.8% from 0.98 to the current 0.89, the support level that was established back in 2012. Since then, this particular Forex pair has been kept in the range between 0.88 and 1.02, and it’s likely to remain there in 2021, traveling from support line to resistance, as the RSI indicator suggests.

The complication here is that the frequent interventions on the part of SNB might be perceived by the US Treasury as currency manipulation (the Swiss national bank is already on the monitoring list of the US authorities), which could even lead to some sort of sanctions that will affect the USD/CHF pair in the negative fashion.

SNB’s FX intervention chart. Source: Swiss National Bank

However, the probability of that is quite low, while the global economic recovery will certainly push the entire Forex market to the upside to some extent that could be expedited if Joe Biden decides to end the economic feud with the EU, started by the former president Trump. All in all, we expect USD/CHF to stay within the designated range (0.88 - 1.02) throughout the entire 2021, ultimately making USD/CHF one of the best Forex pairs to scalp.

EUR/GBP

It’s clear that the developments in this market over the coming year will revolve around the pace of recovery of both the UK and the European economies in the aftermath of the coronavirus pandemic, as well as the results of the tedious negotiations around the infamous Brexit deal. Should the situation go in the right direction, EUR/GBP could well become the best Forex pair to trade in 2021.

1-month EUR/GBP chart

The monthly chart above indicates that one of the major Forex pairs has, in fact, been quite bullish throughout 2020, having bounced off 0.84 straight to the overhead resistance at 0.95. But it was ultimately forced inside the long-lasting channel with support at 0.86 and resistance at 0.92, which stands ever since the market made the recovery after crashing to 0.7 in 2015.

In Q1 of 2021, the price is very likely to test that resistance once again as both economies will start getting on their feet should the vaccination program, which began in the United Kingdom in December while the EU is falling behind a bit, help in containing the virus and bringing the pandemic to a more controllable state.

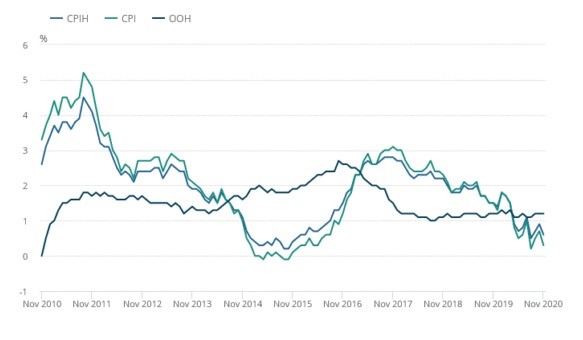

CPI rate for the end of 2020. Source: Office of National Statistics

But while this is certainly one of the best pairs to trade in Forex at any time, traders must exercise caution here because as the latest data from the UK’s Office of National Statistics show that the Consumer Price Index (CPI) has only reached 0.3% against the predicted 0.6%, while the Retail Price Index (RPI) fell short by 0.4%, which means that the recovery is occurring slower than anticipated, so don’t expect any explosive bull rallies in this market, though the re-visit to 0.95 is highly possible, especially in Q1 of 2021 since the price has found support near 0.88, and is gearing up for the retest of 0.92, as RSI suggests.

Two weeks ago, both parties finally came to an agreement regarding the post-Brexit trade deal that has finally brought some clarity regarding the future rules of business conduct, and the fishing rights in particular.

However, the first week has already brought a lot of problems due to the lack of complete customs and VAT data, exacerbated by the recently imposed coronavirus restrictions, caused by a new strain of the virus that had presumably originated in the UK. It’s obvious that the issues will keep on mounting when the business activity gains pace after the vaccination, so watch out for this pair as it might become one of the most volatile Forex pairs in 2021.

AUD/USD

In 2020, AUD/USD was the Forex pair with the highest daily (and monthly) range among the 10 major currency markets. As you can see from the chart below, unlike the overwhelming majority of other markets, AUD/USD has actually gone through a significant bull rally that gave the value of the Australian currency a 42.5% boost as the price traveled from the multi-year low at 0.55 all the way to 0.77, which is a rarity in any of the Forex markets, expect for cryptocurrencies, where such gains could be achieved within a daily trading session.

1-month AUD/USD chart

The Australian dollar owes this tremendous success to the fact that the nation and the government have successfully tackled the coronavirus pandemic straight from its very beginning, while being able to maintain the economic growth thanks to China’s high demand for Australian commodities, mostly iron and copper, during its trade feud with the United States.

With the vaccination program already underway, Australia could be among the first nations to fully take the spread of the virus under control and get its economy going at full speed, while the US economy would keep on going at half the pace until the newly-elected president starts implementing his domestic (stimulus package from Fed) and foreign (the end of the trade war with China and revision of draconian tariffs imposed by the Trump administration).

