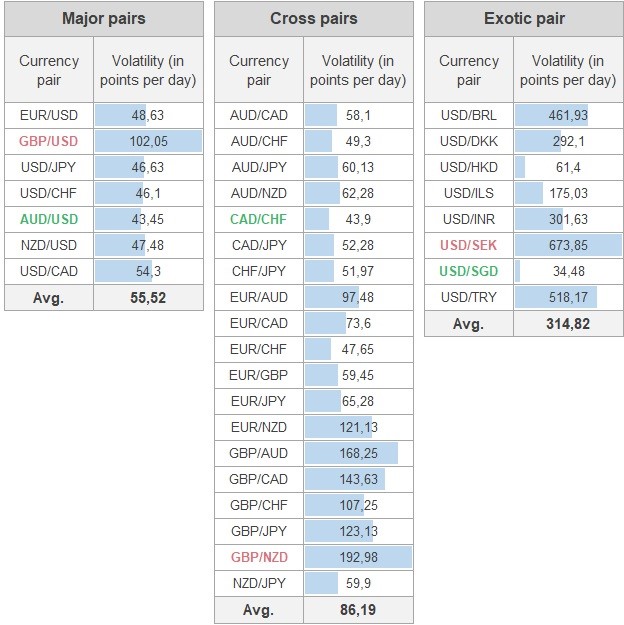

One can’t overstate the importance of mastering the art of stop loss placement when trading Forex or any other financial market for that matter. Stop loss is an advance order to sell the currency if the market turns in the opposite direction to trade and moves away from a predetermined price point. It has always been considered a crucial part of a proper risk management strategy that is needed to shield one from big losses that can occur in every Forex market, especially the ones that are characterized by increased volatility, such as GBP/USD, GBP/AUD, or USD/SEK that is capable of spiking up and down by as many as 673.86 points during one daily trading session.

Table of the most volatile Forex pairs. Source: FXSSI

But even the calmest Forex pairs like USD/CHF and AUD/USD can always move against trader’s position or gap down at the open of the session and leave him either holding the bags or cutting down losses at a much lower level than deemed acceptable, and even make a huge dent in ones trading account if the position is over-leveraged.

Trading Forex with stop loss is a rational solution, and placing it appears to be easy in theory; however, practice shows that it’s one of the hardest things to grasp and successfully implement. The main issue with stop loss is that there is a chance that the market would make a quick dive, ping your stop loss with something like a hammer or a bullish pin bar on a long trade or a gravestone doji or inverted hammer on a short trade, and then continue moving in the right direction, effectively leaving the trader out of the market, with a loss and without the profits that he could have obtained.

Indeed, it’s extremely frustrating to get the market right but then be left in the red instead of grabbing profits, which is why there is a lot of Forex experts and established traders who advocate against using stop loss in general or argue that it’s better to use the so-called mental stop loss or a soft stop loss, which implies that a trader gets a notification if the price of a Forex pair drops to the level where he can still tolerate a loss, but there is no order to be executed automatically - trader decides whether to exit the position or sit tight depending on the current market condition

Is trading without stop loss a big no-no?

We have to be upfront with you - trading Forex without stop losses is a prerogative of hedge funds and ultra experienced traders, who can read the markets like an open book, have their risk management strategies figured out, and are capable of hedging their accounts against potential losses, incurred by an unprotected trade.

The strongest argument that Forex traders have against using stop losses lies in such phenomena as stop hunting. It’s no secret that Forex markets do engage in liquidity hunting. Of course, we don’t support the conspiracy theory regarding devious groups who organize the chase for stops and laugh like Dr. Evil every time some poor chap gets stopped out. But there are examples when traders on pit floors sometimes try to push the price in the direction where the crowd presumably has their stops in order to grab that precious liquidity. In addition, some trading algorithms are tailored to seek out the liquidity in different markets and drive the price towards the area where the majority of traders might have these orders placed. Those who trade without stops reckon that it would suffice to recognize the spot where the crowd has been stopped out to make it an entry point and just watch the market rip to the upside or the downside since the appetite for liquidity has already been sated.