And that is when things could get tricky for Australia and its national currency because China doesn’t tolerate even subtle signs of disaffection from Australia, like the criticism of its methods of handling the coronavirus or the participation in joint military exercises with the US, Japan, and India that enraged the party officials who were quick to slap a ban on several imports from Australia.

Joe Biden has publicly declared that his administration will be looking to return to the policy of multilateralism to counteract the increasing influence of China on the global economy. It means that we might see the revival of the Trans-Pacific Partnership (TPP) that included Australia, which would lead to repercussions from China. Besides, the Asian superpower has been making a transition to the post-industrial economy with a heavy focus on high-tech, which means far less demand for Australian commodities and the weakening of AUD.

To summarize, after a tremendous 2020, this year could be tough for AUD, while USD is likely to start regaining its strength if the monetary policies of the new administration and the normalization of relations with Europe and other democratic countries. But should Australia find a way to compensate for the deterioration of relationships with China, Forex traders could see the price take another rally to 0.87 or even to the overhead resistance at 0.94.

USD/KRW

Although USD/KRW is considered one of 10 major Forex pairs, this market has had a very rough year as it had been crushing for seven out of the last twelve months, having lost 16.5% and denied itself a breakout from the long-established channel with resistance at 1250. During 2020, South Korea was forced into a technical recession after the 4.6% loss in GDP showings throughout the first two quarters of the year. Although this economic decline has proven to be much softer than that in other developed countries, though it didn’t help the national currency in the pair with the weakening US dollar.

1-month USD/KRW chart

Nevertheless, it appears that the landslide in this major Forex pair is over as the price seems to have rebounded off the support at 1080, though it could still fall inside the support channel that lies between 1058 - 1079 and keep a neutral stance. The likelihood of USD/KRW dropping below 1058 is slim since both South Korean and American economies are set to start the recovery after the pandemic is being taken under a firmer control, though it won’t be conquered any time soon, further extending its negative effect on the financial activity and the demand for Korean goods and commodities. Experts predict that the South Korean GDP will rise by 3.3% in 2021, which won’t be enough to pose a competition to the gradually strengthening USD, which would translate to the price appreciation in this Forex pair either to 1150 or even the multi-year resistance at 1240, should the battle against COVID-19 end faster than expected.

BTC/USD

Although Bitcoin has joined the Forex market relatively recently, the BTC/USD has already become one of the best and the most volatile Forex pairs to trade. Those who have at least half-heard about the crypto market this year know that Bitcoin has been rallying like crazy since November, largely due to the influx of institutional buyers like MicroStrategy, PayPal, and Grayscale.

1-month BTC/USD chart

Over the past months, BTC has been smashing through one all-time high after another, stopping its ceaseless push to the upside only a few dollars short to $42,000. As of the time of writing BTC is going through a correction phase after losing as much as 20% in two daily trading sessions. It’s widely believed that Bitcoin will keep on rallying in 2021 as the interest towards the first cryptocurrencies from the institutional investors won’t cease as they continue to buy out more coins than mined, pushing the demand for BTC to new heights, along with the price. JP Morgan has recently predicted that the price of Bitcoin will rise to $146,000 as the millennials see BTC as a viable alternative to the classic safe-haven asset that is gold.

Since the first cryptocurrency is now in the state of price discovery, with no resistance above it whatsoever, the most modest Bitcoin price prediction for 2021 would be $50,000 per coin that can be achieved within the next couple of months, given that BTC would be able to find support above $30,000 and continue that rally.

However, Forex traders should also expect a deeper correction that might start in mid-February or early March, as it has always been happening to the cryptocurrency market before, that could take the price down to $14,000, the first macro support in sight. But all in all, our Bitcoin price forecast for 2021 is definitely bullish because the retail investors are yet to jump into this market on FOMO.

ETH/USD

Ethereum has also been making a lot of headlines last year that were related mostly to the launch of a major upgrade called Ethereum 2.0, the first phase of which took place on December 1, 2020. This upgrade should eventually help the transition to the more cost-effective Proof-of-Staking mechanism and resolve the issues of scalability and high gas prices that affect the transaction fees, which had skyrocketed these past few months.

1-month ETH/USD chart

Unlike Bitcoin, which has already surpassed the all-time high, Ethereum has come close to it only on January 10 and has almost immediately gone into a correction mode, dropping from $1347 to $916 in just two daily trading sessions, which is quite common for the cryptocurrency market, making it one of the most volatile Forex pairs.

In doing so, ETH has already touched the macro support that stood since 2018 and bounced back. If the buyers manage to hold the price above $1000, Ethereum will certainly surpass the all-time high at $1,435 in Q1 and then go on to rally to $2,000, and probably even higher, over the course of 2021 as the bull market will get more mature. However, there is also a possibility of a deeper correction to $800 before the market goes back to bullish ways.