There is also quite a valid point that no one, even Forex trading gurus, can’t always get the entry point right by just getting into the market in one go and then have a stop loss somewhere below the entry point. Entering a trade before the market mustered enough strength for a move in the opposite direction is likely to result in the position being stopped out. Therefore, Forex traders who avoid stop losses usually execute multiple buys and sells near the point of interest, adjusting the size accordingly before the market reassures them that it’s about to drive in the right direction.

Also, size matters when it comes to trading without stop. If you are trading micro accounts or keep your position size slim, then you could stomach the losses that might incur if the price goes the other way, contrary to seeing your account bleeding heavily when the oversized trade goes south. Controlling the risk with the size is a viable Forex risk management strategy, but then again, it isn’t suitable for those who lack trading discipline and diligence or don’t have enough faith in the trade. Abandoning stop loss could be the prerogative of large hedge funds that can compensate for the losses by diversifying their positions in order to mitigate the downside or the upside risks. Instead, traders at hedge funds re-evaluate their positions and adjust them in accordance with market conditions to get back to earning alpha for the investors. Retail Forex traders simply don’t have the means, both monetary and infrastructural, for carrying out such sophisticated hedging strategies to be able to forget about stops altogether.

All in all, trading without a stop loss is a risky strategy to apply in Forex or any other market because no trader can foresee when the whales might enter a particular market and turn the things upside down or the black swan events that can send the markets tumbling in a matter of hours. The refusal to use stop loss makes Forex trading a bit more similar to gambling, where there is practically no means for protecting oneself from significant losses. Therefore, we strongly advise against trading in the absence of stop loss, especially if you are a nascent or a mid-level Forex trader.

The ambiguousness of mental stop loss

There is no point in arguing the fact that soft stop loss offers a higher probability of staying in the winning trade even if the market briefly moves against you. You get a notification from a trading platform that the price has arrived at a place where further movement in the same direction would lead to unacceptable losses. You may then quickly tune into the market and make the decision on the fly regarding whether or not to exit the trade at a loss or see whether the selling or the buying pressure subsides and the price starts flowing in the necessary direction.

And while we reckon that ignoring the stop buy or sell orders can do more harm than good, we would still provide the arguments for that particular trading method because, in order for our readers to become successful at trading foreign currencies, they need to have the full scope of information to be able to develop a unique trading style.

In trading theory, there is a thing called the probability of touch (the price touches a certain price level and then reverses) and the probability of close (the price closes above the said level). It was established that the probability of touch is generally twice the probability of close. Basically, when entering any trade, there is a 50% chance that the price would move against you and take the stop loss out. One might argue that proper analysis decreases the probability of trade going sour, but let’s face it, any Forex market, especially a volatile one, remains unpredictable until it reaches your price target. So, the theory has it that even though the probability of touch is as high as 50%, the probability of price closing above the presumed stop loss level is only 25%. Therefore, Forex traders who prefer mental stops would rather wait for the price to close above or below the determined level and exit the position at a loss instead of relying on hard stops. It’s in the nature of the Forex markets to probe price levels and then come back, so those traders who think it’s wise to stay on the better side of probability theory and employ a soft stop usually make the decision on the basis of that rule.

The benefit of using mental stop loss is that it allows assessing the market conditions before deciding whether to exit or stay in the trade, whereas hard stops are executed automatically without any regard to what’s going on in that market. Besides, the decision as to where to place a hard stop is based on the historical (or old) data, which isn’t always relevant in the fast-paced and unpredictable markets or the markets that are prone to anomalies. Soft stops, on the other hand, afford a trader an opportunity to assess the situation in the market on the basis of fresh data and current conditions, thus increase the probability of making the right call.

Besides, mental stops are deemed more appropriate for day traders and scalpers who make multiple entries and exits during one trading session because oftentimes, they would miss out on an opportunity to make a quick profit while ruminating about it and setting up a stop loss. But then again, soft stops are suitable only for an experienced trader with a strong psychological profile and impeccable discipline, as well as the understanding of a particular market in order to be able to determine whether the price degradation constitutes a pullback that will resolve itself soon enough or a full-fledged reversal that will ultimately lead to bigger losses than those that might have occurred if a hard stop was in place.

Lastly, the efficient use of mental stops requires traders to monitor the developments in that particular market at all times, or at least be able to check out the situation immediately upon receiving the notification to avoid falling victims to rapid pullbacks or market crashes. This goes against the style of swing and positional traders, or those who have a day job and for whom Forex trading is just a side gig. And you certainly shouldn’t rely on soft stops when trading markets that are live 24/7, like Bitcoin (BTC) or ETH (ETH), because while money never sleeps, traders do need proper rest to be at their best and avoid making bad decisions due to fatigue.

To summarize, trading Forex with mental stops isn’t necessarily a bad thing like doing it without ones, but this approach definitely carries a lot of risks that can be mitigated only through discipline, experience, deep understanding of the markets, and constant presence at the trading desk. If you don’t fit even one of those criteria, don’t try to be fancy and just go with the good old hard stop.

Top tips for placing a stop loss right on the money

We might disappoint some conspiracy lovers now, but most of the time, retail Forex traders are getting stopped out not because the evil market enjoys their frustration but rather because these speculators place their stop orders only a tick or two below their entry point or below the last low, which is usually based on a candlestick pattern with a confirmation coming from some indicators. But in that case, they go against the institutional traders who are being hardwired to buy “good levels'' or refrain from entering a trade altogether because, given the size of positions they are trading, their order mightn’t get filled at the “retail” level because institutions often have to generate the liquidity first before jumping on that bandwagon. And once again, the liquidity is being acquired at those obvious price levels where the majority of retail traders have their stop losses. Just try this simple trick: next time you intend to place an order to buy some currency, try to put it at the level where you’d initially have a stop loss and see how many times the market would probe that level before going in the planned direction. So try putting your entries where the masses are likely to have their stop losses and see for yourselves whether you would no longer be hunted down.

But, of course, the most common reason why traders are being pinged by that nasty long wick is that they have stops placed too tight to the area of price action. The reasoning behind having a stop loss only several pips away from the entry area is simple: everyone wants to get huge profits but avoid the risk of losing a substantial percentage of position size. But the rule of thumb here is simple - the tighter is the stop loss, the higher is the probability of being thrown out of the market.

The good way to think about where to put a stop is to have it in the place where the entire premise of the trade would be negated in case you get stopped out. To put it simply, the market has to decisively deny the whole reasoning you had for entering the market. For instance, you could have placed a short order on the premise that the GBP/USD market is going to turn bearish after the emergence of the double top candlestick pattern.

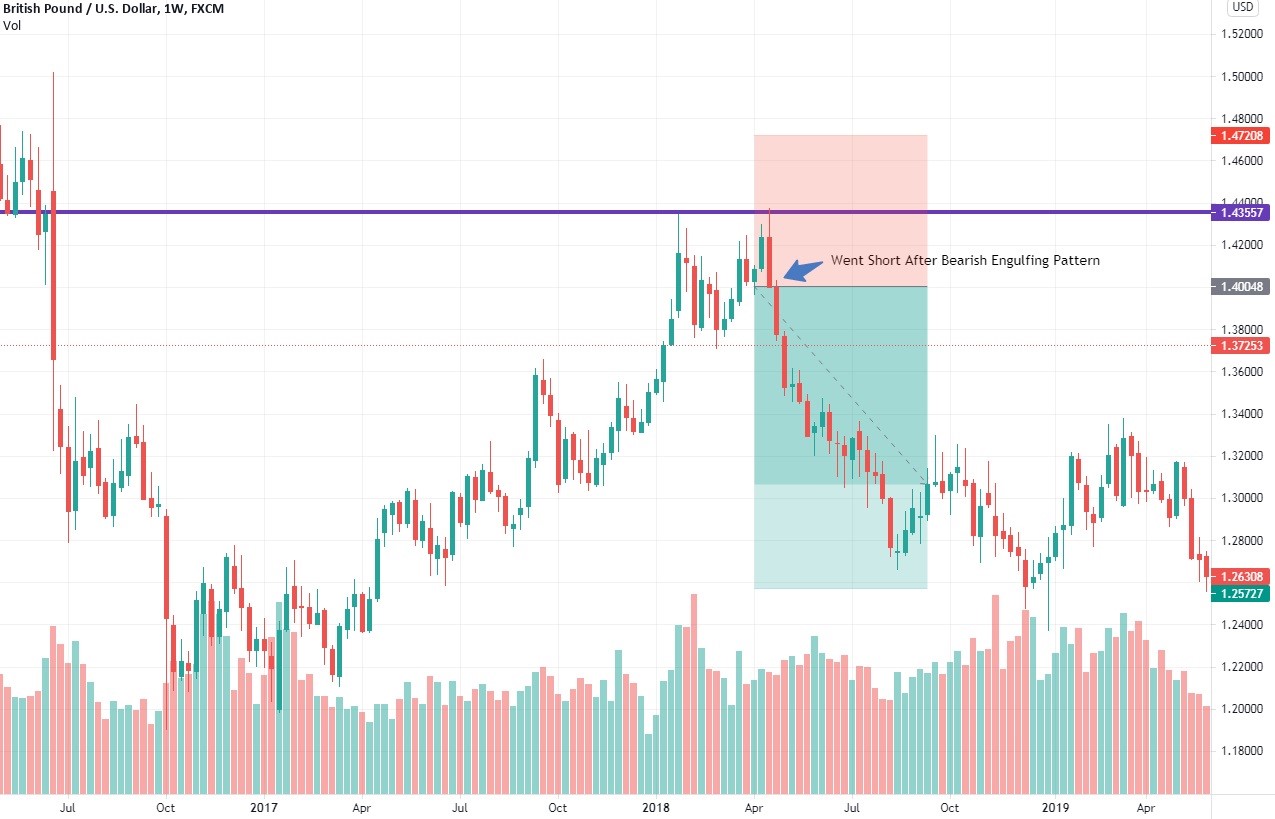

1-week GBP/USD chart. Source: Tradingview

Let’s assume that you went short on GBP/USD on the weekly time frame, thus having entered a long-term position after the price action had flashed the bearish engulfing pattern after testing 1.435 twice but to no avail, hence posting a double top.

You go short after the price breaks 1.4 to the downside and plan on exiting when it falls to 1.25 for a nice risk/reward ratio of 2. In that case, the stop loss should be placed in the area between 1.474 and 1.478, leaving room for the price to recover just enough to make the triple bottom and even penetrate the resistance with an upper wick. But should it close near 1.455 and aim at 1.481, the entire premise set by that bearish pattern would be negated, and you might either close the trade using a soft stop or if, for instance, the action takes place when you are away from the screen, allow the position to be close automatically at a slightly bigger loss.

Another tip for placing a stop loss on Forex is not to try and walk in the shoes of an institutional trader but rather to wait until the crowd that is too fearful of having stops placed much higher in order to have a more attractive risk to reward ratio. But remember, fear and greed are Forex trader’s worst enemies, while patience and logic are surely the finest allies. Let’s analyze the GBP/USD chart again - it’s obvious that when the price had put up a lower high at 1.412, the crowd decided that it’s a prime time to go short here because the price had already tested the strong resistance at 1.435 and rolled back quite significantly, so they counted on seeing a deeper correction. Instead, the price had one more dash to the upside, liquidating all those short stops, which led to the emergence of the bearish engulfing candle and the commencement of the full-fledged market reversal. If you were to wait for all these fellas to get stopped out and entered the trade shortly after the opening of the second bearish candle, you would have been in for some massive profits instead of suffering losses due to the lack of patience and critical thinking. Therefore, to increase the chance of placing the stop loss correctly, you would need to think like a member of the crowd, feel that initial impulse that usually let’s you down, then gather some patience and stay out of the market until that crowd gets massacred and only then get into the trade. It might sound a bit cynical, but that’s the name of the game when trading Forex - let others give back to the market and then capitalize on their mistakes.

Another piece of advice that would make you a much more successful Forex trader is to avoid moving your stop loss too soon to break even or to ensure a small profit. Let’s assume you are going long on EUR/USD after entering the trade at 1.165 with the profit target at 300 pips and the stop loss of 50 pips. The market starts moving in your direction by 50 pips or so, and a little profit appears on the table. That’s when fear and greed might come into play again and whisper you to move up the stop to break even or secure that insignificant profit.

But by doing so, you deny the market a chance to oscillate and digest all that noise that occurs quite often, especially on smaller time frames. You are lucky if the currency pair you’re trading gets injected with rocket fuel and rips to the upside without ever looking down, but most of the time, the price would loiter around, go up and down a bit and then consolidate for a while before it continues to chug to the upside, which is especially relevant for low-volatility Forex pair mentioned at the beginning of the article.

Sometimes, the price might even come back and test that entry at 1.165 before going to the upside again. If you bought the currency at the resistance and then moved the stop loss up to protect against potential loss and the price makes a return trip, you would be selling out the position instead of adding to it if the resistance holds, which is counter-productive, to say the least. One of the ways to avoid that is to wait for the price to form another support level above the one you have entered the trade at, go to the upside again after posting a continuation pattern, and only then you might move the stop below that second resistance, thus ensuring that an extra layer of protection stays intact.

However, that approach is relevant only at the initial stages of the trend development - once it starts approaching the point of exhaustion, it would be wise to start moving up the stop loss more aggressively or better place a One-Cancels-the-Other (OCO) order that combines both the stop and the limit order to increase the chances of exiting the trade at the top instead of doing it when the price has already begun to travel in the opposite direction. Also, remember that even if you get stopped out at a small profit numerous times, your long-term (weekly, monthly) P&L could still end up in the red because those unimpressive profits are likely to be negated by a couple of big losses. Therefore, always look for trades with a big enough risk/reward ratio and don’t be too hasty to close the trade at a small profit only to miss out on a chance to make significantly more.

Other efficient tactics for stop loss placement involved the use of the Average True Range (ATR) indicator that determines the current level of volatility. A high ATR implies that the market is overly volatile, while a low one is indicative of consolidation or stagnation. You can use the following formula: 10% x ATR pips from the price level where you’ve made the initial entry. The percentage of the ATR stop may vary, depending on your trading style: 10% is suitable for day traders, while swing and positional traders must use no less than 50% ATR to figure out the level of stop loss using this formula. But if you aren’t into calculating formulas, just make sure that you don’t put the stop loss too tight when the indicator is at the high extremities, in which case the Forex market that you are trading is characterized as very volatile and wouldn’t have any trouble moving 50 or more pips in the direction of your stop loss to hunt it down. Conversely, when ATR is at the lower extremities, it means that the market is in a tranquil state and traveling rather uneventfully, meaning that the stop loss should be adjusted and tightened up a bit.

Lastly, if you are not a scalper or an aggressive day trader, don’t try to determine the spot where to have the stop loss on small time frames (1M, 5M, and even 15M). The price action on these time frames, especially if the market is volatile, is filled with noise and traps. But if you are planning to hold onto the trade for a few days or even weeks, then you must pick a place for the stop limit order on higher time frames, such as 1H, 6H, 1D, and even 3D. The higher is the time frame, the bigger picture you’d see, and the better your stop loss placement would be.

In summary, stop loss is an integral part of Forex trading, without which you are putting the capital at risk. Some traders might boast about trading without stop loss, but that only invokes false confidence. Forex markets can be unpredictable in their movements, which threatens traders’ capital, so stop loss is a must if you don’t want to see your trading account melt like ice on summer sun. Stop loss is a superior tool for risk management in Forex, and it should be used at all times, especially in the low and medium-volatility markets. Trading without stop loss could be thrilling, but this trill could change to the feeling of despair almost in an instant. Don’t be afraid to take small losses but avoid being burned when markets get feverish. A planned loss is a part of the game called Forex trading, and the trader’s main purpose is to bring that risk to a minimum. The best way to go is to try and think like a member of the crowd and then do the opposite thing, or wait until the crowd makes mistakes and then ride the liquidity wave made of the money they gave back to the market.